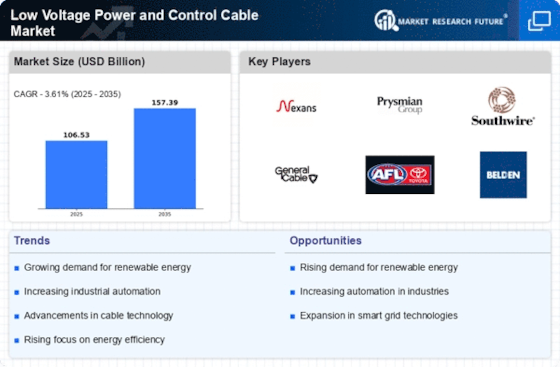

Low Voltage Power and Control Cable Market Summary

As per Market Research Future analysis, the Low Voltage Power and Control Cable Market Size was valued at USD 57,699.7 million in 2024. The Low Voltage Power and Control Cable Industry is projected to grow from USD 60,418.0 million in 2025 to USD 1,00,572.2 million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.2% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

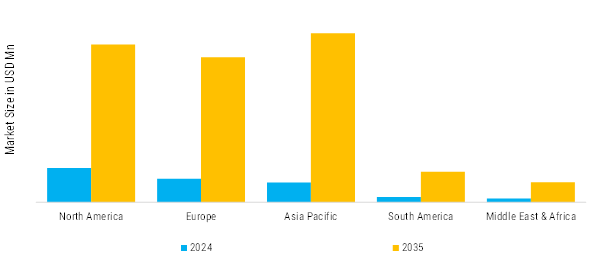

The Global low voltage power and control cable market reflect surging demand from urbanization, renewable energy adoption, and technological advancements in electrical infrastructure.

- The Cross-linked polyethylene (XLPE) insulation rises for superior thermal stability and longevity in harsh environments. Biodegradable polymers emerge in Europe to meet circular economy goals.

- IoT-enabled smart cables with embedded sensors for real-time monitoring of faults and performance dominate industrial automation, supporting Industry 4.0 factories. Data centers, fueled by AI growth, demand high-density, low-voltage control cables with EMI shielding.

- Demand rises for shock-resistant, low-voltage systems in industrial and commercial settings amid rising electricity consumers.

- Smart city initiatives boost needs for reliable underground cables, expected to hold 58% share due to weather resistance.

- Integration of solar, wind, and EVs increases demand for low voltage cables handling up to 240V, dominating residential applications. Energy demand surges 49% over two decades, pushing durable, efficient cables for grid upgrades.

Market Size & Forecast

| 2024 Market Size | 57,699.7 (USD Million) |

| 2035 Market Size | 1,00,572.2 (USD Million) |

| CAGR (2025 - 2035) | 5.2% |

Major Players

Prysmian Group, Southwire Company, Elsewedy Electric, Sumitomo Electric Industries, Hitachi Energy, LS Cable & System, Finolex Cables Ltd., Polycab Wires, Far East Cable Co., Ltd., Atkore Inc. and Others.