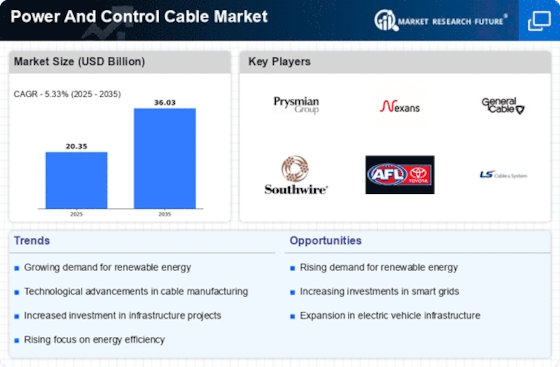

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is a pivotal driver for the Power And Control Cable Market. As nations strive to reduce carbon emissions, investments in solar, wind, and hydroelectric power are surging. This transition necessitates robust power and control cables to efficiently transmit electricity from generation sites to consumers. For instance, the International Energy Agency indicates that renewable energy capacity is expected to grow significantly, leading to heightened demand for specialized cables that can handle varying voltages and environmental conditions. Consequently, manufacturers are focusing on developing cables that meet these new requirements, thereby propelling the Power And Control Cable Market forward.

Infrastructure Development Projects

Infrastructure development remains a crucial driver for the Power And Control Cable Market. Governments and private sectors are investing heavily in upgrading and expanding electrical grids, transportation systems, and urban infrastructure. According to recent reports, the global investment in infrastructure is projected to reach trillions of dollars over the next decade. This surge in infrastructure projects necessitates the installation of reliable power and control cables to ensure efficient energy distribution and operational safety. As a result, the Power And Control Cable Market is likely to experience substantial growth, driven by the demand for high-quality cables that can support these expansive projects.

Regulatory Standards and Compliance

Regulatory standards and compliance requirements are increasingly shaping the Power And Control Cable Market. Governments and regulatory bodies are implementing stringent safety and performance standards for electrical installations, which directly impacts the types of cables used in various applications. Compliance with these regulations often necessitates the use of high-quality power and control cables that meet specific criteria for safety, durability, and efficiency. As industries strive to adhere to these regulations, the demand for compliant cables is expected to rise, thereby driving growth in the Power And Control Cable Market. This trend underscores the importance of quality assurance and regulatory adherence in the cable manufacturing process.

Increased Urbanization and Electrification

The trend of urbanization is a significant driver for the Power And Control Cable Market. As populations migrate to urban areas, the demand for reliable electricity supply escalates. This urban growth necessitates the expansion of electrical infrastructure, including power and control cables, to meet the rising energy needs of densely populated regions. According to various studies, urban areas are expected to account for a substantial portion of global energy consumption in the coming years. Consequently, the Power And Control Cable Market is likely to benefit from this trend, as utilities and developers seek to enhance their electrical networks to accommodate urban demands.

Technological Innovations in Cable Manufacturing

Technological advancements in cable manufacturing are significantly influencing the Power And Control Cable Market. Innovations such as improved insulation materials, enhanced conductivity, and advanced manufacturing techniques are enabling the production of more efficient and durable cables. For example, the introduction of cross-linked polyethylene (XLPE) insulation has improved the thermal and electrical performance of cables, making them suitable for high-voltage applications. These innovations not only enhance the performance of power and control cables but also reduce maintenance costs and increase lifespan. As manufacturers continue to invest in research and development, the Power And Control Cable Market is poised for growth driven by these technological improvements.