Marine Auxiliary Engine Size

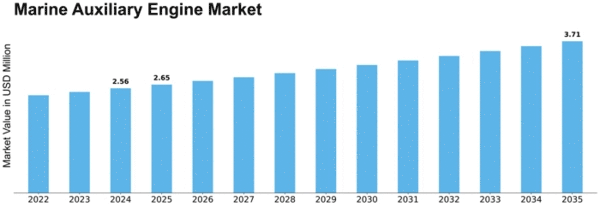

Marine Auxiliary Engine Market Growth Projections and Opportunities

The marine auxiliary engine market is influenced by several key factors that shape its growth and development. Marine auxiliary engines are critical components of ships and vessels, providing power for various onboard systems such as generators, pumps, compressors, and propulsion systems. One of the primary drivers of the marine auxiliary engine market is the increasing demand for marine transportation worldwide, driven by globalization, trade expansion, and growth in maritime commerce. As the volume of goods transported by sea continues to rise, there's a corresponding need for reliable and efficient auxiliary engines to power the auxiliary machinery and systems essential for vessel operations.

Moreover, advancements in engine technology, including developments in fuel efficiency, emissions control, and digitalization, have led to innovations in marine auxiliary engines, driving further adoption across the maritime industry. New generations of auxiliary engines offer features such as higher power output, reduced fuel consumption, lower emissions, and improved reliability, meeting the evolving needs of shipowners and operators for more environmentally friendly and cost-effective propulsion solutions. This drives demand for marine auxiliary engines that offer superior performance, efficiency, and compliance with increasingly stringent environmental regulations and emission standards.

Furthermore, the growing emphasis on energy efficiency and sustainability in the maritime sector is driving investment and innovation in marine auxiliary engines with alternative fuel options, such as liquefied natural gas (LNG), hydrogen, and biofuels. As concerns about greenhouse gas emissions and air pollution increase, shipowners and operators are seeking ways to reduce the environmental impact of their vessels by adopting cleaner and greener propulsion technologies. LNG-fueled auxiliary engines, in particular, offer advantages such as lower emissions of sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter (PM), making them attractive options for ships operating in emission control areas (ECAs) and environmentally sensitive regions.

Additionally, the increasing focus on vessel electrification and hybrid propulsion systems is driving demand for marine auxiliary engines that are compatible with electric propulsion motors, energy storage systems, and hybrid powertrain configurations. Electric auxiliary engines offer advantages such as silent operation, reduced vibrations, and lower maintenance requirements compared to traditional diesel engines, making them suitable for use in passenger vessels, ferries, and luxury yachts. Hybrid propulsion systems combine diesel engines with electric motors and batteries to optimize fuel efficiency, reduce emissions, and enhance maneuverability, providing a flexible and adaptable solution for various maritime applications.

Moreover, the growing trend towards digitalization and connectivity in the maritime industry is driving investment in smart and connected marine auxiliary engines with remote monitoring, diagnostics, and predictive maintenance capabilities. Smart auxiliary engines leverage sensor technology, data analytics, and cloud-based platforms to monitor engine performance, detect anomalies, and optimize maintenance schedules in real-time, improving reliability, uptime, and operational efficiency for shipowners and operators. This creates opportunities for engine manufacturers to develop integrated solutions that offer advanced features and functionalities to meet the evolving needs of the digital maritime ecosystem.

Leave a Comment