Research Methodology on Medical Supplies Market

I. Introduction:

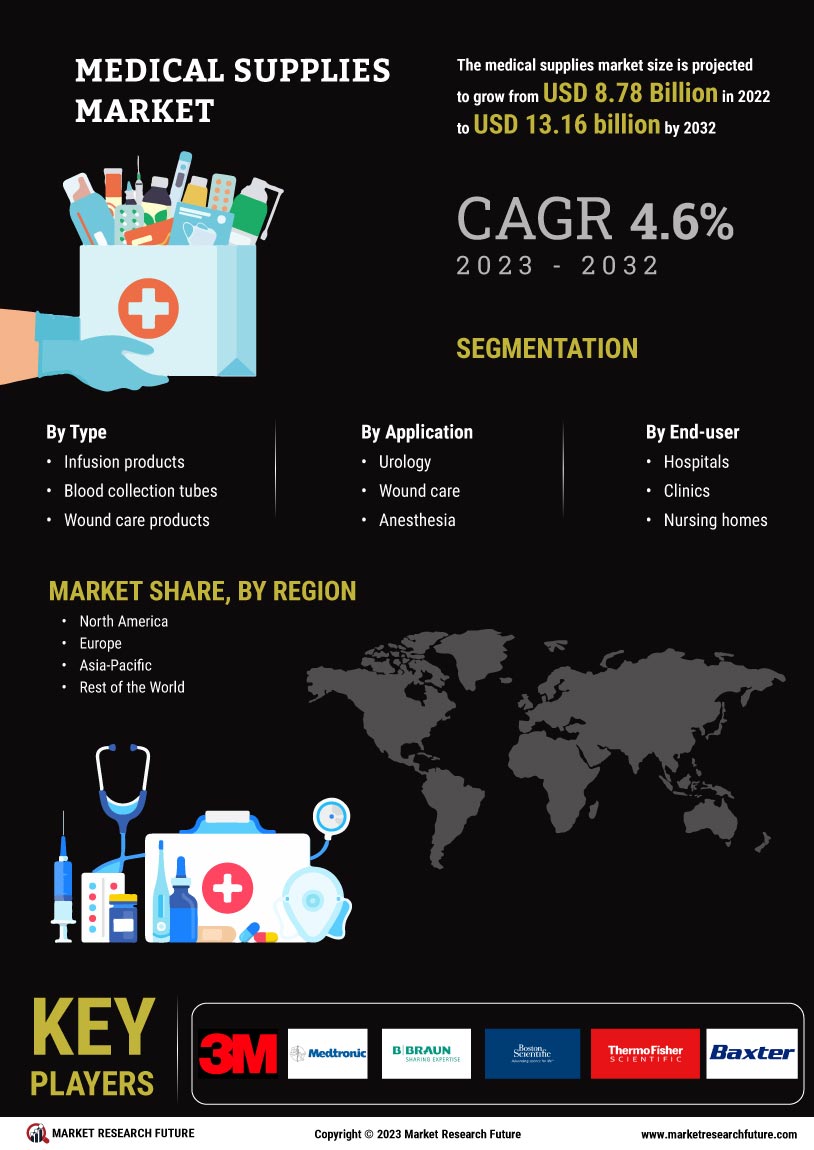

The research report titled “Medical Supplies Market- Forecast to 2030” focuses on understanding the current dynamics and the forecast of the Global Medical Supplies Market. It provides an in-depth analysis of the market including research methodology, market definition, competitive landscape, market dynamics, historical data, and estimated market size in terms of value and volume. Market segmentation by product type, distribution channel and geographical regions has been also discussed in detail throughout the research.

II. Research Objectives:

The objectives of this research are:

- To provide a detailed analysis of the Global Medical Supplies Market, including both qualitative and quantitative aspects.

- To present an overview of the key players and competitors in the Global Medical Supplies Market and their strategies

- To analyze opportunities, trends and drivers in the market

- To analyze the latest developments and product innovations that affect the Global Medical Supplies Market

- To identify and profile key players in the Global Medical Supplies Market

- To provide an overview of the competitive landscape in the Global Medical Supplies Market

- To analyze the impact of the regulatory environment on the Global Medical Supplies Market

III. Research Methodology:

Research Design:

The research methodology adopted for this study involves a methodological design integrating components common to the fields of both qualitative and quantitative research. In order to analyze the various components of the Global Medical Supplies Market, comprehensive primary and secondary research is conducted. The primary research material obtained is validated with the secondary data sources obtained through research. An in-depth analysis of the Global Medical Supplies Market is then presented in the study.

Primary Research:

Primary research is conducted to gain a greater understanding of the Global Medical Supplies Market. For primary research, qualitative and quantitative techniques were used. Primary sources include interviews and surveys of industry experts, global analysts and company executives. The qualitative analysis includes face-to-face interviews and guided conversations, while the quantitative analysis includes structured questionnaires and surveys.

Secondary Research:

Secondary research is conducted to collect data pertaining to the Global Medical Supplies Market. Primary sources for secondary research include industry journals, trade magazines, company documents, scientific studies, and other sources available in the public domain. In addition, industry reports from various databases such as Merger Market, Factiva, and IBISWorld, as well as public research data from the US Census Bureau, US Bureau of Labour Statistics, and the US Commerce Department are studied extensively.

Data Collection Tools:

Data is collected through both primary and secondary sources and analyzed using quantitative and qualitative techniques. To gain a better understanding of the Global Medical Supplies Market, a survey is conducted among industry experts and company executives. In addition, face-to-face interviews are also conducted. Both these techniques enabled the gathering of top-level market information and insights. Quantitative techniques such as mean, median, and mode were used to analyze the survey responses.

IV. Market Data Analysis:

The data obtained from primary and secondary sources is collated, validated and analyzed. This data is then used to generate insights into the Global Medical Supplies Market. Various factors such as market size, market dynamics, and competition in the Global Medical Supplies Market are taken into consideration for a better understanding of the market.

The data is then used to generate the estimated market size of the Global Medical Supplies Market. The estimated market size is further validated through the triangulation method to ensure that every aspect of the Global Medical Supplies Market is captured properly. Secondary sources such as financial reports, trade associations, industry associations, and other reliable sources were used to validate the estimated market size.

V. Market Segmentation:

The Global Medical Supplies Market is segmented into five major categories. These categories are product type, distribution channel, and geographical regions.

Product Type: The product type segment includes medical gloves, syringes, needles, tubing and catheters, syringes and needles and other medical supplies.

Distribution Channel: The distribution channel segment includes hospitals, pharmacies, speciality medical stores, and e-commerce.

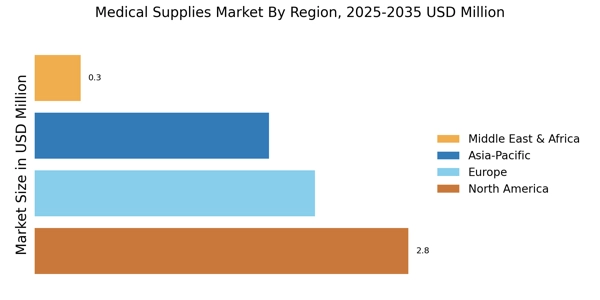

Geographical Regions: The geographical regions considered in this report include North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America.