Cost Efficiency and Financial Flexibility

Cost efficiency remains a pivotal driver for the Medium and Heavy Duty Truck Rental Leasing Market. Businesses are increasingly recognizing the financial advantages of leasing over purchasing vehicles outright. Leasing allows companies to conserve capital, reduce maintenance costs, and avoid depreciation associated with ownership. Recent studies indicate that companies utilizing rental leasing services can save up to 30% on transportation costs compared to traditional ownership models. This financial flexibility is particularly appealing for small to medium-sized enterprises that may not have the resources to invest heavily in a fleet of trucks.

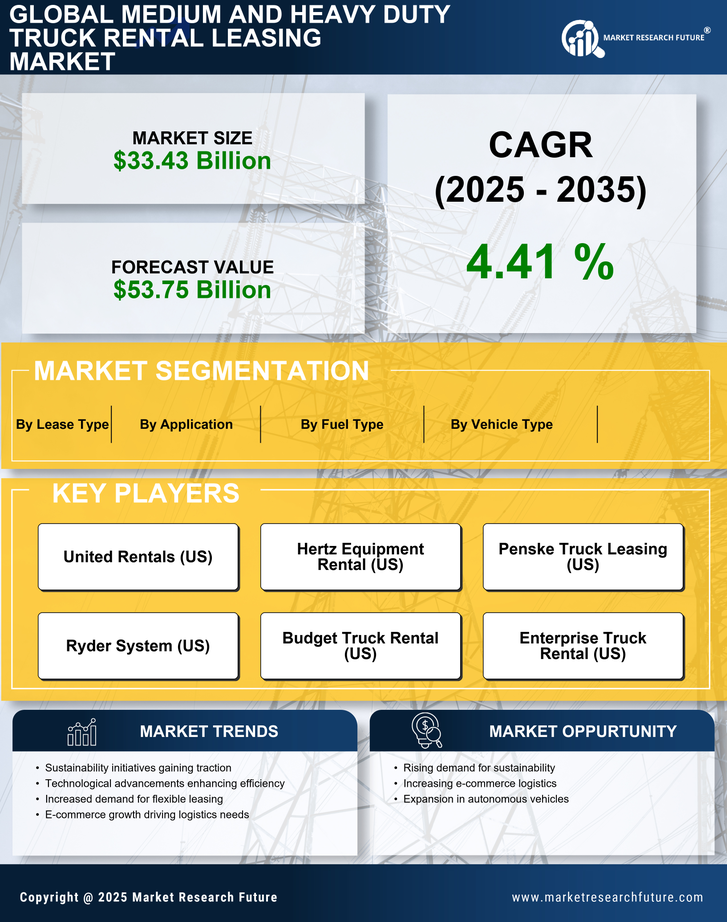

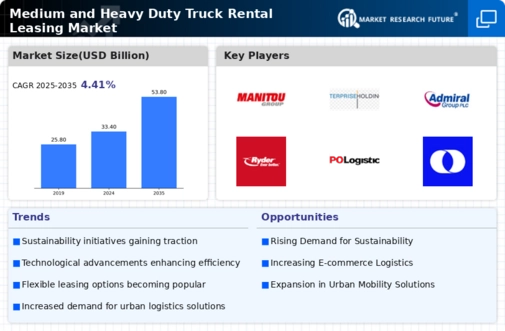

Increasing Demand for E-commerce Logistics

The rise of e-commerce has led to a substantial increase in demand for logistics services, which in turn drives the Medium and Heavy Duty Truck Rental Leasing Market. As online shopping continues to expand, businesses require efficient transportation solutions to meet customer expectations. This trend is evidenced by the fact that logistics and transportation sectors are projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. Consequently, rental leasing services for medium and heavy-duty trucks are becoming increasingly essential for companies looking to optimize their supply chains without the burden of ownership costs.

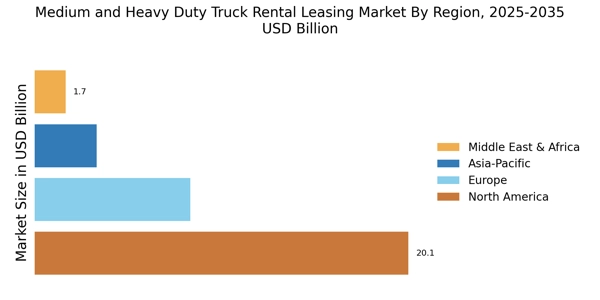

Urbanization and Infrastructure Development

Urbanization is a significant factor influencing the Medium and Heavy Duty Truck Rental Leasing Market. As more people migrate to urban areas, the demand for construction and infrastructure development rises. This necessitates the use of medium and heavy-duty trucks for transporting materials and equipment. According to recent data, urban areas are expected to account for nearly 70% of the global population by 2050, which will likely lead to increased construction activities. Consequently, rental leasing services for trucks become a viable option for construction companies seeking flexibility and cost-effectiveness in their operations.

Regulatory Compliance and Environmental Standards

The Medium and Heavy Duty Truck Rental Leasing Market is also shaped by stringent regulatory compliance and environmental standards. Governments are increasingly implementing regulations aimed at reducing emissions and promoting sustainability. This has led many companies to consider rental leasing as a means to access newer, more environmentally friendly vehicles without the long-term commitment of ownership. The market for low-emission trucks is projected to grow significantly, with many rental companies adapting their fleets to meet these standards. This shift not only helps companies comply with regulations but also enhances their corporate social responsibility profiles.

Technological Integration and Fleet Management Solutions

The integration of advanced technologies into fleet management is transforming the Medium and Heavy Duty Truck Rental Leasing Market. Companies are increasingly adopting telematics and fleet management software to optimize operations, enhance efficiency, and reduce costs. These technologies provide real-time data on vehicle performance, fuel consumption, and maintenance needs, allowing businesses to make informed decisions. As a result, rental leasing companies are investing in technology to offer value-added services that improve customer satisfaction. The trend towards digitalization in logistics is expected to continue, further driving the demand for rental leasing services.