Increased Security Concerns

The rise in security threats in Mexico has led to a heightened demand for effective counter-IED solutions. As incidents of improvised explosive devices (IEDs) have been reported, the handheld counter-IED market has gained traction. Government agencies and private sectors are investing in advanced handheld devices to enhance safety measures. The market is projected to grow at a CAGR of approximately 8% over the next five years, driven by the need for portable and efficient security solutions. This trend indicates a robust growth trajectory for the handheld counter-IED market, as stakeholders prioritize the protection of citizens and infrastructure.

Military Modernization Initiatives

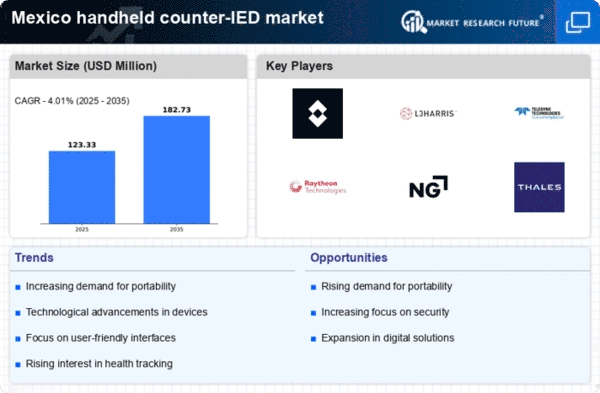

Mexico's military modernization efforts are significantly impacting the handheld counter-IED market. The government has allocated substantial budgets to upgrade defense capabilities, including the procurement of advanced handheld counter-IED systems. In 2025, military spending is expected to reach $10 billion, with a notable portion directed towards enhancing counter-terrorism measures. This investment reflects a strategic focus on improving operational readiness and response capabilities against IED threats. Consequently, the handheld counter-IED market likely experiences increased demand from military and defense sectors, fostering innovation and technological advancements..

Collaboration with Technology Firms

Strategic partnerships between government agencies and technology firms are shaping the handheld counter-IED market in Mexico. These collaborations aim to develop innovative solutions that address the evolving nature of IED threats. By leveraging cutting-edge technologies, such as artificial intelligence and machine learning, the handheld counter-IED market is poised for significant advancements. In 2025, investments in research and development are projected to increase by 15%, reflecting a commitment to enhancing the effectiveness of counter-IED systems. This collaborative approach is likely to yield sophisticated devices that meet the specific needs of security forces.

Public Awareness and Training Programs

The increasing awareness of IED threats among the public and security personnel is driving the handheld counter-IED market. Training programs aimed at educating law enforcement and military personnel about the use of handheld devices are being implemented across Mexico. These initiatives are crucial for enhancing operational efficiency and response times in critical situations. As more personnel become proficient in utilizing these technologies, the demand for handheld counter-IED systems is likely to rise. This trend underscores the importance of education and training in fostering a safer environment and promoting the growth of the handheld counter-IED market.

Urbanization and Infrastructure Development

Rapid urbanization in Mexico is contributing to the growth of the handheld counter-IED market. As cities expand, the risk of IED threats in urban environments increases, prompting authorities to seek effective countermeasures. The government has initiated various infrastructure projects, which necessitate the deployment of handheld counter-IED devices to ensure safety during construction and public events. The market is expected to witness a surge in demand, as urban planners and security agencies prioritize the integration of advanced technologies to mitigate risks associated with urban development.