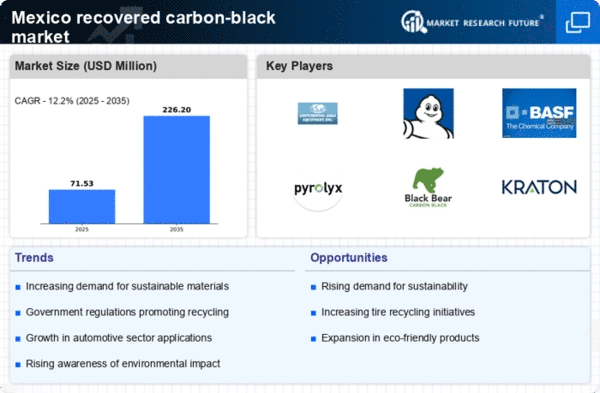

The recovered carbon-black market in Mexico is characterized by a dynamic competitive landscape, driven by increasing demand for sustainable materials and stringent environmental regulations. Key players such as Continental AG (DE), Michelin (FR), and BASF SE (DE) are actively shaping the market through strategic initiatives focused on innovation and sustainability. These companies are not only investing in advanced technologies to enhance the quality of recovered carbon black but are also exploring partnerships and collaborations to expand their market reach. Their collective efforts indicate a trend towards a more integrated and environmentally conscious industry, where operational efficiency and product quality are paramount.In terms of business tactics, companies are increasingly localizing manufacturing to reduce logistics costs and enhance supply chain resilience. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they leverage their established networks and resources to optimize operations and drive growth. This competitive structure fosters an environment where innovation and strategic partnerships are essential for maintaining a competitive edge.

In October Continental AG (DE) announced a partnership with a local recycling firm to enhance its supply chain for recovered carbon black. This strategic move is likely to bolster Continental's operational capabilities in Mexico, allowing for more efficient sourcing of raw materials and improved sustainability metrics. Such collaborations may also position the company favorably in the eyes of environmentally conscious consumers and regulatory bodies.

In September Michelin (FR) unveiled a new facility dedicated to the production of high-quality recovered carbon black in Mexico. This investment underscores Michelin's commitment to sustainability and innovation, as the facility is designed to utilize cutting-edge technology to minimize waste and energy consumption. The establishment of this facility not only enhances Michelin's production capacity but also reinforces its position as a leader in sustainable tire manufacturing.

In August BASF SE (DE) launched a new line of recovered carbon black products aimed at the automotive sector. This strategic initiative reflects BASF's focus on meeting the growing demand for sustainable materials in automotive applications. By diversifying its product offerings, BASF is likely to capture a larger share of the market while addressing the increasing pressure from consumers and regulators for environmentally friendly solutions.

As of November the competitive trends in the recovered carbon-black market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate and enhance their competitive positioning. Looking ahead, it appears that the focus will shift from price-based competition to differentiation through innovation, technology, and supply chain reliability. This evolution suggests that companies that prioritize sustainable practices and technological advancements will likely emerge as leaders in the market.