Market Share

Micro Mobile Data Center Market Share Analysis

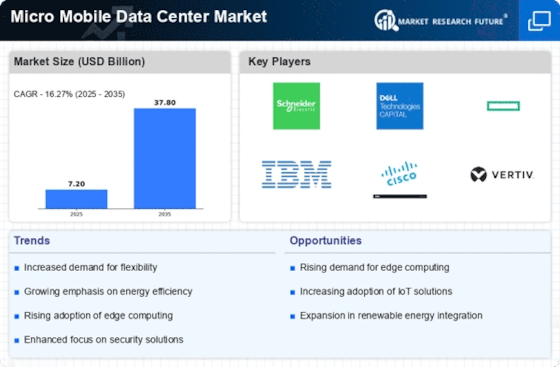

The Micro Mobile Data Center market is trending as companies seek flexible and compact solutions for data processing and storage. Organisations are using mini mobile data centres to process and analyse data closer to the source to reduce latency and improve real-time decision-making as network data volumes rise dramatically. This development highlights the importance of mini mobile data centers in edge computing's scattered nature.

Micro Mobile Data Center tendencies are influenced by 5G technology. With 5G networks, speeds for transmitting data and connectivity improve, requiring infrastructure solutions to keep up. Small and efficient micro mobile data centers can process and store data at the network edge in 5G scenarios. This development shows the industry's realization that 5G and mini mobile data centers work together to speed up and improve apps and services.

Modularity drives Micro Mobile Data Center market developments. Modular solutions with deployment, flexibility, and maintenance flexibility are valued by organizations. Micro mobile data centers, which are tiny and flexible, enabling enterprises to grow their IT infrastructure and adapt to changing needs. This trend supports the industry's desire for more flexible and adaptive data center systems that can handle changing technologies.

Advanced technologies like AI and IoT are affecting Micro Mobile Data Centers. These technologies allow smart monitoring, predictive maintenance, and resource allocation in mini mobile data centers. AI-driven analytics improve these tiny data centers' performance and stability, making them better at dynamic workloads. This trend shows the industry's search of smart and automated solutions to optimize micro mobile data center operations in different locations.

Environmental concerns are growing in the Micro Mobile Data Center sector. Cost-effective and eco-friendly data center solutions are becoming more popular as companies prioritize environmental responsibility. Micro mobile data centers use energy-efficient cooling and power management to reduce their environmental effect. This tendency supports the industry's drive for sustainable IT systems.

The rise of edge-native apps is impacting Micro Mobile Data Centers. As companies deploy edge-native apps that need low latency and high performance, mini mobile data centers are adapting. These small data centers have the computing power and storage to host edge applications, enabling responsive and efficient services. This shows the industry's response to edge computing needs.

Security is crucial to Micro Mobile Data Center market trends. As data processing and storage migrate closer to the edge, enterprises prioritize micro mobile data center physical and cyber security. Encryption, access restrictions, and surveillance technologies protect sensitive data and edge computing settings in these solutions. This development shows the industry's dedication to edge data security.

Leave a Comment