Microbiology Testing Market Summary

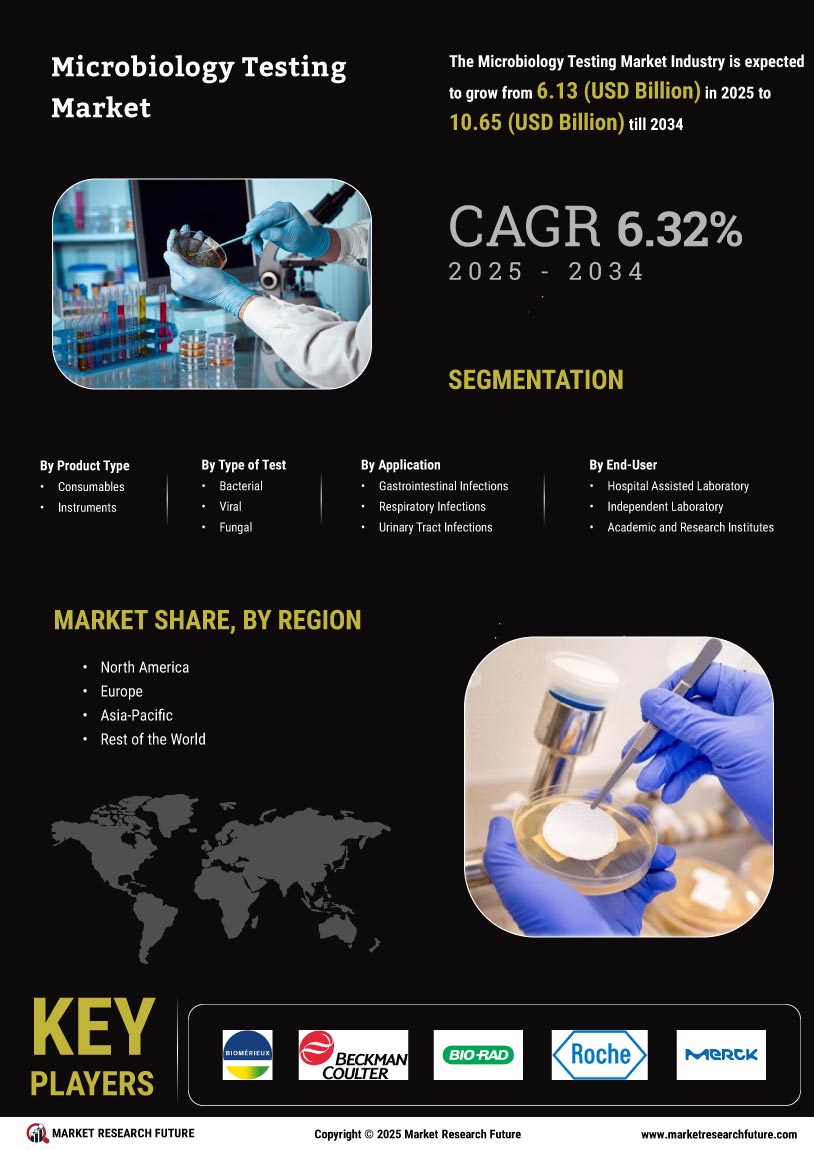

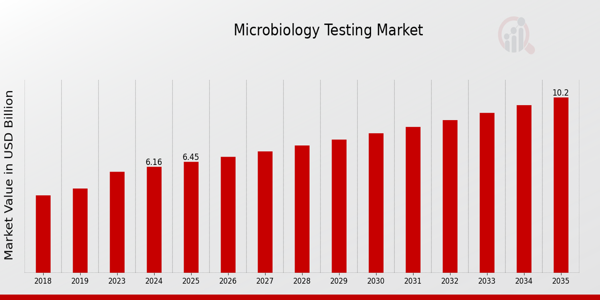

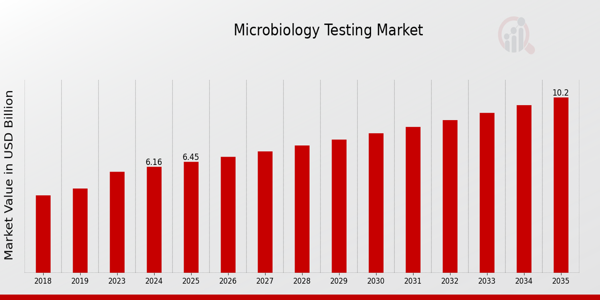

As per Market Research Future analysis, the Microbiology Testing Market was valued at 6.16 USD Billion in 2024 and is projected to grow to 10.2 USD Billion by 2035, reflecting a CAGR of 4.69% from 2025 to 2035. The market is driven by the rising prevalence of infectious diseases, stringent food safety regulations, and advancements in testing technologies.

Key Market Trends & Highlights

Key trends driving the Microbiology Testing Market include technological advancements and increased awareness among healthcare professionals.

- Rising prevalence of infectious diseases is a major driver, with WHO reporting 13 million deaths annually due to such illnesses.

- Technological advancements like PCR and NGS are enhancing testing efficiency, with PCR expected to grow from 1.54 USD Billion in 2024 to 2.57 USD Billion by 2035.

- Food safety regulations are tightening, with the Codex Alimentarius emphasizing microbiological testing for consumer protection.

- Growing awareness among healthcare professionals is leading to increased testing activities, enhancing public health outcomes.

Market Size & Forecast

2023 Market Size: USD 5.89 Billion

2024 Market Size: USD 6.16 Billion

2035 Market Size: USD 10.2 Billion

CAGR (2025-2035): 4.69%

Largest Regional Market Share in 2024: North America.

Major Players

Key players include Lonza, Neogen Corporation, Abbott Laboratories, BD, Thermo Fisher Scientific, Charles River Laboratories, Merck KGaA, Hygiena, Romer Labs, Genomatica, Qiagen, Wuxi AppTec, Danaher, SigmaAldrich, bioMérieux.

Key Microbiology Testing Market Trends Highlighted

Several important market factors are driving the notable expansion of the Global Microbiology Testing Market. Rising numbers of infectious illnesses in different areas have increased the need for efficient diagnostic techniques. Furthermore, the growing worry about food safety and the rigorous quality control standards in the food and beverage industry are driving the need for microbiological testing. Hospitals and labs are progressively using cutting-edge testing technologies to enhance diagnosis accuracy. Hence, the healthcare industry is also a key driver. The world market offers several possibilities to investigate.

Rapid testing technology innovations provide businesses the opportunity to improve their product offers and shorten the time to findings. The increasing focus on individualized medicine also creates opportunities for customized microbiological testing tools. Partnerships between healthcare practitioners and technology companies may result in the creation of more efficient testing methods in line with the need for faster diagnoses. Recent trends point to a move toward automated microbial testing technologies, which not only simplify laboratory operations but also improve workflow effectiveness. Testing procedures are increasingly incorporating artificial intelligence and machine learning, which will enable better data analysis and interpretation.

Moreover, the growing use of point-of-care testing equipment is changing the way microbiological testing is done, providing quicker findings in different healthcare environments. These changes show a wider dedication to enhancing public health results and handling new issues in the worldwide microbiological scene. The sector is also seeing a rising need for responsible testing methods and processes as attention on antibiotic resistance rises, hence guaranteeing that therapies fit present health standards.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Microbiology Testing Market Drivers

Rising Prevalence of Infectious Diseases

The rising incidence of infectious illnesses globally is a major factor for the Global Microbiology Testing Market Industry. World Health Organization statistics show that infectious diseases cause almost 13 million fatalities annually, hence stressing the pressing necessity of efficient microbiological testing. Growing illness incidence drives the need for sophisticated diagnostic technologies, which drives more funding from respected institutions like the Global Fund and the Centers for Illness Control and Prevention.

Their projects aim to enhance diagnostics and surveillance capacity, therefore driving the expansion of the microbiological testing industry. The market is projected to rise significantly in the next years as healthcare systems give early diagnosis and control of infectious illnesses top priority under a worldwide focus on quick detection techniques and the improved sensitivity of microbiological testing.

Technological Advancements in Testing Methods

Technological developments in testing techniques are driving the exceptional expansion of the Global Microbiology Testing Market Industry. Innovations like automated methods, next-generation sequencing (NGS), and polymerase chain reaction (PCR) have significantly improved the efficiency and accuracy of microbiology tests. The evolution of fast diagnostic tests, for example, has changed laboratory procedures and allowed faster turnaround times for findings.

The Food and Drug Administration claims these developments have greatly shortened testing times, facilitating the quick diagnosis and treatment of infections by healthcare professionals. Established businesses such as Thermo Fisher Scientific and Bio-Rad Laboratories are propelling this trend by always funding Research and development projects to improve testing methods, which then helps the market grow.

Increase in Food Safety Regulations

Rising worries about food safety and the application of rigorous regulatory criteria globally mostly drive the Global Microbiology Testing Market Industry. Developed by the World Health Organization and the Food and Agriculture Organization, the Codex Alimentarius stresses the need for microbiological testing to guarantee food safety and consumer protection. Companies in the food industry are progressively using microbiological testing to follow these guidelines as regulatory agencies tighten food safety rules.

This tendency supports market expansion and creates a need for microbial testing tools. Companies like the US Food and Drug Administration and the European Food Safety Authority are always improving their testing criteria, therefore promoting the further use of microbiological testing in the food sector.

Growing Awareness Among Healthcare Professionals

Another major factor for the Global microbiological Testing Market is the growing knowledge among healthcare workers about the need for microbiological testing. Programs and seminars run by organizations such as the American Society for Microbiology and the Infectious Diseases Society of America are promoting knowledge-sharing and stressing the vital importance of microbiology in the diagnosis and treatment of illnesses.

This increasing knowledge results in doctors' tendency to use microbiological tests for patient treatment, which increases testing activities. Therefore, hospitals and labs are spending more on microbiological testing capacity, thereby driving market expansion as they work to enhance public health and patient outcomes.

Microbiology Testing Market Segment Insights

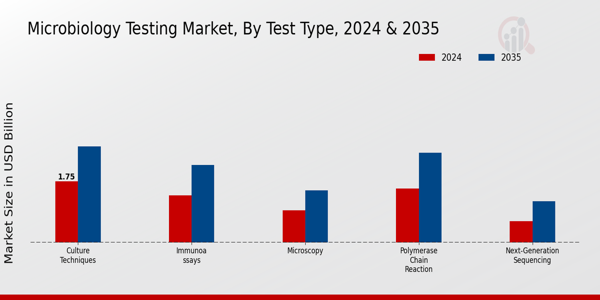

Microbiology Testing Market Test Type Insights

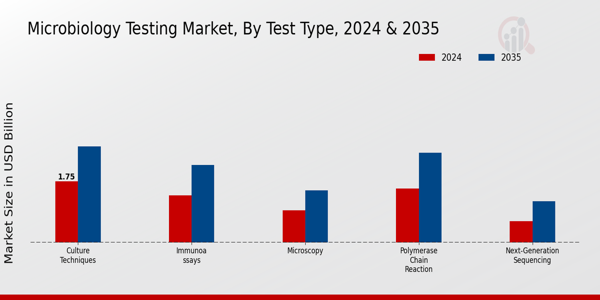

The Global Microbiology Testing Market has shown robust growth, particularly within its Test Type segment, which comprises various methodologies fundamental to medical diagnostics and pathogen detection. As the overall market is expected to be valued at 6.16 USD Billion in 2024, it reflects a burgeoning sector driven by advancements in laboratory technologies and an increasing prevalence of infectious diseases.

Among the methodologies, Polymerase Chain Reaction (PCR) emerges as a leading technique, with a market valuation of 1.54 USD Billion in 2024, rising to 2.57 USD Billion by 2035.This method is critical for its ability to amplify small segments of DNA, thus enabling rapid and precise detection of pathogens, which is vital for timely patient care. Also noteworthy is the Immunoassays method, which has a valuation of 1.35 USD Billion in 2024, anticipated to reach 2.22 USD Billion by 2035. This technique leverages antibody-antigen interactions to detect specific proteins, playing a significant role in diagnosing various infections and chronic conditions.

Culture Techniques hold a substantial market share as well, valued at 1.75 USD Billion in 2024 and expected to expand to 2.75 USD Billion by 2035; this conventional approach, while slower than molecular methods, remains essential for isolating infectious organisms and determining antibiotic susceptibility.In addition, Microscopy, with a market value of 0.92 USD Billion in 2024 projected to increase to 1.49 USD Billion by 2035, is crucial in visualizing microorganisms, contributing significantly to both research and clinical diagnostic applications.

Lastly, Next-Generation Sequencing (NGS) is valued at 0.6 USD Billion in 2024, with growth to 1.18 USD Billion by 2035, representing an emergent area in microbiology testing that allows extensive genomic analysis of pathogens at an unprecedented scale, aiding in outbreak investigations and understanding microbial genetics. Overall, these methodologies not only represent a significant portion of the Global Microbiology Testing Market revenue but also illustrate the ongoing transition toward more sensitive, efficient, and rapid diagnostic tools capable of addressing global health challenges.

As the demand for efficient testing methods increases, the Global Microbiology Testing Market segmentation will continue to evolve, driven by technological advancements and an urgent need for improved health outcomes influenced by global trends such as rising antibiotic resistance and the growing emphasis on precision medicine.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Microbiology Testing Market Application Insights

The Global Microbiology Testing Market is projected to be valued at 6.16 billion USD by 2024, showcasing significant growth within the Application segment. This segment includes various critical areas such as Clinical Diagnostics, Food and Beverage Testing, Environmental Testing, and Pharmaceutical Testing. Clinical Diagnostics holds a prominent position as it plays a vital role in diagnosing infections and diseases, ensuring patient safety and treatment efficacy globally. Food and Beverage Testing is crucial for maintaining public health standards, with regulatory requirements driving its importance in ensuring consumer safety.

Environmental Testing addresses critical issues related to public health and safety, monitoring water, air, and soil quality to prevent outbreaks. Furthermore, Pharmaceutical Testing is essential for ensuring product safety and efficacy, complying with stringent regulations globally. The demand for advanced microbiology testing methods, alongside increased awareness regarding hygiene and safety, drives market growth and emphasizes the significance of these applications in various sectors. As the Global Microbiology Testing Market evolves, the interplay between technological advancements and regulatory standards will further increase the importance of these applications in addressing public health challenges and ensuring safety.

Microbiology Testing Market End User Insights

The Global Microbiology Testing Market demonstrates significant growth within its End User segment, which includes Clinical Laboratories, Pharmaceutical Companies, Food and Beverage Industry, and Research Institutions. In 2024, the overall market is poised to reach a value of 6.16 billion USD, reflecting an upward trend fueled by rising health concerns and stricter food safety regulations. Clinical Laboratories are crucial, as they perform essential testing for infections, thus directly impacting patient outcomes and public health. Pharmaceutical Companies leverage microbiology testing extensively in drug development and quality control, making it integral for compliance with regulations.

The Food and Beverage Industry relies on microbiology to ensure product safety and quality, addressing consumer demand for safer food products. Research Institutions are vital for fostering innovation through studies and developments in microbiology, driving advancements that impact various sectors. Collectively, these end users contribute to the evolving landscape of the Global Microbiology Testing Market, with forces such as technological advancements and increased investments shaping its future trajectory.

Microbiology Testing Market Microorganism Type Insights

The Global Microbiology Testing Market, particularly focusing on the Microorganism Type segment, is poised for notable growth, reflecting a market valuation of 6.16 billion USD in 2024. This segment encompasses diverse types of microorganisms, including Bacteria, Viruses, Fungi, and Parasites, each playing a vital role in the overall landscape of microbiology testing.

Bacteria have long been a key focus due to their relevance in various infections and antibiotic resistance challenges, while Viruses have gained prominence, especially in the wake of global health crises emphasizing the need for rapid and accurate testing methods.Fungi are significant in areas like food safety and agriculture, showcasing market growth as awareness increases about their impact on human health and the food supply. Parasites, although often overlooked, represent a critical public health concern, especially in developing regions where parasitic diseases persist.

The Global Microbiology Testing Market is thus seeing a robust expansion driven by technological innovations, increased awareness regarding hygiene and health, and a growing emphasis on preventive healthcare measures. Collectively, the Microorganism Type segment not only demonstrates majority holding in market share but also underscores the importance of continuous research and advancement in microbiological methodologies to effectively combat various health challenges globally.

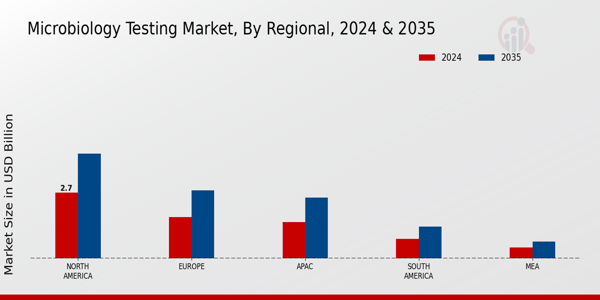

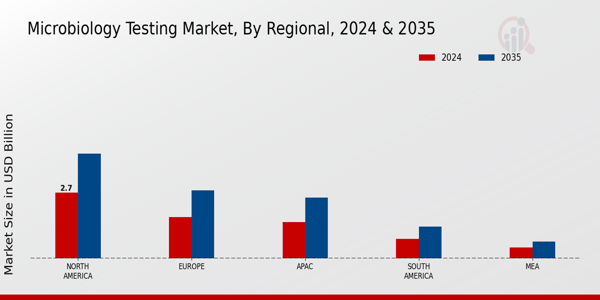

Microbiology Testing Market Regional Insights

The Global Microbiology Testing Market exhibits substantial growth across regional segments, with North America leading the market. In 2024, North America is valued at 2.7 USD Billion, dominating the regional landscape and highlighting the significant demand for microbiology testing solutions, primarily driven by advanced healthcare infrastructure and robust Research and Development activities. Europe follows with a market value of 1.7 USD Billion in the same year, benefitting from stringent regulatory standards and increased focus on food safety and quality, thereby underlining its critical role in Global Microbiology Testing Market statistics.

The Asia Pacific (APAC) region shows promising growth, estimated at 1.5 USD Billion in 2024, fueled by rising healthcare investments and expanding research initiatives, making it a focal point for future market growth. Meanwhile, South America and the Middle East and Africa (MEA) appear to hold smaller shares valued at 0.8 USD Billion and 0.46 USD Billion respectively, yet both regions present opportunities due to increasing awareness about microbial diseases and diagnostic methods. Overall, the Global Microbiology Testing Market segmentation reflects a diverse landscape with each region contributing uniquely to the industry's growth trajectory.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Microbiology Testing Market Key Players and Competitive Insights

The Global Microbiology Testing Market has been witnessing significant advancements and growth driven by increasing concerns regarding food safety, healthcare-associated infections, and the need for effective disease diagnosis. As the demand for rapid testing solutions and innovative technologies rises, several key players have emerged, leading to a highly competitive landscape. The market is characterized by a mix of large multinational corporations and smaller niche firms, each striving to enhance their product offerings and capture larger market shares.

This competitive environment has spurred increased research and development activities, strategic collaborations, and frequent mergers and acquisitions as companies aim to stay at the forefront of microbiology testing innovations, ensuring comprehensive solutions across various sectors including clinical diagnostics, pharmaceuticals, and food and beverage industries.Lonza holds a prominent position in the Global Microbiology Testing Market, known for its robust portfolio of high-quality products and services tailored for microbiological analysis. With a strong emphasis on research and development, Lonza focuses on providing innovative solutions that cater to the diverse needs of laboratories worldwide.

Their strengths lie in their extensive expertise in cell biology, molecular biology, and advanced microbiological testing methodologies, positioning them as a trusted partner for various industries. Lonza's global presence enables it to leverage its resources effectively across regions, facilitating the delivery of tailored microbiology testing solutions.

The company’s commitment to quality assurance, coupled with a strong focus on customer service, enhances its reputation in the market, making it a preferred choice for customers seeking reliable testing solutions.Neogen Corporation also plays a significant role in the Global Microbiology Testing Market, recognized for its broad range of specialized products that focus on food safety and animal health. Neogen's key offerings include rapid test kits for detecting pathogens in food and environmental samples, along with advanced diagnostic equipment.

The company has established a solid market presence, benefiting from its innovative approach to developing simple yet effective testing solutions that meet consumers' evolving needs. Neogen's strengths lie in its dedication to quality and compliance, coupled with an agile response to emerging industry trends, ensuring their products are aligned with regulatory standards. The company has also engaged in strategic mergers and acquisitions to bolster its product portfolio and expand its market reach, further solidifying its role as a leader in the microbiology testing domain on a global scale.

Key Companies in the Microbiology Testing Market Include

- Lonza

- Neogen Corporation

- Abbott Laboratories

- BD

- Thermo Fisher Scientific

- Charles River Laboratories

- Merck KGaA

- Hygiena

- Romer Labs

- Genomatica

- Qiagen

- Wuxi AppTec

- Danaher

- SigmaAldrich

- bioMérieux

Microbiology Testing Market Industry Developments

The Global Microbiology Testing Market has recently witnessed significant developments, particularly in terms of growth and innovation. For instance, in October 2023, Lonza announced the expansion of its microbiological testing capabilities to enhance products aimed at the pharmaceutical industry, while Neogen Corporation launched new microbiology testing kits targeting food safety. Abbott Laboratories has also made headlines with the introduction of novel diagnostic tools designed to improve the speed and accuracy of microbial identification. Additionally, BD reported advancements in its automated systems for rapid microbial testing, showcasing a trend towards automation in the sector.

In a notable merger, Merck KGaA acquired a biotechnology firm in July 2023, consolidating its position in the microbiological testing landscape, which reflects the growing importance of strategic partnerships for market competitiveness. Moreover, Thermo Fisher Scientific's significant investment in Research and Development has underscored the industry's focus on innovation and product diversification. In the past two years, investments and partnerships have surged, with companies recognizing the escalating need for reliable microbiological testing solutions in various sectors, including pharmaceuticals, food safety, and environmental monitoring.

Microbiology Testing Market Segmentation Insights

Microbiology Testing Market Test Type Outlook

- Polymerase Chain Reaction

- Immunoassays

- Culture Techniques

- Microscopy

- Next-Generation Sequencing

Microbiology Testing Market Application Outlook

- Clinical Diagnostics

- Food and Beverage Testing

- Environmental Testing

- Pharmaceutical Testing

Microbiology Testing Market End User Outlook

- Clinical Laboratories

- Pharmaceutical Companies

- Food and Beverage Industry

- Research Institutions

Microbiology Testing Market Microorganism Type Outlook

- Bacteria

- Viruses

- Fungi

- Parasites

Microbiology Testing Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

5.89(USD Billion) |

| MARKET SIZE 2024 |

6.16(USD Billion) |

| MARKET SIZE 2035 |

10.2(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

4.69% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Lonza, Neogen Corporation, Abbott Laboratories, BD, Thermo Fisher Scientific, Charles River Laboratories, Merck KGaA, Hygiena, Romer Labs, Genomatica, Qiagen, Wuxi AppTec, Danaher, SigmaAldrich, bioMérieux |

| SEGMENTS COVERED |

Test Type, Application, End User, Microorganism Type, Regional |

| KEY MARKET OPPORTUNITIES |

Increased demand for rapid testing, Rise in infectious diseases, Growth in food safety testing, Advancements in molecular diagnostics, Expanding biopharmaceutical sector |

| KEY MARKET DYNAMICS |

Technological advancements, Rising infectious diseases, Stringent regulatory standards, Increased funding for research, Growing awareness of hygiene |

| COUNTRIES COVERED |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Global Microbiology Testing Market is expected to be valued at 6.16 USD Billion in 2024.

The expected CAGR for the Global Microbiology Testing Market from 2025 to 2035 is 4.69%.

North America is projected to hold the largest market share, valued at 2.7 USD Billion in 2024.

The Global Microbiology Testing Market is expected to reach a value of 10.2 USD Billion by 2035.

The Polymerase Chain Reaction segment is estimated to be valued at 1.54 USD Billion in 2024.

Key players include Lonza, Neogen Corporation, Abbott Laboratories, BD, and Thermo Fisher Scientific.

The Immunoassays segment is projected to be worth 2.22 USD Billion in 2035.

The APAC region is expected to have a market value of 1.5 USD Billion in 2024.

The market size for Next-Generation Sequencing is valued at 0.6 USD Billion in 2024.

The Culture Techniques segment is forecasted to reach a market size of 2.75 USD Billion by 2035.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review