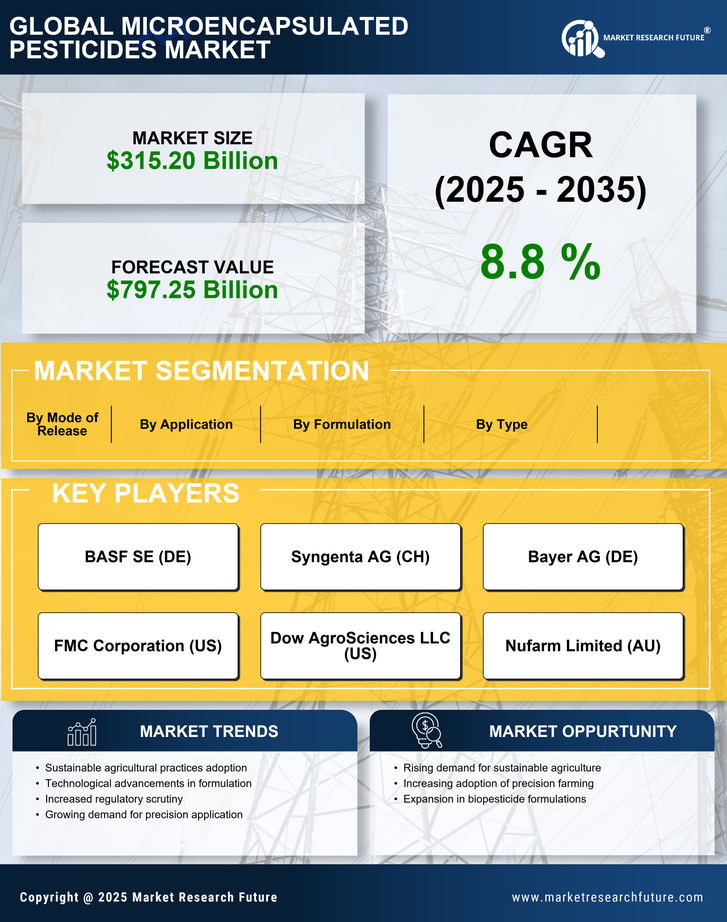

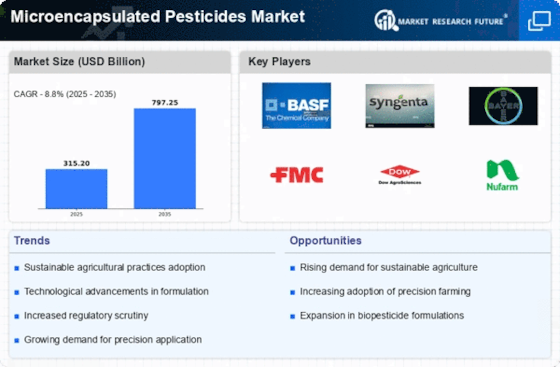

Expansion of Crop Protection Market

The expansion of the crop protection market is a significant driver for the Microencapsulated Pesticides Market. As the global population continues to grow, the demand for food production is increasing, leading to a heightened focus on effective pest management solutions. Microencapsulated pesticides are gaining traction due to their ability to enhance the efficacy of active ingredients while minimizing environmental impact. Market analysis reveals that the crop protection market is projected to reach USD 80 billion by 2027, with microencapsulated products expected to capture a substantial share. This growth underscores the potential for microencapsulated pesticides to play a crucial role in meeting the challenges of modern agriculture.

Rising Demand for Precision Agriculture

The Microencapsulated Pesticides Market is experiencing a notable surge in demand due to the increasing adoption of precision agriculture techniques. Farmers are increasingly seeking methods that enhance crop yield while minimizing chemical usage. Microencapsulated pesticides offer targeted delivery, reducing the risk of over-application and environmental contamination. According to recent data, the market for precision agriculture is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This trend indicates a shift towards more sustainable farming practices, where microencapsulated solutions play a pivotal role in optimizing resource use and improving agricultural productivity.

Growing Awareness of Environmental Impact

There is a growing awareness regarding the environmental impact of traditional pesticide use, which is driving the Microencapsulated Pesticides Market. As consumers and regulatory bodies become more conscious of ecological sustainability, the demand for eco-friendly alternatives is rising. Microencapsulated pesticides, which reduce the volatility and leaching of active ingredients, are perceived as a more responsible choice. Market data suggests that the eco-friendly pesticide segment is expected to witness a growth rate of around 10% annually. This shift reflects a broader trend towards sustainable agricultural practices, where the emphasis is placed on minimizing harm to non-target organisms and preserving biodiversity.

Technological Innovations in Microencapsulation

Technological innovations in microencapsulation techniques are significantly influencing the Microencapsulated Pesticides Market. Advances in materials science and engineering have led to the development of more effective microencapsulation methods, enhancing the stability and release profiles of pesticides. These innovations allow for controlled release, which can improve efficacy and reduce the frequency of applications. Recent studies indicate that the market for microencapsulation technology is expected to grow by approximately 15% over the next few years. This growth is indicative of the increasing investment in research and development aimed at creating more efficient and sustainable pest management solutions.

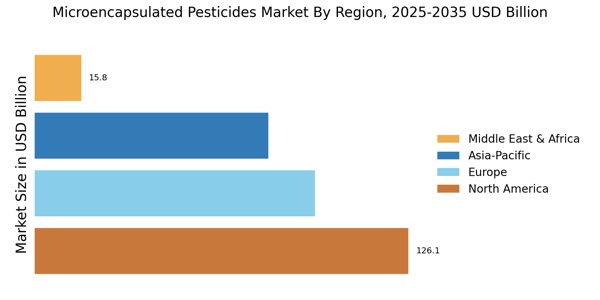

Increasing Regulatory Support for Sustainable Practices

The Microencapsulated Pesticides Market is benefiting from increasing regulatory support aimed at promoting sustainable agricultural practices. Governments are implementing policies that encourage the use of environmentally friendly pest control methods, including microencapsulation technologies. This regulatory landscape is fostering innovation and investment in the development of safer pesticide formulations. Data indicates that regions with stringent environmental regulations are witnessing a faster adoption of microencapsulated pesticides, as they align with the goals of reducing chemical residues in food and protecting ecosystems. This trend suggests a favorable environment for market growth in the coming years.