Top Industry Leaders in the Military Tactical Vest Market

Strategies Adopted: Key players in the Military Tactical Vest Market deploy various strategies to maintain their competitive edge and capitalize on market opportunities. These strategies include:

Product Innovation: Companies invest in research and development to develop advanced materials, ergonomic designs, and modular systems for tactical vests, enhancing comfort, mobility, and protection while accommodating various mission requirements and equipment configurations.

Customization and Personalization: Companies offer customizable options, such as adjustable straps, MOLLE (Modular Lightweight Load-carrying Equipment) compatibility, and customizable pouch configurations, allowing users to tailor their vests to individual preferences, body types, and operational needs.

Strategic Partnerships: Collaborations with military units, law enforcement agencies, equipment manufacturers, and research institutions enable companies to gain insights into end-user requirements, validate product performance, and enhance market credibility, driving adoption and brand recognition.

International Expansion: Companies focus on expanding their geographical presence through international sales channels, distribution networks, and strategic alliances, targeting emerging markets and military forces seeking advanced tactical gear and personal protection solutions.

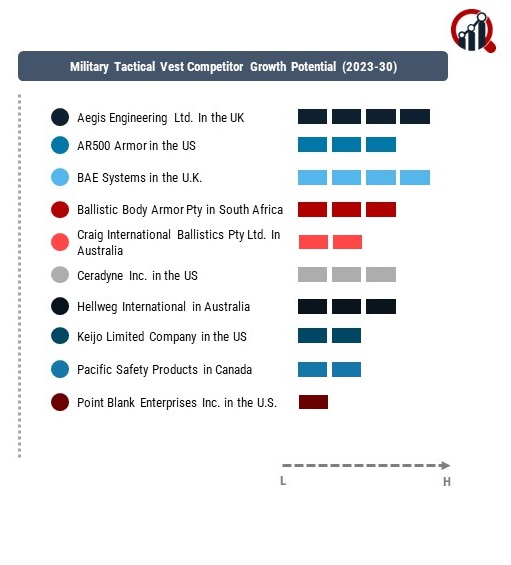

The Competitive Intensity of the Industry

Aegis Engineering Ltd. In the UK

AR500 Armor in the US

BAE Systems in the U.K.

Ballistic Body Armor Pty in South Africa

Craig International Ballistics Pty Ltd. In Australia

Ceradyne Inc. in the US

Hellweg International in Australia

Keijo Limited Company in the US

Pacific Safety Products in Canada

Point Blank Enterprises Inc. in the U.S.

Safariland LLC in U.S.

Factors for Market Share Analysis: Several factors contribute to the analysis of market share in the Military Tactical Vest Market, including:

Performance and Durability: The performance, durability, and reliability of tactical vests in real-world conditions, including ballistic protection, load-bearing capacity, comfort, and ergonomics, play a critical role in gaining market share, with companies offering high-quality, battle-proven solutions leading the market.

Brand Reputation: Established brands with a track record of excellence, customer satisfaction, and industry recognition have a competitive advantage in gaining market share, with companies investing in brand building, marketing, and customer engagement to enhance brand loyalty and preference among military and law enforcement agencies.

Pricing Competitiveness: Competitive pricing, value-added features, and cost-effective solutions influence market share by addressing budget constraints and delivering superior value for money to customers, with companies offering flexible pricing options and bulk discounts gaining a competitive edge.

Regulatory Compliance: Compliance with ballistic standards, body armor regulations, and industry certifications, such as NIJ (National Institute of Justice) standards and ISO (International Organization for Standardization) certifications, is essential for gaining market share and securing contracts with government agencies and military organizations.

New and Emerging Companies: In addition to established players, new and emerging companies are entering the Military Tactical Vest Market, bringing innovative technologies, materials, and designs. Some notable new and emerging companies in the market include:

Spiritus Systems

Ferro Concepts

Velocity Systems

Tyr Tactical

Shellback Tactical

Velocity Systems

LBT Inc. (London Bridge Trading)

FirstSpear LLC

HRT (High Risk Training) Tactical Gear

Blue Force Gear

Industry News and Current Investment Trends: Recent developments and investment trends in the Military Tactical Vest Market reflect a growing focus on lightweight materials, advanced protection technologies, and integrated equipment solutions. Key highlights include:

Lightweight Materials: Adoption of lightweight materials, such as high-strength fibers, composite ceramics, and advanced polymers, enables companies to reduce the weight and bulk of tactical vests without compromising protection, increasing user comfort and mobility in the field.

Integrated Equipment Solutions: Integration of equipment pouches, hydration systems, communication devices, and ballistic inserts into tactical vests streamlines gear carriage, enhances mission effectiveness, and reduces the need for additional load-bearing equipment, improving soldier survivability and operational efficiency.

Sustainability Initiatives: Companies are increasingly focusing on sustainability initiatives, such as eco-friendly materials, recyclable components, and energy-efficient manufacturing processes, to reduce environmental impact and meet regulatory requirements while aligning with customer preferences for sustainable products.

Overall Competitive Scenario: The Military Tactical Vest Market is characterized by intense competition, innovation, and customer-centricity. Established players leverage their experience, brand reputation, and global reach to maintain market leadership, while new entrants disrupt the market with agile strategies and innovative solutions. As the demand for lightweight, modular, and high-performance tactical vests continues to grow, companies that prioritize innovation, quality, and customer satisfaction will remain competitive in the dynamic landscape of the Military Tactical Vest Market.

Recent Market Development

Several countries are investing in the military market. They are the U.S., Russia, China, India, and the U.K., spending around 62% of the global military expenditure.

Female officers are getting armours made according to their size and fit. Combat gears are also made for them, which are lighter and also fit them better.