Research Methodology on Military Wearable Sensors Market

1. Introduction

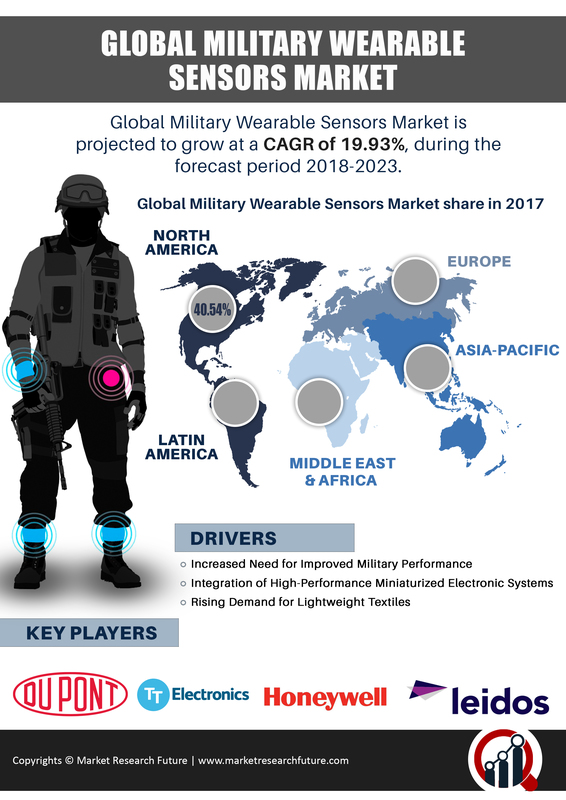

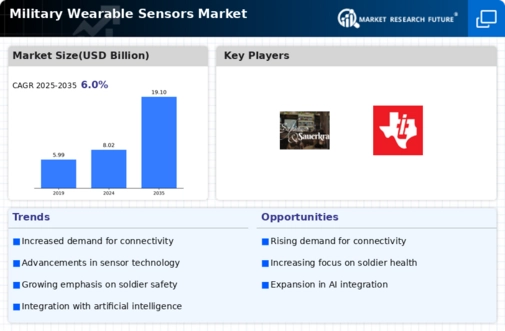

The global military wearable sensors market is predicted to experience notable growth during the period 2023 -2030. Wearable sensors have strengthened the monitoring capability of military forces and enhanced their operational performance. As these sensors are being deployed, the demand for military wearable sensors has increased. The report mentioned in the link provides a comprehensive analysis of the global military wearable sensors market. It includes in-depth information on the market's segmentation, structure, future outlook and industry trends. To conduct this research report, a well-defined research methodology was followed. The following section elaborates on the research methodology of the report.

2. Research Objectives

The primary objective of this research was to make a comprehensive analysis of the global military wearable sensors market. To achieve the objective, the research report had seven specific objectives.

- To determine the current size of the global military wearable sensors market

- To examine the dynamics of the market including drivers, trends, and opportunities

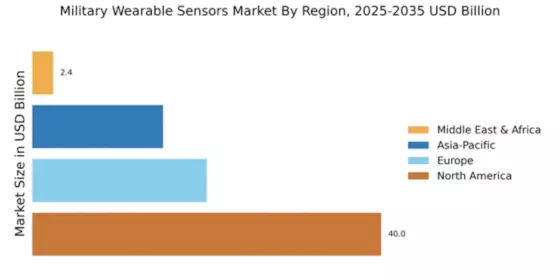

- To identify and segment the market based on type, technology, application, and region

- To analyze the competitive landscape of the global military wearable sensors market

- To provide a detailed analysis of the key players in the market

- To provide a forecast of the market growth till 2030.

3. Research Design

To achieve the research objectives, a mixed methods approach was used that included primary and secondary research. The following section provides a detailed description of the various stages involved in the research design.

3.1 Primary Research Method

A primary research method was employed to collect detailed information about the military wearable sensors market and its outlook. This method included in-depth interviews with industry stakeholders and experts, surveys, focus groups, and workshops. The data gathered through primary research provided insight into real-world trends, industry practices, and customer preferences.

3.2 Secondary Research Method

A secondary research method was used to access information about the market from existing public and private sources. The sources included reports of industry associations, documents and reports of government bodies, and documents of trade associations. The key information acquisition sources included Factiva, Hoovers, Avention, and Capital Business. The secondary research data provided a deeper understanding of the market, which further enabled the researchers to arrive at reliable estimates.

3.3 Data Collection Method

The data collected from primary and secondary sources were organized, filtered, and analyzed to draw empirical conclusions. For analysis purposes, a bottom-up approach was employed wherein the data is collected and analyzed from various micro and macro segments of the market. The micro-segments covered by this research were type, technology, and application, while the macro segments included the various regions.

3.4 Data Analysis Method

The data collected was analyzed using various advanced tools and techniques such as Porter's Five Forces Analysis, SWOT Analysis, Market Analysis Matrix, and Quantitative techniques. The qualitative insights gathered from primary research are combined with the quantitative data garnered from secondary sources to come up with accurate estimates and report conclusions.

3.5 Sampling Plan

The primary research method adopted a probability proportional to population size (PPS) sampling technique for selecting respondents for surveys and interviews. This method ensured that the responses collected could accurately and objectively represent the target population. The primary respondent pool consisted of C-level executives, industry experts, and stakeholders from both public and private organizations.

4. Conclusion

The research methodology employed for the report was well-defined and detailed. It included extensive primary and secondary research that was conducted by collecting data from various sources, such as surveys, focus groups, interviews, workshops, and existing literature. The data collected was filtered and analyzed using various tools and techniques, such as Porter's Five Forces Analysis, SWOT Analysis, Market Analysis Matrix, and Quantitative techniques. The end result was a comprehensive analysis of the global military wearable sensors market that accurately depicted market trends and dynamics.