Focus on Cost Efficiency

The Milling Machine Market is increasingly characterized by a focus on cost efficiency among manufacturers. As competition intensifies, companies are seeking ways to reduce production costs while maintaining quality. This trend is prompting investments in milling machines that offer better energy efficiency and lower operational costs. Recent findings suggest that energy-efficient milling machines can reduce energy consumption by up to 30%, which is a significant factor for manufacturers aiming to improve their bottom line. Additionally, the integration of advanced technologies such as predictive maintenance and real-time monitoring is likely to enhance the cost-effectiveness of milling operations. This focus on cost efficiency is expected to drive the demand for innovative milling solutions that align with the financial objectives of manufacturers.

Emergence of Advanced Materials

The Milling Machine Market is adapting to the emergence of advanced materials, which are increasingly being utilized in various applications. Industries such as aerospace and automotive are exploring materials like composites and titanium, which require specialized milling techniques. The demand for milling machines capable of processing these advanced materials is on the rise, as traditional machines may not provide the necessary performance. Recent market analysis indicates that the segment for milling machines designed for advanced materials is expected to grow by approximately 7% over the next few years. This growth is likely to drive innovation in milling technologies, leading to the development of machines that can handle the unique properties of these materials while maintaining high levels of efficiency and precision.

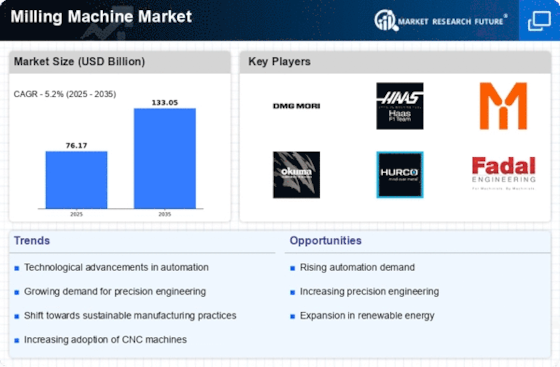

Increased Adoption of Automation

The Milling Machine Market is significantly influenced by the increased adoption of automation technologies. As manufacturers seek to optimize production processes and reduce labor costs, there is a growing trend towards integrating automated milling machines into production lines. Data suggests that the automation market within the manufacturing sector is expected to grow at a rate of 8% annually, indicating a strong shift towards automated solutions. This trend is likely to enhance the capabilities of milling machines, allowing for greater precision, speed, and consistency in production. Additionally, automated milling machines can operate continuously, thereby increasing overall productivity and reducing downtime, which is crucial for meeting the demands of modern manufacturing.

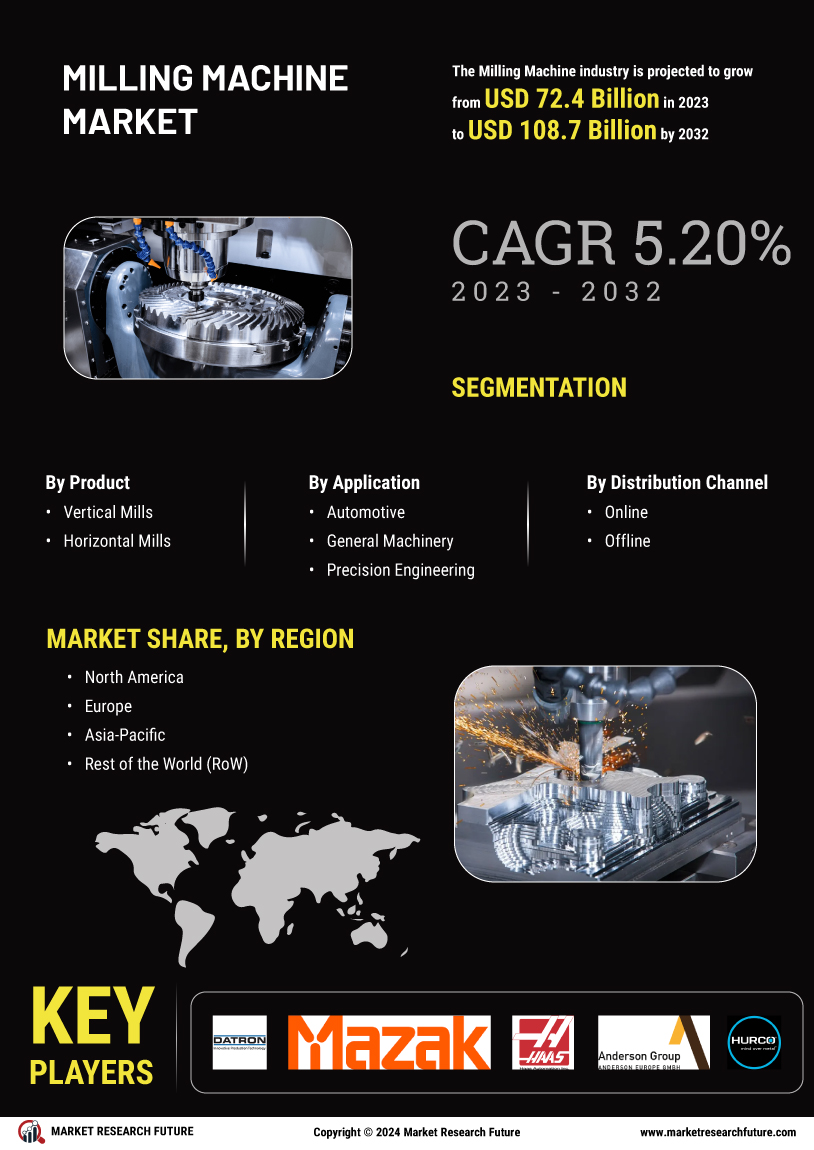

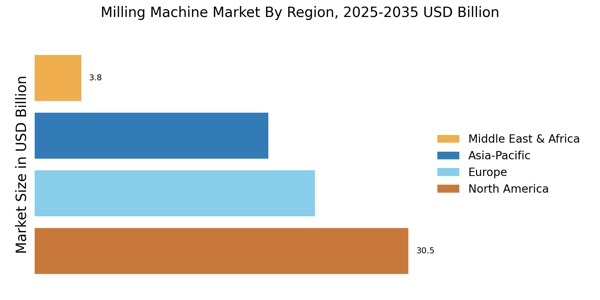

Expansion of the Manufacturing Sector

The Milling Machine Market is poised for growth due to the ongoing expansion of the manufacturing sector. As economies recover and industrial activities ramp up, there is a corresponding increase in the demand for milling machines. Recent statistics indicate that the manufacturing sector is expected to witness a growth rate of around 5% annually, which is likely to spur investments in milling technologies. This expansion is driven by the need for efficient production processes and the ability to produce complex components. Furthermore, the rise of smart manufacturing and Industry 4.0 initiatives is pushing manufacturers to adopt advanced milling machines that integrate seamlessly with digital technologies, thereby enhancing operational efficiency and competitiveness.

Rising Demand for Precision Engineering

The Milling Machine Market is experiencing a notable increase in demand for precision engineering across various sectors, including aerospace, automotive, and medical devices. As industries strive for higher accuracy and efficiency, the need for advanced milling machines that can deliver precise tolerances becomes paramount. According to recent data, the precision engineering sector is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth is likely to drive investments in milling technologies that enhance productivity and reduce waste. Consequently, manufacturers are focusing on developing milling machines equipped with advanced features such as CNC capabilities and automation, which are essential for meeting the stringent requirements of precision engineering applications.

Leave a Comment