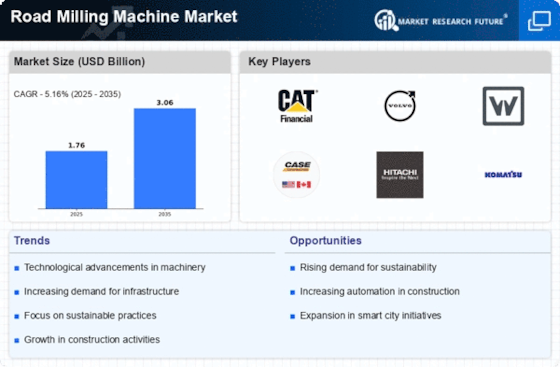

Rising Demand for Road Maintenance

The rising demand for road maintenance is a crucial factor influencing the Road Milling Machine Market. As urbanization accelerates, the need for efficient road repair and resurfacing becomes increasingly apparent. In many regions, the deterioration of road surfaces necessitates the use of advanced milling machines to ensure safety and longevity. The market is projected to expand as municipalities and private contractors seek to invest in high-performance road milling equipment. In 2025, the Road Milling Machine Market is anticipated to grow by 4.8%, reflecting the urgency of maintaining road quality and safety standards.

Expansion of Construction Activities

The expansion of construction activities across various sectors is a vital driver for the Road Milling Machine Market. With the rise in residential, commercial, and industrial construction projects, the need for efficient road milling solutions is becoming more pronounced. This trend is particularly evident in developing regions where infrastructure development is a priority. The Road Milling Machine Market is projected to experience a growth rate of 5.1% in 2025, as construction companies increasingly adopt advanced milling technologies to meet project demands. This expansion is likely to create new opportunities for manufacturers and suppliers in the market.

Infrastructure Development Initiatives

The ongoing infrastructure development initiatives across various regions appear to be a primary driver for the Road Milling Machine Market. Governments are increasingly investing in road construction and maintenance to enhance connectivity and support economic growth. For instance, the demand for road milling machines is likely to rise as countries prioritize the rehabilitation of aging road networks. In 2025, the market is projected to witness a growth rate of approximately 5.2%, driven by these initiatives. The Road Milling Machine Market is expected to benefit from public-private partnerships that aim to modernize transportation infrastructure, thereby creating a favorable environment for manufacturers and suppliers.

Technological Innovations in Machinery

Technological innovations in machinery are reshaping the Road Milling Machine Market. The introduction of advanced features such as GPS-guided systems and automated controls enhances the efficiency and precision of milling operations. These innovations not only improve productivity but also reduce operational costs, making road milling machines more attractive to contractors. As manufacturers continue to invest in research and development, the market is likely to see an influx of new models equipped with cutting-edge technology. This trend is expected to drive the Road Milling Machine Market forward, with a projected growth rate of 6% in the coming years.

Increased Focus on Environmental Sustainability

The increased focus on environmental sustainability is influencing the Road Milling Machine Market significantly. As regulations surrounding emissions and waste management become stricter, manufacturers are compelled to develop eco-friendly milling machines. These machines are designed to minimize environmental impact while maintaining high performance. The market is likely to see a shift towards machines that utilize sustainable materials and energy-efficient technologies. In 2025, the Road Milling Machine Market is expected to grow by 5.5%, driven by the demand for sustainable practices in road construction and maintenance.

Leave a Comment