Market Growth Projections

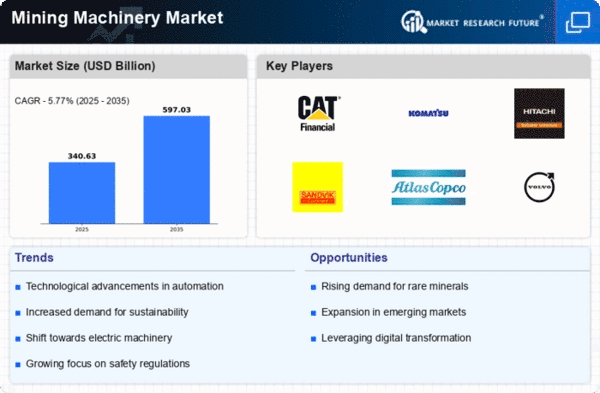

The Global Mining Machinery Market Industry is projected to experience robust growth over the next decade. With a compound annual growth rate (CAGR) of 5.77% anticipated from 2025 to 2035, the market is expected to expand significantly. By 2035, the market size is estimated to reach 597.0 USD Billion, reflecting the increasing demand for advanced mining solutions. This growth is driven by various factors, including technological advancements, rising mineral demand, and sustainability initiatives. As the industry adapts to these changes, the Global Mining Machinery Market Industry is poised for a transformative period, characterized by innovation and increased investment.

Rising Demand for Minerals

The Global Mining Machinery Market Industry is significantly influenced by the rising demand for minerals, driven by various sectors such as construction, automotive, and electronics. As urbanization and industrialization continue to expand globally, the need for essential minerals like copper, lithium, and rare earth elements is escalating. This trend is expected to propel the market, with estimates suggesting a growth to 597.0 USD Billion by 2035. The increasing reliance on advanced machinery to extract these minerals efficiently indicates a robust future for the Global Mining Machinery Market Industry, as companies seek to optimize their operations to meet this growing demand.

Sustainability Initiatives

Sustainability initiatives are becoming increasingly pivotal within the Global Mining Machinery Market Industry. Mining companies are under pressure to adopt environmentally friendly practices, leading to the development of machinery that minimizes ecological impact. This includes the use of electric and hybrid equipment, which reduces carbon emissions and energy consumption. As regulations tighten and public awareness of environmental issues grows, the demand for sustainable mining solutions is likely to rise. Consequently, this shift may drive innovation and investment in the Global Mining Machinery Market Industry, aligning with global sustainability goals and potentially enhancing market growth.

Technological Advancements

The Global Mining Machinery Market Industry is experiencing a surge in technological advancements that enhance operational efficiency and safety. Innovations such as automation, artificial intelligence, and IoT integration are transforming traditional mining practices. For instance, autonomous haul trucks and drones are increasingly utilized for surveying and monitoring, reducing labor costs and improving productivity. These advancements are expected to contribute to the market's growth, with projections indicating a market size of 322.1 USD Billion in 2024. As mining companies adopt these technologies, they are likely to gain a competitive edge, further driving demand within the Global Mining Machinery Market Industry.

Market Consolidation Trends

Market consolidation trends are emerging within the Global Mining Machinery Market Industry, as companies seek to enhance their competitive positioning. Mergers and acquisitions are becoming more common as firms aim to expand their product offerings and geographic reach. This consolidation can lead to increased efficiency and innovation, as combined resources allow for greater investment in research and development. The resulting economies of scale may also reduce costs, making advanced machinery more accessible to a broader range of mining operations. As the industry evolves, these consolidation trends could significantly influence the dynamics of the Global Mining Machinery Market Industry.

Government Regulations and Support

Government regulations and support play a crucial role in shaping the Global Mining Machinery Market Industry. Many countries are implementing policies to promote safe and efficient mining practices, which often include incentives for adopting advanced machinery. For instance, subsidies for environmentally friendly equipment can encourage mining companies to invest in new technologies. Additionally, regulatory frameworks aimed at enhancing worker safety and reducing environmental impact are likely to drive demand for modern machinery. As governments prioritize sustainable mining practices, the Global Mining Machinery Market Industry may witness accelerated growth, aligning with national and international standards.