Market Share

Mobile Payment Technologies Market Share Analysis

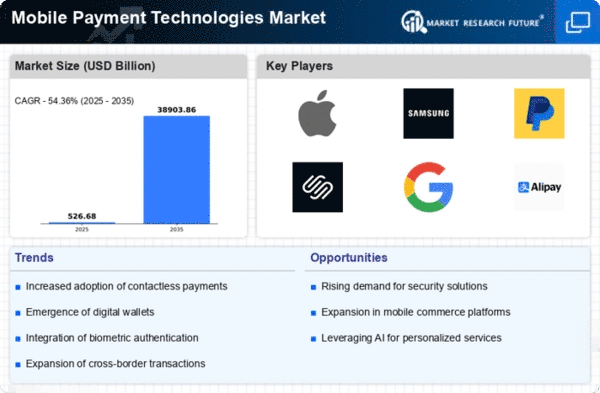

The market for mobile payment technology has grown rapidly due to smartphone use and cashless transactions. One of the biggest mobile payment trends is the move to contactless payments like NFC and QR code. Mobile wallet and payment app usage is rising as consumers prefer contactless payment solutions for ease and security.

Biometric authentication like fingerprint and face recognition has also improved mobile payment security, boosting consumer confidence. As biometric technology improves and becomes more popular, frictionless and safe payments will continue.

Another mobile payment technology development is payment and shopping convergence. Mobile payment solutions allow retailers and e-commerce platforms to link shopping and payment, allowing customers to buy from their phones. This convergence improves shopping and simplifies checkout, increasing consumer pleasure and loyalty.

Additionally,P2P payment services have changed how people send money to friends and relatives. Popular P2P mobile payment applications let users divide bills, refund debts, and send money instantaneously. Many people now utilize P2P payment services for daily transactions due to its simplicity and accessibility.

Additionally, in-app and online payment solutions are in demand in the mobile payment sector. The rise of mobile apps and e-commerce platforms has led users to use mobile payment technology for safe and smooth transactions in apps and websites. This trend is fueled by in-app payments and the need for seamless checkout, especially online.

Mobile payments are now more secure and transparent thanks to tokenization and blockchain technology. By replacing sensitive payment data with unique tokens, tokenization reduces fraud and improves data security. Blockchain technology promotes mobile payment ecosystem trust and accountability by providing decentralized, tamper-resistant transaction records."

Leave a Comment