Research Methodology on Mobile Payment Technologies Market

Introduction

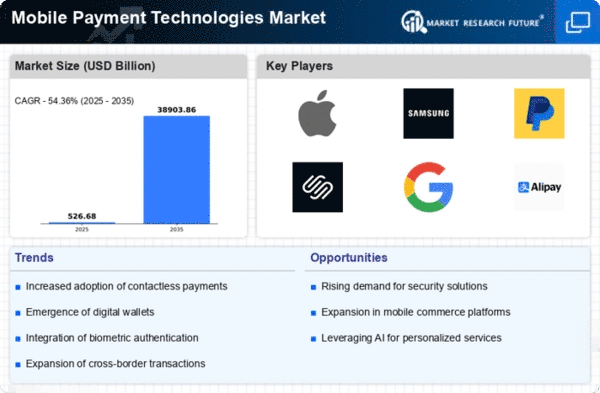

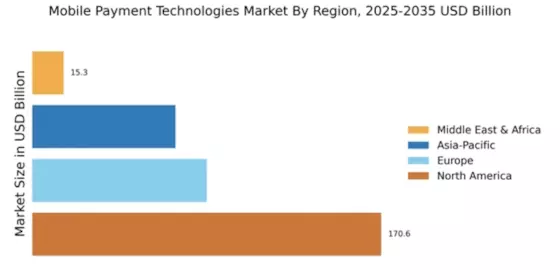

The purpose of this research project is to discover the market potential, drivers, barriers, and strategies of mobile payment technologies. The Market Research Future (MRFR) report titled Mobile Payment Technologies Market - Forecast to 2030 (referenced in this methodology) will be used as the primary source of data and information for this research.

The research methodology involves conducting a comprehensive literature review and examining primary data sources such as reports, surveys, interviews, and secondary data sources such as SBI Life Insurance Proxy Corporation reports, Catalogue of Global Financial Data, and The World Bank Statistics. Preceding this, data screening will be conducted to ensure the validity and accuracy of the data before moving forward with the research.

This research methodology will discuss the following: the research approach, data collection sources, data analysis, and data verification and ethics.

Research Approach

The research approach for this project can be broken down into five sections: literature review, data sourcing, data screening and analysis, primary data analysis, and data verification and ethics.

Literature Review

The literature review will comprise secondary sources gathered through web-based research and related journals and books. Relevant quantitative and qualitative studies conducted in past and present markets will be examined and evaluated.

Data Sourcing

The data sources chosen to refine, validate, and update the report's findings include primary and secondary sources. The primary data sources include surveys and interviews with industry experts. The secondary sources include economic reports and analysis, published reports, articles and other related sources, such as the Catalogue of Global Financial Data and the World Bank Statistics.

Data Screening and Analysis

Data screening and analysis are executed before any conclusions, results, or interpretations of the research data are made. The data sourced will be sorted and analysed using a range of quantitative and qualitative tools such as SWOT analysis, macro and micro-economic analysis, and Porter's Five Forces Model.

Primary Data Analysis

The primary data analysis will be performed based on survey responses, interviews, and panel discussions. Statistical techniques such as correlation and regression techniques will be used to analyse the primary data.

Data Verification and Ethics

Data verification and ethics are important steps towards ensuring the accuracy and validity of data and findings. The data verification process takes place in two methods: validation of primary and secondary data. The primary data is verified through interviews with subject matter experts, while the secondary data is verified through related reports, articles and other sources.

Conclusion

This research methodology for the MRFR report titled Mobile Payment Technologies Market - Forecast to 2030 outlines the steps and procedures employed to explore and analyse the opportunities within the field of mobile payment technologies. This report analyses the market potential, drivers, barriers, and strategies of mobile payment technologies through a comprehensive literature review and examines primary data sources such as surveys, interviews, and secondary data sources such as reports and articles. Data screening, data analysis, and data verification process techniques are used to ensure the accuracy and validity of the findings. These techniques will help to form the basis of this research project.