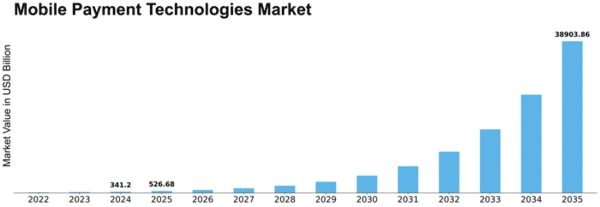

Mobile Payment Technologies Size

Mobile Payment Technologies Market Growth Projections and Opportunities

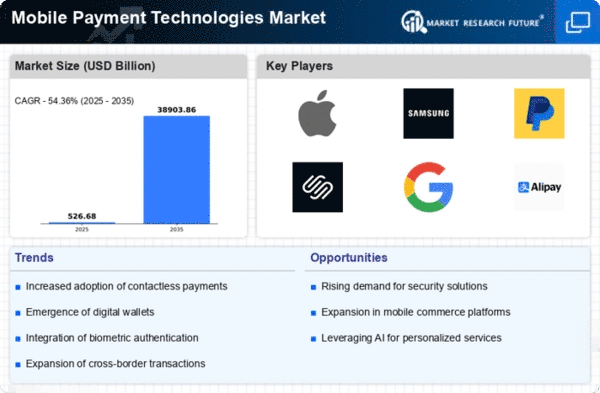

The desire for easy, secure, and efficient payment solutions has caused mobile payment technology industry dynamics to change fast. Smartphone use and digital transaction preference are driving this trend. The mobile payment technologies industry has seen fierce rivalry, innovation, and strategic collaborations among important competitors.

The market features mobile wallets, contactless payments, mobile banking apps, and peer-to-peer payment networks. These technologies cater to distinct customer preferences and merchant needs with their own features and benefits. This diversity has created a vibrant and competitive industry, with players competing to dominate mobile payments.

Regulatory rules, security requirements, and customer trust also affect market dynamics. Mobile payments are shaped by regulatory frameworks that provide data privacy, interoperability, and consumer rights. As consumers and organizations desire safe and fraud-resistant payment options, security also drives market dynamics. To build trust in mobile payment systems, corporations invest in biometric identification, tokenization, and encryption.

Furthermore, customer trust and adoption behavior greatly affect market dynamics. Mobile payment systems' simplicity of use, merchant acceptance, rewards and loyalty programs, and seamless integration with other financial services promote customers' adoption. Businesses that meet these customer demands and preferences acquire a competitive edge and shape market dynamics by increasing adoption and usage.

In addition to consumer-centric considerations, competition and industry collaborations shape market dynamics. Technology firms, financial institutions, and mobile network operators are inventing and distinguishing to stay ahead in the mobile payment technologies industry. This innovation typically spurs strategic partnerships to enhance mobile payment systems' reach and usefulness. Partnerships between mobile wallet providers with retail chains, transportation networks, or e-commerce platforms expand and diversify mobile payment use cases, affecting market dynamics.

Mobile payment technologies market dynamics are further complicated by their worldwide character. Regional consumer behavior, regulatory contexts, infrastructural preparedness, and competition affect market dynamics. Companies in this arena must manage regional variances and modify their strategies to match market dynamics in Asia-Pacific, Europe, North America, and emerging markets in Africa and Latin America.

Leave a Comment