Regulatory Changes

The Mortgage Loan Brokers Market is significantly influenced by ongoing regulatory changes aimed at enhancing consumer protection and promoting fair lending practices. Recent legislation has introduced stricter guidelines for mortgage brokers, requiring greater transparency in fee structures and loan terms. These regulations are designed to safeguard consumers from predatory lending practices and ensure that brokers act in the best interests of their clients. While compliance may pose challenges for some brokers, it also presents opportunities for those who can navigate the regulatory landscape effectively. By prioritizing ethical practices and transparency, brokers can build trust with clients, ultimately leading to increased market share and customer loyalty.

Economic Conditions

Economic conditions play a crucial role in shaping the Mortgage Loan Brokers Market. Factors such as interest rates, employment rates, and overall economic growth directly impact consumer confidence and borrowing behavior. In a favorable economic environment, characterized by low unemployment and rising disposable incomes, individuals are more likely to seek mortgage loans for home purchases or refinancing. Conversely, economic downturns can lead to decreased demand for mortgages, as potential borrowers may hesitate to take on new debt. Consequently, brokers must remain vigilant and adaptable to changing economic indicators, as these fluctuations can significantly influence their business strategies and market positioning.

Increased Competition

The Mortgage Loan Brokers Market is witnessing heightened competition as new entrants and established players vie for market share. This competitive landscape is driven by the proliferation of online mortgage platforms and the emergence of fintech companies offering innovative lending solutions. As a result, traditional brokers are compelled to differentiate themselves by enhancing their service offerings and leveraging technology to improve efficiency. The increased competition may lead to more favorable terms for consumers, as brokers strive to attract clients through competitive pricing and superior customer service. To succeed in this dynamic environment, brokers must continuously innovate and adapt their strategies to meet the demands of an increasingly discerning clientele.

Technological Advancements

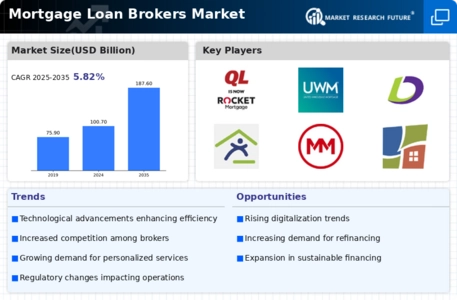

The Mortgage Loan Brokers Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as artificial intelligence and machine learning are streamlining the loan application process, enhancing customer experience, and improving risk assessment. These technologies enable brokers to analyze vast amounts of data quickly, leading to more informed lending decisions. Furthermore, the integration of digital platforms allows for seamless communication between brokers and clients, fostering transparency and efficiency. As a result, the market is projected to grow, with an estimated increase in the number of mortgage applications processed through digital channels. This shift not only enhances operational efficiency but also positions brokers to better meet the evolving needs of consumers in a competitive landscape.

Changing Consumer Preferences

Consumer preferences are shifting significantly within the Mortgage Loan Brokers Market, driven by a desire for personalized services and convenience. Today's borrowers are increasingly seeking tailored mortgage solutions that align with their unique financial situations. This trend is reflected in the growing demand for brokers who can offer customized advice and flexible loan options. Additionally, the rise of online platforms has empowered consumers to conduct research and compare mortgage products more easily, leading to a more informed decision-making process. As a result, brokers who adapt to these changing preferences by providing exceptional customer service and innovative solutions are likely to thrive in this evolving market landscape.