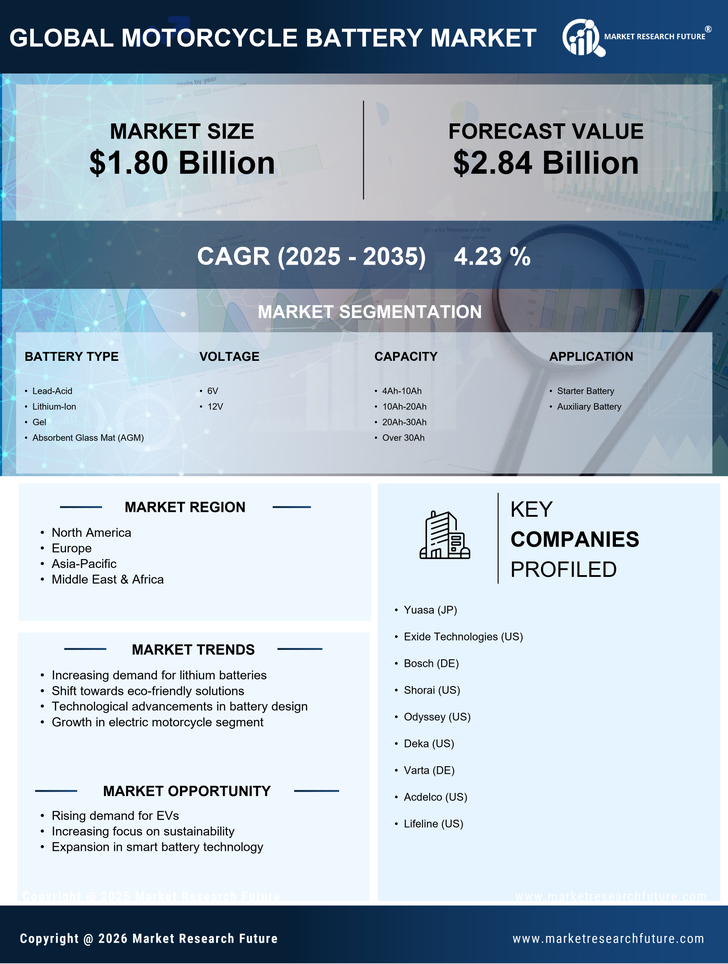

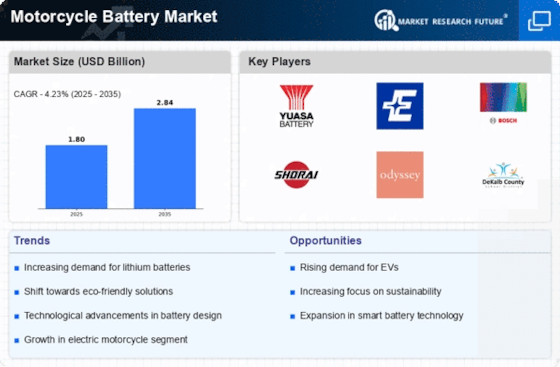

Increasing Motorcycle Sales and Usage

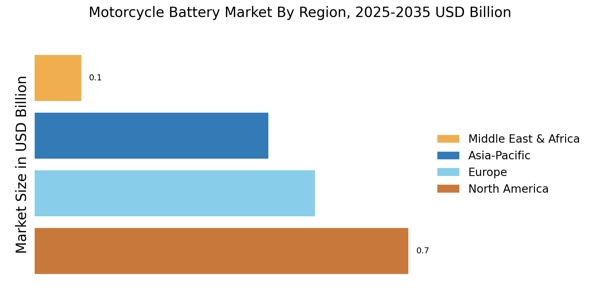

The Motorcycle Battery Market is closely linked to the rising sales and usage of motorcycles worldwide. As urbanization continues to expand, more individuals are opting for motorcycles as a cost-effective and efficient mode of transportation. Recent data indicates that motorcycle sales have surged, with millions of units sold annually. This increase in motorcycle ownership directly correlates with a heightened demand for reliable and high-performance batteries. Consequently, manufacturers are compelled to innovate and enhance their offerings, thereby propelling the Motorcycle Battery Market to new heights.

Focus on Performance and Customization

The Motorcycle Battery Market is also driven by a growing focus on performance and customization among motorcycle enthusiasts. Riders are increasingly seeking batteries that not only provide reliable power but also enhance the overall performance of their motorcycles. This trend has led to a rise in demand for high-performance batteries that can withstand extreme conditions and provide superior energy output. Manufacturers are responding by developing specialized batteries tailored to the needs of performance-oriented riders. This emphasis on customization and performance is likely to further stimulate growth within the Motorcycle Battery Market.

Rising Fuel Prices and Economic Factors

The Motorcycle Battery Market is influenced by rising fuel prices and broader economic factors. As fuel costs escalate, consumers are increasingly turning to motorcycles as a more economical alternative to cars. This trend is particularly evident in regions where fuel prices have surged, prompting a shift in consumer behavior. The increased adoption of motorcycles necessitates a corresponding demand for high-quality batteries, as consumers seek reliable performance. Consequently, this economic shift is likely to bolster the Motorcycle Battery Market, as manufacturers respond to the growing need for efficient battery solutions.

Growing Interest in Electric Motorcycles

The Motorcycle Battery Market is witnessing a paradigm shift with the growing interest in electric motorcycles. As consumers become more environmentally conscious, the demand for electric two-wheelers is on the rise. This trend is supported by various government initiatives promoting electric mobility, which aim to reduce carbon emissions. The electric motorcycle segment is expected to capture a significant share of the overall motorcycle market, leading to increased demand for specialized batteries. This shift not only presents opportunities for battery manufacturers but also indicates a transformative phase for the Motorcycle Battery Market.

Technological Advancements in Battery Technology

The Motorcycle Battery Market is experiencing a notable transformation due to rapid technological advancements. Innovations in battery chemistry, such as lithium-ion and lithium-polymer technologies, are enhancing performance and longevity. These advancements are not only improving energy density but also reducing weight, which is crucial for motorcycle performance. The market for lithium-ion batteries is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This shift towards more efficient battery solutions is likely to attract both manufacturers and consumers, thereby driving the Motorcycle Battery Market forward.