Expansion of End-User Industries

The MRO Protective Coating Market is benefiting from the expansion of various end-user industries, including construction, automotive, and oil and gas. As these sectors grow, the demand for protective coatings that can withstand harsh conditions and provide long-lasting protection is increasing. For example, the construction industry is projected to see a significant uptick in infrastructure projects, which will require robust protective coatings to ensure durability and safety. Additionally, the automotive sector is increasingly focusing on lightweight materials and advanced coatings to enhance vehicle performance and fuel efficiency. Market forecasts suggest that the MRO Protective Coating Market will continue to thrive as these end-user industries expand, driving the need for innovative and effective coating solutions.

Growing Environmental Regulations

The MRO Protective Coating Market is increasingly influenced by stringent environmental regulations aimed at reducing harmful emissions and promoting sustainability. Governments and regulatory bodies are implementing policies that require the use of eco-friendly coatings, which has led to a shift in market dynamics. Companies are now compelled to adopt low-VOC and water-based coatings to comply with these regulations. This shift not only addresses environmental concerns but also opens up new opportunities for manufacturers of sustainable coatings. Market analysis indicates that the demand for environmentally friendly protective coatings is expected to rise, as industries strive to meet compliance standards while maintaining operational efficiency. Thus, the MRO Protective Coating Market is likely to evolve in response to these regulatory pressures.

Increased Focus on Asset Longevity

In the MRO Protective Coating Market, there is an increasing emphasis on asset longevity and performance optimization. Organizations are recognizing that investing in high-quality protective coatings can significantly reduce the frequency of repairs and replacements. This focus is particularly evident in industries such as aerospace, automotive, and marine, where the cost of downtime can be substantial. Data suggests that companies that implement effective maintenance strategies, including the use of advanced protective coatings, can achieve up to a 30% reduction in maintenance costs. As a result, the MRO Protective Coating Market is likely to see a surge in demand for innovative coating solutions that not only protect but also enhance the operational efficiency of critical assets.

Rising Demand for Maintenance Services

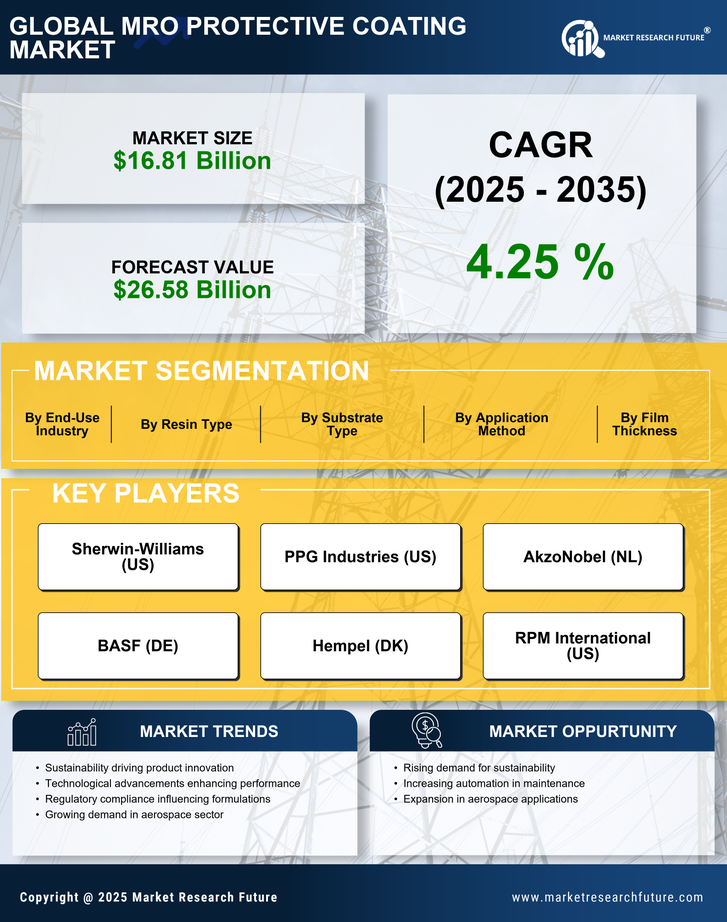

The MRO Protective Coating Market is experiencing a notable increase in demand for maintenance, repair, and operations services. This trend is largely driven by the aging infrastructure across various sectors, including manufacturing, transportation, and energy. As facilities and equipment age, the need for protective coatings to extend their lifespan becomes critical. According to recent data, the maintenance sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is indicative of a broader recognition of the importance of regular maintenance, which in turn fuels the demand for protective coatings that can withstand harsh environments and prevent corrosion. Consequently, the MRO Protective Coating Market is poised to benefit from this rising demand, as companies seek to enhance the durability and performance of their assets.

Technological Innovations in Coating Solutions

The MRO Protective Coating Market is witnessing a wave of technological innovations that are transforming the landscape of protective coatings. Advancements in materials science have led to the development of coatings that offer superior resistance to chemicals, UV radiation, and extreme temperatures. For instance, the introduction of nanotechnology in coatings has resulted in products that provide enhanced durability and performance. Market data indicates that the segment of high-performance coatings is expected to grow significantly, driven by the need for specialized solutions in demanding environments. This trend suggests that as technology continues to evolve, the MRO Protective Coating Market will likely expand, offering a wider array of options for end-users seeking effective protective solutions.