Market Trends

Key Emerging Trends in the Multi Layer Cryogenic Insulation Market

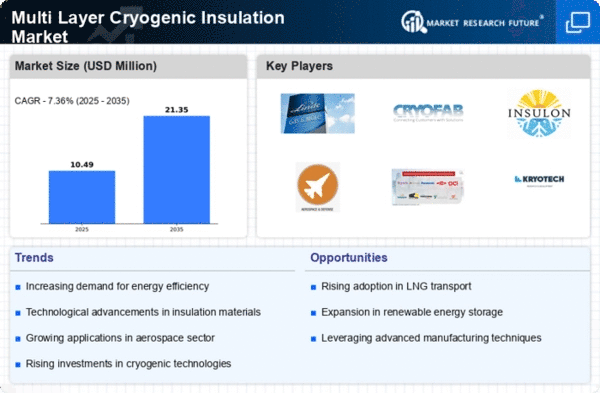

This sector has several trends concerning demand alteration as well as application change within major sectors such as energy aerospace, healthcare among other sectors resulting in significant shifts in Multi-Layer Cryogenic Insulation market. For instance, liquefied natural gas (LNG) storage, space exploration, medical cryopreservation require multi-layered insulations providing extremely low-temperature thermal protection. One key trend observed is an increased call for cryogenic insulations required by growing LNG industry worldwide. Due to rising global demand for cleaner energy sources, the LNG sector is expanding rapidly hence creating a need for more advanced insulating materials which can maintain very low temperatures thereby ensuring effective storage and transport of liquid gases.

Besides that, aerospace influences on trends seen in the multi-layer cryogenic insulation market are highly important. The push towards space exploration together with deep-space missions has led to the development of innovative cryogenic material technologies used in spacecrafts as well as launch vehicles. Multi-layer insulation (MLI) blankets made of reflective foil sheets and low conductance spacers offer good protection to spaceships against extreme temperature changes in the outer space. This trend supports the aerospace industries’ search for lightweight and efficient materials that can withstand harsh space environmental conditions.

Technological advances are driving trends in the Multilayer Cryogenic Insulation market. Continuous R&D efforts emphasize improving performance attributes of insulating materials such as thermal conductivity, flexibility, and durability among others. Innovations involving advanced materials like aerogels and nanostructured composites are being increasingly hailed due to their improved insulation capabilities coupled with minimized heat transfer. These technological advancements make the market more responsive to different industry’s changing needs.

Moreover, healthcare is driving some of the changes seen in multilayer cryogenic insulation trends. Medical applications such as cryopreservation rely on cryogenic insulations to store biological samples and tissues at ultra-low temperatures for medical research as well as organ transplantation purposes. A trend towards better medical cryopreservation techniques has resulted in a growing demand for insulation products which will provide reliable and consistent thermal protection for critical medical specimens.

Environmental factors also influence the multi-layer cryogenic insulation market. The tendency for environmental sustainability and energy efficiency is pushing towards development of insulation materials with less harm to nature. Manufacturers are working on new environment friendly alternatives and improved recycling methods for insulation materials in line with global efforts of greener and more sustainable technologies.

Leave a Comment