Regulatory Support

Regulatory frameworks promoting the use of natural ingredients are playing a crucial role in shaping the Natural Fatty Acids Market. Governments and regulatory bodies are increasingly recognizing the benefits of natural fatty acids, leading to supportive policies that encourage their use in various applications, including food, cosmetics, and pharmaceuticals. This regulatory support is fostering a favorable environment for manufacturers, enabling them to innovate and expand their product lines. Additionally, the establishment of standards for natural fatty acids is enhancing consumer trust and driving demand. As regulations continue to evolve, the market is expected to benefit from increased acceptance and utilization of natural fatty acids across multiple sectors.

Health Consciousness

The rising awareness of health and wellness among consumers is driving the Natural Fatty Acids Market. With a growing body of research linking natural fatty acids to various health benefits, including improved cardiovascular health and enhanced cognitive function, consumers are increasingly seeking products that incorporate these ingredients. Market data indicates that the demand for omega-3 and omega-6 fatty acids, which are essential for human health, is on the rise. This trend is further supported by the food and beverage sector, which is incorporating natural fatty acids into their offerings to cater to health-conscious consumers. As a result, the market for natural fatty acids is expected to witness robust growth, reflecting the changing dietary preferences of the population.

Technological Innovations

Technological advancements in extraction and processing methods are significantly influencing the Natural Fatty Acids Market. Innovations such as supercritical fluid extraction and enzymatic processes are enhancing the efficiency and yield of fatty acid production. These technologies not only improve the quality of the final products but also reduce waste and energy consumption, aligning with sustainability goals. Furthermore, the integration of biotechnology in the production of natural fatty acids is opening new avenues for market expansion. As companies invest in research and development to leverage these technologies, the market is likely to experience a transformation, with new products emerging that meet the evolving needs of consumers.

Sustainability Initiatives

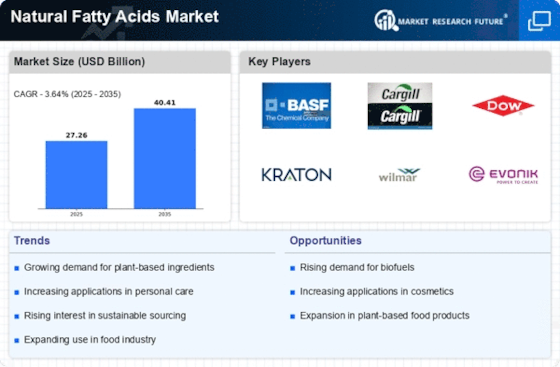

The increasing emphasis on sustainability appears to be a pivotal driver for the Natural Fatty Acids Market. As consumers and manufacturers alike prioritize eco-friendly products, the demand for natural fatty acids, derived from renewable sources, is likely to surge. This shift is evidenced by the growing number of companies adopting sustainable practices in their production processes. For instance, the market for bio-based fatty acids is projected to expand significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend not only aligns with consumer preferences but also encourages innovation in the formulation of natural fatty acids, thereby enhancing their market appeal.

Rising Demand in Personal Care

The personal care and cosmetics sector is witnessing a notable increase in the incorporation of natural fatty acids, which serves as a significant driver for the Natural Fatty Acids Market. Consumers are increasingly seeking products that are free from synthetic chemicals, leading to a surge in demand for natural ingredients. Fatty acids, known for their moisturizing and skin-nourishing properties, are becoming essential components in formulations for creams, lotions, and hair care products. Market analysis suggests that the personal care segment is projected to grow at a substantial rate, with natural fatty acids playing a pivotal role in this expansion. This trend reflects a broader shift towards clean beauty, further propelling the market for natural fatty acids.