Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, such as heart disease and diabetes, is significantly influencing the Polyunsaturated Fatty Acids PUFAs Market. Research indicates that diets rich in PUFAs can help mitigate the risk of these diseases, leading to a heightened consumer focus on dietary choices. As healthcare costs continue to rise, individuals are more inclined to adopt preventive measures, including the incorporation of PUFAs into their diets. This shift is reflected in the growing sales of PUFA-rich products, which are projected to increase by approximately 8% annually. Consequently, the demand for PUFAs is expected to rise, further propelling the growth of the Polyunsaturated Fatty Acids PUFAs Market as consumers seek healthier lifestyle options.

Increasing Demand for Omega-3 Fatty Acids

The rising awareness regarding the health benefits of omega-3 fatty acids is propelling the Polyunsaturated Fatty Acids PUFAs Market. Omega-3 fatty acids, primarily found in fish oil and certain plant oils, are linked to numerous health advantages, including cardiovascular health and cognitive function. According to recent data, the demand for omega-3 supplements has surged, with the market projected to reach approximately 57 billion USD by 2027. This trend indicates a growing consumer preference for dietary supplements rich in omega-3, thereby driving the overall growth of the Polyunsaturated Fatty Acids PUFAs Market. As consumers increasingly seek natural sources of omega-3, manufacturers are likely to innovate and expand their product lines to meet this demand.

Expansion of Functional Foods and Beverages

The Polyunsaturated Fatty Acids PUFAs Market is experiencing a notable shift towards functional foods and beverages. These products, which are fortified with essential nutrients, including PUFAs, are gaining traction among health-conscious consumers. The functional food market is expected to grow significantly, with estimates suggesting it could reach over 300 billion USD by 2025. This growth is largely attributed to the increasing consumer inclination towards foods that offer health benefits beyond basic nutrition. As a result, food manufacturers are incorporating PUFAs into various products, such as dairy, snacks, and beverages, to enhance their nutritional profiles. This trend not only supports the health of consumers but also drives the demand for PUFAs, thereby positively impacting the Polyunsaturated Fatty Acids PUFAs Market.

Regulatory Support for Nutritional Guidelines

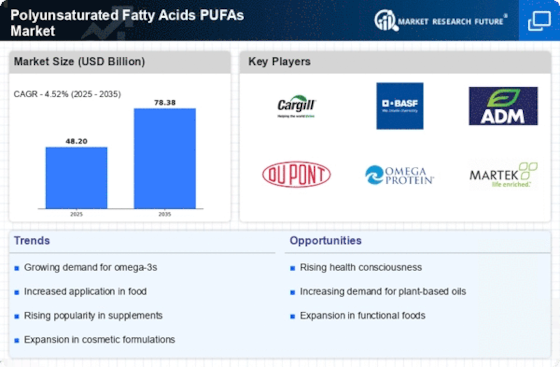

Regulatory bodies are increasingly emphasizing the importance of polyunsaturated fatty acids in dietary guidelines, which is positively affecting the Polyunsaturated Fatty Acids PUFAs Market. Governments and health organizations are advocating for the inclusion of PUFAs in daily diets due to their beneficial effects on health. This regulatory support is likely to encourage food manufacturers to enhance their product formulations with PUFAs, thereby increasing market availability. As a result, the market for PUFAs is expected to expand, with projections indicating a compound annual growth rate of around 7% over the next few years. This regulatory push not only raises awareness among consumers but also drives the demand for PUFA-enriched products in the Polyunsaturated Fatty Acids PUFAs Market.

Technological Advancements in Extraction Methods

Technological advancements in extraction methods are playing a crucial role in shaping the Polyunsaturated Fatty Acids PUFAs Market. Innovations in extraction techniques, such as supercritical fluid extraction and cold pressing, are enhancing the efficiency and quality of PUFA extraction from various sources. These advancements are likely to reduce production costs and improve the purity of PUFAs, making them more accessible to manufacturers. As a result, the market is expected to witness a surge in the availability of high-quality PUFA products, which could lead to increased consumer adoption. The ongoing research and development in extraction technologies suggest a promising future for the Polyunsaturated Fatty Acids PUFAs Market, as manufacturers strive to meet the growing demand for premium PUFA products.

.png)