Infrastructure Development

Infrastructure development plays a pivotal role in the Global Natural Gas Liquid Market (NGL) Market Industry, as enhanced transportation and processing facilities facilitate the efficient movement of NGL products. Investments in pipelines, storage facilities, and processing plants are crucial for meeting the growing demand. For instance, the expansion of the U.S. pipeline network has significantly increased the availability of NGLs for domestic and international markets. This infrastructure enhancement not only supports the current demand but also positions the industry for future growth, as it enables the seamless integration of NGLs into the global energy supply chain.

Growing Global Energy Demand

The growing global energy demand is a fundamental driver of the Global Natural Gas Liquid Market (NGL) Market Industry. As populations expand and economies develop, the need for energy sources continues to rise. NGLs, being versatile energy carriers, are increasingly utilized in power generation, heating, and transportation. This trend is particularly pronounced in regions with rapid urbanization and industrial growth. The increasing reliance on natural gas as a cleaner alternative to coal further propels the demand for NGLs. Consequently, the market is poised for substantial growth, supported by the ongoing transition towards more sustainable energy sources.

Increasing Demand for Petrochemicals

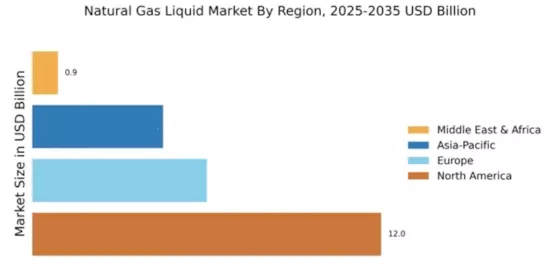

The Global Natural Gas Liquid Market (NGL) Market Industry experiences a surge in demand for petrochemicals, driven by their extensive applications in various sectors such as plastics, fertilizers, and pharmaceuticals. As industries expand, the need for ethane, propane, and butane, which are key components of NGL, rises. This trend is particularly evident in emerging economies where industrialization is accelerating. The market is projected to reach 23.4 USD Billion in 2024, reflecting a robust growth trajectory. By 2035, the market could potentially expand to 43.0 USD Billion, indicating a compound annual growth rate (CAGR) of 5.7% from 2025 to 2035.

Regulatory Support and Policy Frameworks

Regulatory support and favorable policy frameworks significantly influence the Global Natural Gas Liquid Market (NGL) Market Industry. Governments worldwide are increasingly recognizing the importance of NGLs in achieving energy security and reducing carbon emissions. Policies promoting the use of cleaner fuels and incentivizing NGL production and consumption are becoming more prevalent. For example, the implementation of tax incentives for NGL producers in various regions encourages investment in this sector. Such supportive measures not only enhance market stability but also stimulate innovation and technological advancements, further driving the growth of the NGL market.

Technological Advancements in Extraction and Processing

Technological advancements in extraction and processing techniques are transforming the Global Natural Gas Liquid Market (NGL) Market Industry. Innovations such as improved fractionation processes and enhanced recovery methods increase the efficiency of NGL production. These advancements not only reduce operational costs but also minimize environmental impacts, aligning with global sustainability goals. For instance, the adoption of advanced separation technologies has enabled producers to maximize yield from natural gas, thereby increasing the availability of NGLs. As technology continues to evolve, it is likely to play a crucial role in shaping the future landscape of the NGL market.