Escalating Cybersecurity Threats

The Network Traffic Analytics Market is significantly influenced by the escalating threats posed by cyberattacks. As organizations increasingly rely on digital infrastructure, the risk of data breaches and network intrusions has intensified. Recent reports indicate that cybercrime costs are expected to reach trillions of dollars annually, prompting businesses to prioritize cybersecurity measures. Network traffic analytics plays a crucial role in identifying and mitigating these threats by providing real-time monitoring and anomaly detection capabilities. By analyzing traffic patterns, organizations can proactively address vulnerabilities and enhance their security posture. This growing emphasis on cybersecurity is likely to drive investments in network traffic analytics solutions, thereby propelling the market forward.

Regulatory Compliance Requirements

The Network Traffic Analytics Market is also shaped by stringent regulatory compliance requirements across various sectors. Organizations are mandated to adhere to data protection regulations, such as GDPR and HIPAA, which necessitate robust monitoring and reporting mechanisms. The need for compliance drives the adoption of network traffic analytics solutions, as these tools enable organizations to track data flows and ensure that sensitive information is handled appropriately. As regulatory frameworks continue to evolve, the demand for analytics solutions that facilitate compliance is expected to rise. This trend underscores the importance of network traffic analytics in helping organizations navigate complex regulatory landscapes while maintaining operational integrity.

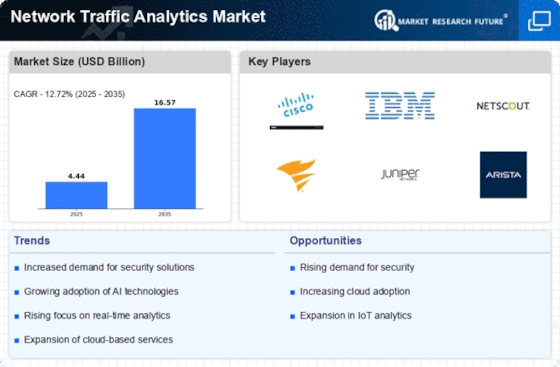

Rising Demand for Data-Driven Insights

The Network Traffic Analytics Market is experiencing a notable surge in demand for data-driven insights. Organizations are increasingly recognizing the value of analyzing network traffic to enhance operational efficiency and decision-making processes. According to recent estimates, the market is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is driven by the need for businesses to leverage data analytics to optimize network performance, reduce downtime, and improve user experience. As companies strive to remain competitive, the integration of advanced analytics tools into their network management strategies becomes essential. Consequently, the Network Traffic Analytics Market is poised for substantial expansion as organizations invest in technologies that provide actionable insights from their network data.

Growth of Remote Work and Digital Transformation

The Network Traffic Analytics Market is witnessing growth fueled by the rise of remote work and ongoing digital transformation initiatives. As organizations adapt to flexible work arrangements, the volume of network traffic has surged, necessitating advanced analytics to manage and optimize performance. The shift towards cloud-based applications and services further complicates network management, making traffic analytics indispensable for ensuring seamless connectivity and user experience. Market data suggests that the remote work trend is likely to persist, with a significant portion of the workforce continuing to operate remotely. This sustained demand for effective network management solutions is expected to bolster the Network Traffic Analytics Market as businesses seek to enhance their digital infrastructure.

Emergence of Artificial Intelligence and Machine Learning

The Network Traffic Analytics Market is being transformed by the emergence of artificial intelligence (AI) and machine learning (ML) technologies. These advanced technologies enable organizations to analyze vast amounts of network data with unprecedented speed and accuracy. AI and ML algorithms can identify patterns and anomalies that may go unnoticed by traditional analytics methods, thereby enhancing threat detection and response capabilities. As organizations increasingly adopt AI-driven solutions, the demand for network traffic analytics tools that incorporate these technologies is likely to rise. This trend indicates a shift towards more sophisticated analytics capabilities, positioning the Network Traffic Analytics Market for continued growth as businesses seek to leverage AI and ML for improved network performance and security.