Rising Incidence of Neurovascular Disorders

The prevalence of neurovascular disorders, such as stroke and aneurysms, is on the rise, significantly impacting the Neurovascular Guidewire Market. As the population ages, the incidence of these conditions is expected to increase, leading to a higher demand for effective treatment options. Data suggests that stroke remains one of the leading causes of death and disability worldwide, necessitating timely and efficient medical interventions. This growing patient population drives the need for specialized neurovascular devices, including guidewires, which are essential for minimally invasive procedures. The increasing awareness and early diagnosis of neurovascular disorders further contribute to the market's expansion, as healthcare providers seek to implement advanced treatment modalities.

Shift Towards Minimally Invasive Procedures

The Neurovascular Guidewire Market is witnessing a notable shift towards minimally invasive procedures, which are preferred for their reduced recovery times and lower complication rates. This trend is largely driven by advancements in medical technology that allow for safer and more effective interventions. Minimally invasive techniques, such as endovascular procedures, rely heavily on the use of guidewires to navigate through the vascular system. As a result, the demand for high-quality neurovascular guidewires is expected to increase. Market analysis indicates that the minimally invasive segment is anticipated to capture a significant share of the neurovascular device market, further propelling the growth of the guidewire sector.

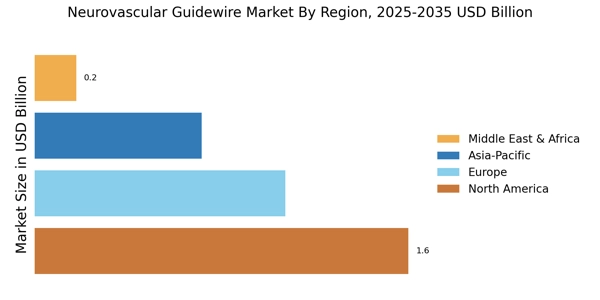

Increasing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a critical driver for the Neurovascular Guidewire Market. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, particularly in developing regions. This investment is aimed at improving access to advanced medical technologies and treatments for neurovascular disorders. Enhanced healthcare infrastructure not only facilitates the adoption of innovative neurovascular devices but also ensures that healthcare professionals are adequately trained in their use. As a result, the demand for neurovascular guidewires is likely to rise, as more facilities become equipped to perform complex neurovascular procedures. The expansion of healthcare infrastructure is expected to create a favorable environment for market growth.

Growing Awareness and Education on Neurovascular Health

The Neurovascular Guidewire Market is benefiting from a growing awareness and education regarding neurovascular health among both healthcare professionals and the general public. Increased educational initiatives and campaigns aimed at highlighting the importance of early detection and treatment of neurovascular disorders are contributing to a more informed patient population. This heightened awareness is likely to lead to earlier diagnosis and treatment, thereby increasing the demand for neurovascular interventions. As patients become more proactive about their health, the need for effective neurovascular devices, including guidewires, is expected to grow. This trend underscores the importance of education in driving market dynamics and enhancing patient outcomes.

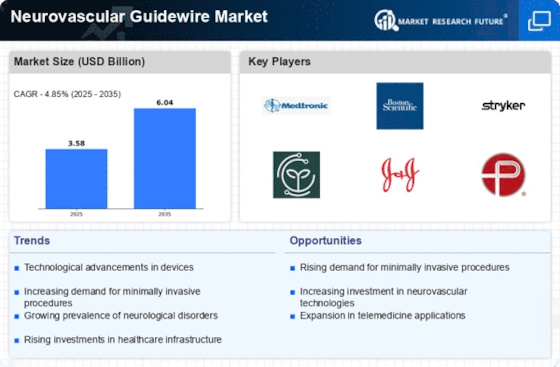

Technological Advancements in Neurovascular Guidewire Market

The Neurovascular Guidewire Market is experiencing a surge in technological advancements that enhance the efficacy and safety of neurovascular procedures. Innovations such as advanced materials and coatings improve the flexibility and maneuverability of guidewires, allowing for better navigation through complex vascular structures. Furthermore, the integration of imaging technologies with guidewires facilitates real-time visualization, which is crucial for successful interventions. According to recent data, the market for neurovascular devices, including guidewires, is projected to grow at a compound annual growth rate of approximately 6.5% over the next several years. This growth is indicative of the increasing reliance on advanced technologies in the medical field, particularly in neurovascular applications.

Leave a Comment