Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure, particularly in emerging economies, is a vital driver for the Vascular Guidewire Market. As countries invest in healthcare facilities and technologies, the availability of advanced medical devices, including vascular guidewires, is increasing. This expansion is accompanied by a rise in the number of interventional procedures performed, as healthcare providers seek to meet the growing demand for cardiovascular treatments. Data suggests that healthcare spending in developing regions is projected to increase by over 10% in the coming years, creating a favorable environment for the Vascular Guidewire Market. This growth indicates that as healthcare systems evolve, the demand for effective vascular solutions will likely continue to rise.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are crucial factors driving the Vascular Guidewire Market. Governments and health authorities are increasingly recognizing the importance of vascular interventions in improving patient outcomes, leading to the establishment of supportive regulatory frameworks. Additionally, reimbursement policies that cover advanced guidewire technologies encourage healthcare providers to adopt these innovations. Recent studies indicate that regions with robust reimbursement structures experience higher rates of adoption of vascular guidewires, which in turn stimulates market growth. This trend suggests that as regulatory environments continue to evolve, the Vascular Guidewire Market will likely benefit from increased accessibility and affordability of these essential medical devices.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases is a critical driver for the Vascular Guidewire Market. As the global population ages, the prevalence of conditions such as coronary artery disease and peripheral artery disease continues to escalate. Reports indicate that cardiovascular diseases account for nearly 31% of all global deaths, underscoring the urgent need for effective treatment options. This growing health crisis necessitates the use of vascular guidewires in various interventional procedures, including angioplasty and stenting. Consequently, the demand for high-quality guidewires is expected to rise, propelling market growth. The Vascular Guidewire Market is thus positioned to benefit from this alarming trend, as healthcare providers seek to improve patient outcomes through advanced vascular interventions.

Technological Innovations in Vascular Guidewire Market

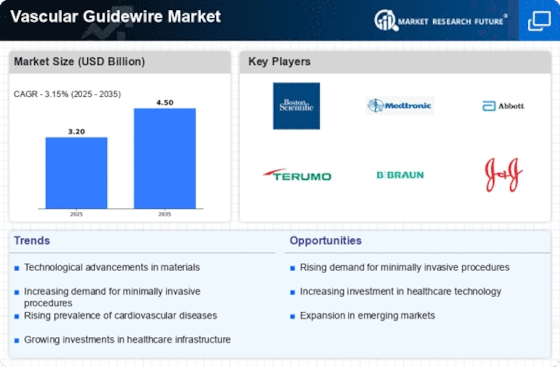

The Vascular Guidewire Market is experiencing a surge in technological innovations that enhance the efficacy and safety of vascular procedures. Advancements in materials, such as the development of hydrophilic coatings, improve the maneuverability and flexibility of guidewires, allowing for better navigation through complex vascular anatomies. Furthermore, the integration of imaging technologies, such as fluoroscopy and ultrasound, with guidewire systems facilitates real-time visualization, thereby reducing procedural complications. According to recent data, the market for advanced guidewires is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, indicating a robust demand for these innovative solutions. This trend suggests that as technology continues to evolve, the Vascular Guidewire Market will likely see increased adoption of these advanced products.

Rising Demand for Minimally Invasive Surgical Techniques

The shift towards minimally invasive surgical techniques is significantly influencing the Vascular Guidewire Market. Patients increasingly prefer procedures that offer reduced recovery times, less postoperative pain, and minimal scarring. Vascular guidewires play a pivotal role in these procedures, enabling surgeons to perform complex interventions with precision and minimal invasiveness. Market analysis suggests that the minimally invasive surgery segment is expected to witness a growth rate of around 7% annually, driven by advancements in surgical techniques and technologies. This trend indicates a growing acceptance of vascular guidewires as essential tools in achieving successful minimally invasive outcomes, thereby enhancing the overall market landscape.

Leave a Comment