Minimally Invasive Procedures

The trend towards minimally invasive procedures is significantly influencing the Vascular Closure Devices Market. As healthcare providers increasingly adopt less invasive techniques, the demand for vascular closure devices that facilitate these procedures is likely to rise. Minimally invasive surgeries are associated with shorter recovery times, reduced hospital stays, and lower risk of complications, making them appealing to both patients and healthcare professionals. This shift is reflected in the growing number of procedures performed annually, with estimates suggesting that minimally invasive techniques account for over 60% of vascular surgeries. Consequently, the market for vascular closure devices is expected to expand as these devices become integral to the success of such procedures.

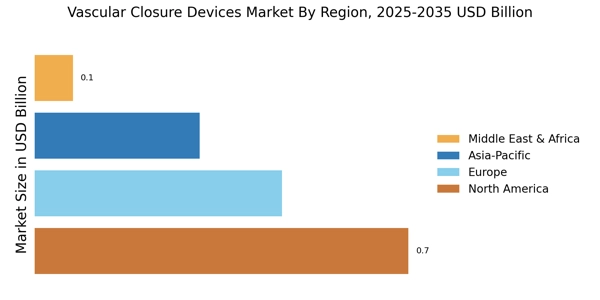

Rising Healthcare Expenditure

The increase in healthcare expenditure is a notable driver for the Vascular Closure Devices Market. As countries invest more in healthcare infrastructure and services, the availability of advanced medical technologies, including vascular closure devices, is likely to improve. This trend is particularly evident in regions where healthcare budgets are expanding to accommodate rising patient demands and technological advancements. According to recent data, healthcare spending is projected to grow at an annual rate of 5% over the next several years, which could translate into increased procurement of vascular closure devices. This financial commitment to healthcare is expected to bolster the market, facilitating the adoption of innovative solutions.

Regulatory Approvals and Market Access

Regulatory approvals play a pivotal role in shaping the Vascular Closure Devices Market. The process of obtaining necessary certifications and clearances can significantly impact the speed at which new devices enter the market. Recent trends indicate that regulatory bodies are streamlining approval processes for innovative vascular closure devices, which may enhance market access for manufacturers. This is particularly relevant as companies strive to introduce advanced solutions that meet evolving clinical needs. The ability to navigate regulatory landscapes effectively can provide a competitive edge, potentially leading to increased market share and revenue growth for those who succeed.

Aging Population and Rising Cardiovascular Diseases

The demographic shift towards an aging population is a critical driver for the Vascular Closure Devices Market. As individuals age, the prevalence of cardiovascular diseases tends to increase, leading to a higher demand for vascular interventions. Reports indicate that cardiovascular diseases are among the leading causes of morbidity and mortality worldwide, necessitating effective treatment options. The World Health Organization has projected that by 2030, cardiovascular diseases will account for approximately 23 million deaths annually. This alarming trend underscores the need for efficient vascular closure devices that can support various cardiovascular procedures, thereby propelling market growth.

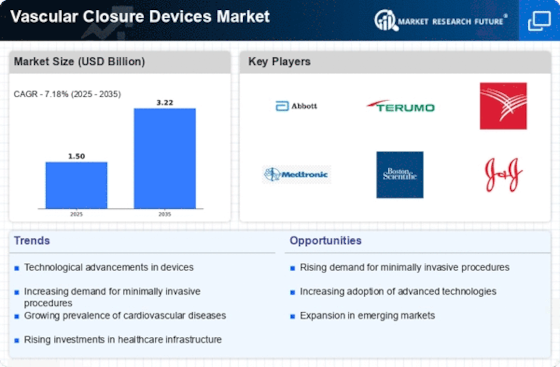

Technological Advancements in Vascular Closure Devices

The Vascular Closure Devices Market is experiencing a surge in innovation, driven by advancements in technology. New materials and designs are being developed to enhance the efficacy and safety of vascular closure devices. For instance, the introduction of bioresorbable materials is gaining traction, as they offer the potential for reduced complications and improved patient outcomes. Furthermore, the integration of digital technologies, such as real-time imaging and monitoring systems, is likely to enhance procedural accuracy. According to recent estimates, the market for vascular closure devices is projected to grow at a compound annual growth rate of approximately 7% over the next few years, indicating a robust demand for technologically advanced solutions.