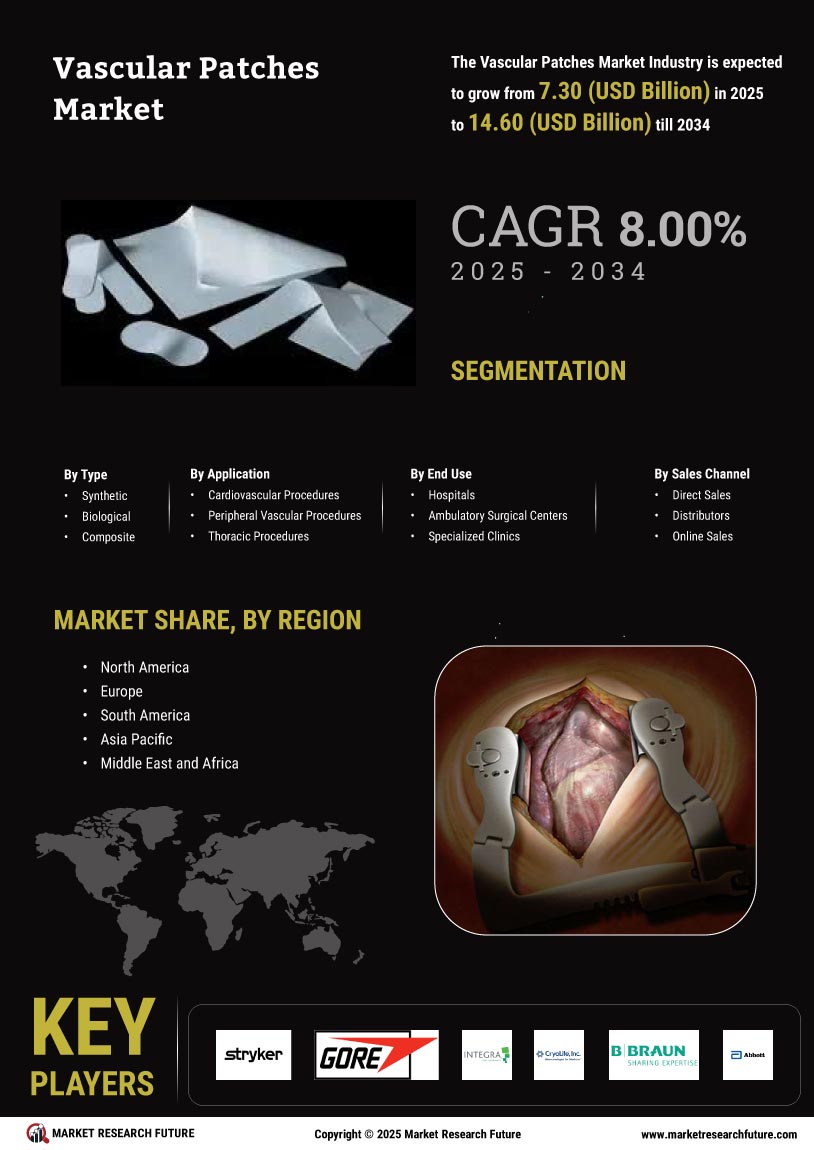

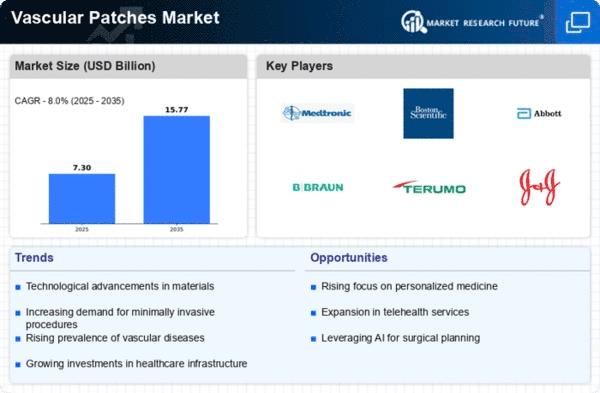

Market Growth Projections

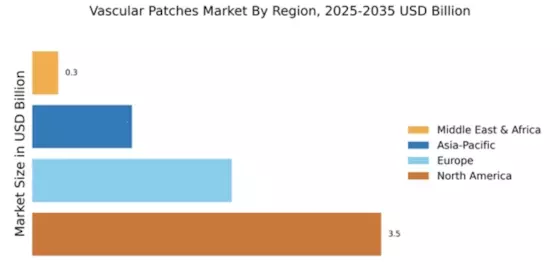

The Global Vascular Patches Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 6.76 USD Billion in 2024, it is anticipated to reach 15.8 USD Billion by 2035. The compound annual growth rate of 8.0% from 2025 to 2035 indicates a robust expansion trajectory. This growth is driven by various factors, including technological advancements, increasing prevalence of vascular diseases, and supportive government policies. The market's dynamics reflect a promising future for vascular patch innovations.

Growing Awareness and Education

There is a notable increase in awareness regarding vascular health and the importance of timely interventions, which is positively impacting the Global Vascular Patches Market Industry. Educational campaigns and initiatives by healthcare organizations are informing patients and healthcare professionals about vascular diseases and available treatment options. This heightened awareness is likely to lead to earlier diagnoses and increased demand for surgical solutions, including vascular patches. As a result, the market is expected to experience sustained growth in the coming years.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for vascular disease research are crucial drivers of the Global Vascular Patches Market Industry. Many countries are investing in healthcare advancements, which includes the development of new medical devices. For instance, increased funding for research and development in vascular surgery technologies is likely to enhance the availability and accessibility of vascular patches. This trend may contribute to the market's expansion, with forecasts suggesting a rise to 15.8 USD Billion by 2035.

Aging Population and Lifestyle Changes

The demographic shift towards an aging population, coupled with lifestyle changes such as poor diet and sedentary behavior, is driving the Global Vascular Patches Market Industry. Older adults are more susceptible to vascular diseases, creating a higher demand for surgical interventions. Additionally, lifestyle-related factors contribute to the prevalence of conditions requiring vascular patches. This demographic trend suggests a growing market, as healthcare systems adapt to meet the needs of an aging population, further reinforcing the market's potential for growth.

Rising Prevalence of Vascular Diseases

The increasing incidence of vascular diseases globally is a primary driver for the Global Vascular Patches Market Industry. Conditions such as atherosclerosis and peripheral artery disease are becoming more common, necessitating effective surgical interventions. As the population ages, the demand for vascular patches is expected to rise, with projections indicating that the market will reach approximately 6.76 USD Billion in 2024. This growing prevalence underscores the need for innovative solutions in vascular surgery, thereby propelling the market forward.

Technological Advancements in Surgical Techniques

Innovations in surgical techniques and materials are significantly influencing the Global Vascular Patches Market Industry. The development of bioengineered patches and minimally invasive procedures enhances patient outcomes and reduces recovery times. These advancements not only improve the efficacy of vascular surgeries but also expand the range of applications for vascular patches. As a result, the market is poised for growth, with an expected compound annual growth rate of 8.0% from 2025 to 2035, reflecting the ongoing evolution of surgical practices.