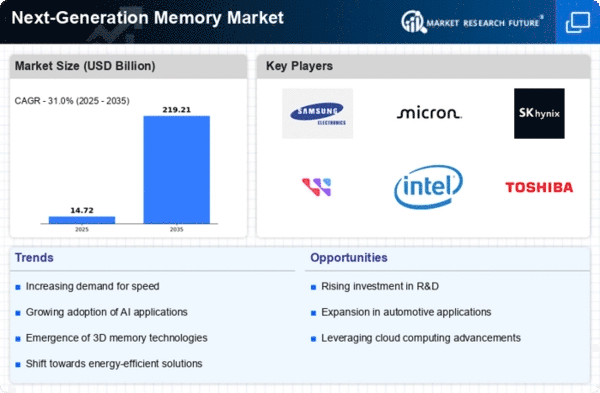

Market Growth Projections

The Global Next Generation Memory Market Industry is poised for substantial growth, with projections indicating a market size of 16.1 USD Billion in 2024 and an anticipated increase to 55 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 11.83% from 2025 to 2035, reflecting the increasing reliance on advanced memory technologies across various sectors. The market's expansion is driven by factors such as the rising demand for high-performance computing, advancements in memory technology, and the growing adoption of IoT devices. These dynamics collectively underscore the transformative potential of the Global Next Generation Memory Market Industry.

Growing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is significantly impacting the Global Next Generation Memory Market Industry. As more devices become interconnected, the need for efficient memory solutions that can handle vast amounts of data in real-time is becoming increasingly apparent. IoT applications require memory that is not only fast but also energy-efficient, which drives the demand for next-generation memory technologies. This trend is expected to contribute to a compound annual growth rate of 11.83% from 2025 to 2035, highlighting the importance of innovative memory solutions in supporting the expanding IoT ecosystem and its associated data requirements.

Increased Focus on Data Security

Data security concerns are driving the Global Next Generation Memory Market Industry towards advanced memory solutions. With the rise in cyber threats and data breaches, organizations are prioritizing secure data storage options. Next-generation memory technologies, such as non-volatile memory, offer enhanced security features that protect sensitive information. This focus on data integrity and security is likely to propel market growth, as businesses seek to safeguard their data assets. As the industry evolves, the integration of security features into memory solutions will become increasingly critical, shaping the future landscape of the Global Next Generation Memory Market Industry.

Advancements in Memory Technology

Innovations in memory technology are a key driver of the Global Next Generation Memory Market Industry. Emerging technologies such as 3D NAND, MRAM, and ReRAM are revolutionizing data storage and retrieval processes. These advancements not only improve performance but also reduce power consumption, which is critical for mobile and embedded applications. As manufacturers invest in research and development, the market is likely to experience substantial growth, with projections indicating a market size of 55 USD Billion by 2035. This evolution in memory technology is essential for accommodating the increasing data demands of modern applications, thereby propelling the Global Next Generation Memory Market Industry forward.

Emerging Applications in Automotive Sector

The automotive sector is emerging as a significant driver for the Global Next Generation Memory Market Industry. With the rise of electric vehicles and autonomous driving technologies, there is a growing need for advanced memory solutions that can support complex computations and real-time data processing. Next-generation memory technologies are essential for applications such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication. As the automotive industry continues to innovate, the demand for high-performance memory solutions is expected to rise, contributing to the overall growth of the market.

Rising Demand for High-Performance Computing

The Global Next Generation Memory Market Industry is witnessing a surge in demand for high-performance computing applications. As industries increasingly rely on data-intensive tasks, the need for faster and more efficient memory solutions becomes paramount. This trend is particularly evident in sectors such as artificial intelligence, machine learning, and big data analytics, where traditional memory technologies struggle to keep pace. The market is projected to reach 16.1 USD Billion in 2024, driven by innovations in memory technologies that enhance speed and efficiency. Consequently, the Global Next Generation Memory Market Industry is evolving to meet these demands, fostering advancements that could redefine computing capabilities.