Market Trends

Key Emerging Trends in the Next-Generation Memory Market

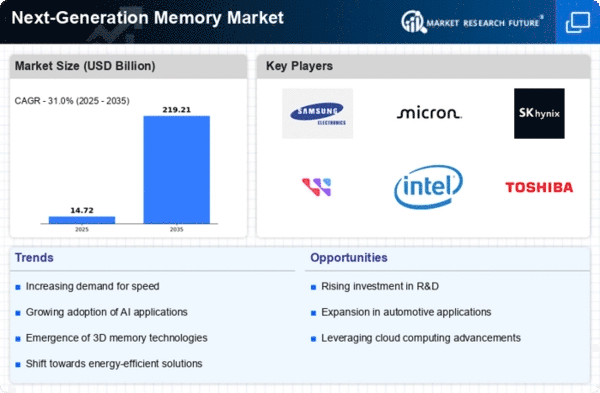

The Next-Generation Memory Market is experiencing a myriad of trends that are shaping its evolution and influencing the future of memory solutions. One prominent trend is the increasing demand for non-volatile memory technologies. As traditional volatile memory options encounter limitations in terms of speed and power consumption, there is a growing preference for non-volatile alternatives. To stress the contributions of these technologies recently, such as resistive random-access memory (RRAM) and phase-change memory (PCM) that they are able to store information even when power has been turned off, hence their goodness for storing data in the applications where persistent storage is required.

The local memory computing is the other notable growth engine of Next-Generation Memory Market. As with the conditions of an evolving demand for faster processing of data and analysis, in-memory computing draws on high-speed, low-latency memory and therefore it performs tasks on the data directly avoiding the necessity of data transfers between storage and processing units, which takes a long period of time. This pattern is necessarily essential in AI field , real-time analytics and database where large sets of data should be accessed in the shortest time possible.

The three-dimensional (3D) NAND technology is another newcomer that is currently sweeping the market. The required storage capacity grows ever larger, and this problem is being tackled by 3D NAND technology through selective placement of cells inside each of the layers, making it possible to increase capacity while maintaining a lower physical footprint. Such device is considered the most common currently in the consumer-electronic space and data centers, where the data sizes and densities that are demanded for storage in small form factors are driving usage of 3D NAND devices.

Besides, edge computing that is a new thing in the Next-Generation Memory Market has been seen as being highly significant. To cope with the publicity of IoT devices as well as to offer the ability of real-time processing at the exact spot where data is generated, edge computing depends on high-speed memory solutions allowing for quicker decisions and lowered latency. Such a trend is causing profound changes in the way old times computer architectures were used, giving rise to more decentralized and distributed processing systems.

The infusion of artificial intelligence (AI) to memory technologies is one of the major changes that can be observed. AI solutions have memory systems being produced to go together with these applications by maximizing the output for machine learning models and neural network processing. Hence, this trend coincides with the increasing number of AI applications in many industries, like healthcare and finances with no change. The need for memory solutions capable of meeting the compute demands of complex AI systems keeps on increasing.

The security dilemmas will as well influence the development due to the fact that the emphasis will be on the development of effective solutions of modern memory that offer the best data protection. Technologies, including hardware-based encryption and firmware-based integrity, are in play now, and they go here to protect the privacy of sensitive information.

Also, the markets are working through the trend of promoting sustainable and eco-friendly memory solutions and getting rid of older and multi-layered memory technologies. With a growing awareness of environmental impacts, manufacturers are exploring materials and processes that reduce the carbon footprint of memory technologies. This trend aligns with global initiatives for sustainability, influencing product development and consumer choices in favor of greener alternatives.

Leave a Comment