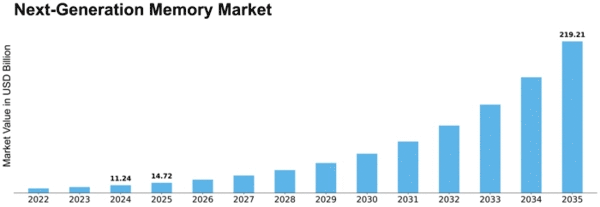

Next Generation Memory Size

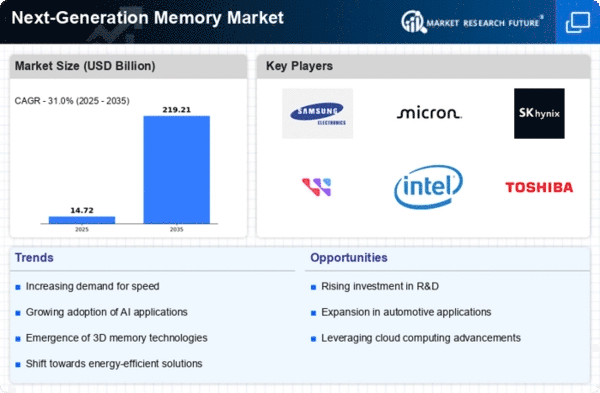

Next-Generation Memory Market Growth Projections and Opportunities

The Next-Generation Memory Market is influenced by a multitude of market factors that shape its growth and dynamics. One of the primary drivers propelling this market forward is the incessant demand for faster, more efficient, and higher-capacity memory solutions. As technological advancements continue to push the boundaries of computing, there is a growing need for memory that can keep pace with the increasingly sophisticated requirements of modern applications. This demand is however crystal clear in the areas such as Artificial intelligence, big data analytics, the field of high-performance computing ones critical thinks and processing power cannot be ignored.

In addition to this the interaction of the Internet Consumer Things (IoT) that is developing yet is very strong towards the market. Along with the expanding number of connected devices having a huge impact of the corresponding data flow that is produced by these devices, the need for memory solutions increases to handle the wave of data. Future memory with its characteristics that a guarantee quickness and energy economy is the main component which will resolve the challenge posed on the growing of IoT.

However, the energy paradigm shift is one of the crucial aspects that bring about the growth of Next-Generation Memory Market extending the battery lifetime and reducing the energy consumption. Many of the familiar memory types struggle under the same limitations when it comes to power consumption, and this is exactly where it comes to the main attractive feature: they require no power to read data. The next-generation memory technologies that can both help this problem and provide a cure because they consume less energy become a solution to that challenge, which attracts the attention of both manufacturers and end-users.

Additionally, long term perspectives are being designed that have the possibility of very high storage densities. The advancement of data then results high volume of data over all industries, this will create the necessity of memory solutions that can perform more than the large information within small footprint. The next-generation memories technologies by virtue of their potential in providing sufficiently powerful storage modules have been designated to underpin the data storage area.

From the positive aspects mentioned above, Next-Generation Memory Market just as most other market faces challenges which are also mentioned below. The cost of adoption is not only shaping the market dynamics but also facilitates the development of effective solutions. Creating and deploying fresh memory technologies may mean extra expenses that might be too high to be depicted as beneficial, thus, adoptaare must consider both advantages and costs. As economies of scale tap in as the market matures and the range of sectors that could adopt this technology are expected to expand with the expected decline in cost.

Besides, the market is influenced by the level of rivalry that is, different players engaged in the contest for leadership of the industry. The Next-Generation Memory Market is characterized by intense competition among semiconductor manufacturers and technology companies striving to innovate and establish their supremacy in this space. Strategic partnerships, research and development initiatives, and intellectual property rights play crucial roles in determining the success of market participants.

Leave a Comment