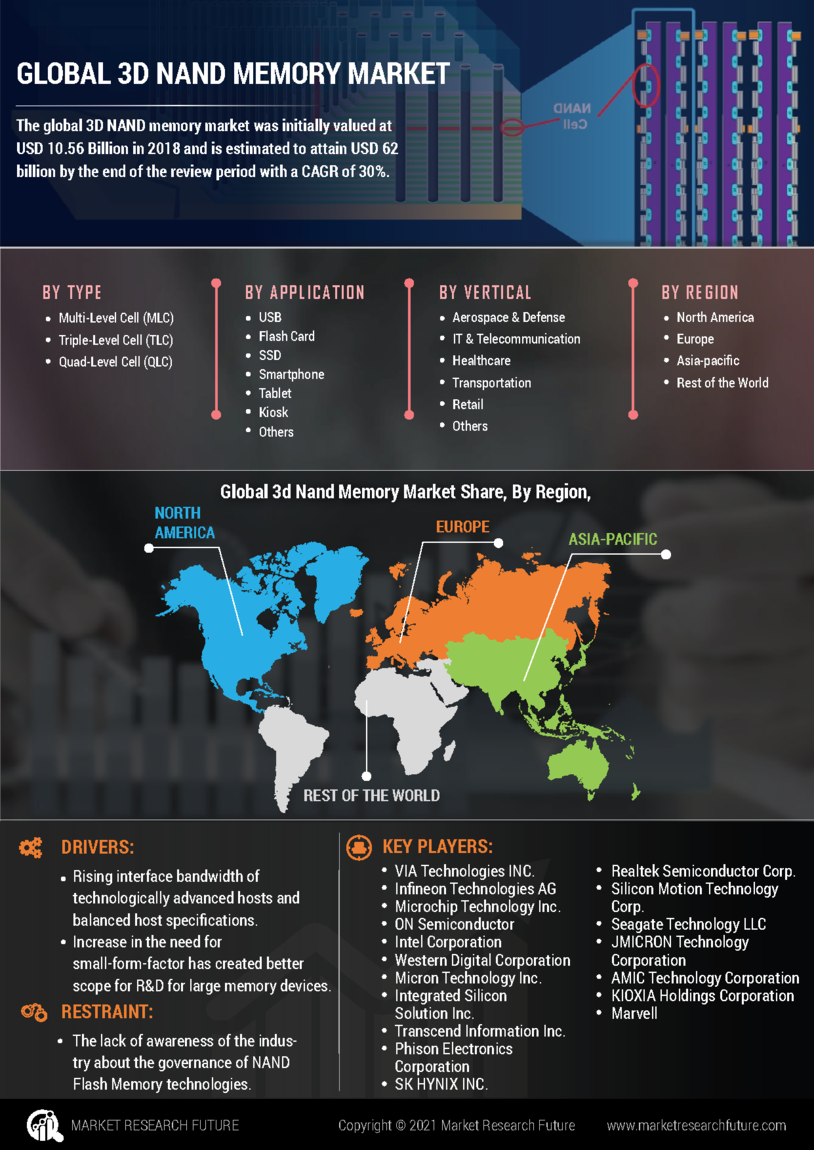

Market Growth Projections

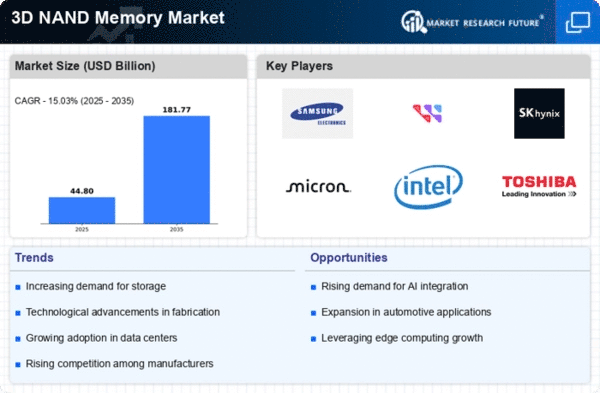

The Global 3D NAND Memory Market Industry is characterized by promising growth projections, with the market expected to reach 39.0 USD Billion in 2024 and 181.7 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 15.03% from 2025 to 2035. Such projections suggest a robust demand for 3D NAND memory solutions across various sectors, including consumer electronics, data centers, and enterprise storage. The anticipated expansion of the market reflects the increasing reliance on advanced memory technologies to support the growing data needs of businesses and consumers alike.

Growth of Consumer Electronics Sector

The Global 3D NAND Memory Market Industry is significantly influenced by the growth of the consumer electronics sector. With the proliferation of smartphones, tablets, and wearable devices, the demand for high-capacity and high-speed memory solutions is on the rise. This sector's expansion is expected to drive the market forward, as manufacturers seek to integrate advanced memory technologies into their products. The increasing consumer preference for devices with enhanced storage capabilities suggests a favorable outlook for the industry. As a result, the Global 3D NAND Memory Market is poised for substantial growth, potentially achieving a compound annual growth rate of 15.03% from 2025 to 2035.

Increased Adoption of Cloud Computing

The increased adoption of cloud computing services is a pivotal driver of the Global 3D NAND Memory Market Industry. As businesses migrate to cloud-based solutions for enhanced flexibility and scalability, the demand for robust storage solutions intensifies. Cloud service providers are increasingly investing in high-capacity memory technologies to meet the storage needs of their clients. This trend is expected to propel the market forward, with projections indicating a significant increase in market size by 2035. The reliance on 3D NAND memory in cloud infrastructures suggests a long-term growth trajectory for the industry, as organizations seek to optimize their data storage and retrieval processes.

Rising Demand for Data Storage Solutions

The Global 3D NAND Memory Market Industry experiences a surge in demand for data storage solutions, driven by the exponential growth of data generation across various sectors. As organizations increasingly rely on cloud computing, big data analytics, and artificial intelligence, the need for efficient and high-capacity storage solutions becomes paramount. The Global 3D NAND Memory Market is projected to reach 39.0 USD Billion in 2024, reflecting the industry's response to this growing demand. This trend indicates a shift towards advanced storage technologies that can accommodate the vast amounts of data being generated, thereby enhancing operational efficiency and data management capabilities.

Technological Advancements in Memory Technology

Technological advancements play a crucial role in shaping the Global 3D NAND Memory Market Industry. Innovations in memory architecture, such as the development of multi-layer stacking techniques, have significantly improved storage density and performance. These advancements enable manufacturers to produce memory chips that are not only faster but also more energy-efficient. As a result, the market is likely to witness a robust growth trajectory, with projections indicating a market size of 181.7 USD Billion by 2035. The continuous evolution of memory technology suggests that the industry will remain competitive, catering to the increasing demands for high-performance computing and mobile applications.

Emergence of Artificial Intelligence and Machine Learning

The emergence of artificial intelligence and machine learning technologies is reshaping the Global 3D NAND Memory Market Industry. These technologies require substantial data processing capabilities, necessitating high-performance memory solutions. As AI applications proliferate across various industries, the demand for 3D NAND memory is likely to increase, driven by the need for faster data access and processing speeds. This trend indicates a growing reliance on advanced memory technologies to support complex algorithms and large datasets. Consequently, the Global 3D NAND Memory Market is expected to benefit from this shift, positioning itself as a key player in the evolving landscape of technology.