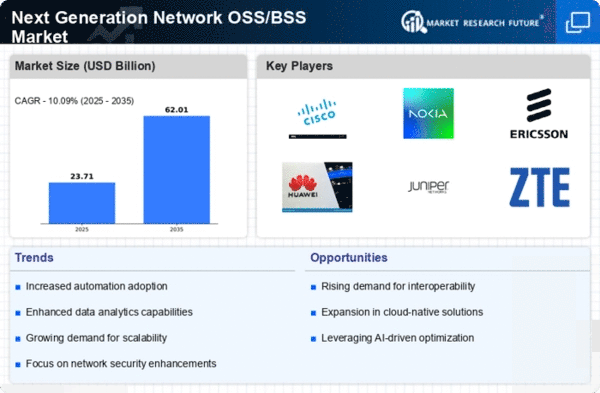

The Next Generation Network Oss Bs Market is characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for efficient network management solutions. Key players such as Cisco Systems (US), Nokia (FI), and Ericsson (SE) are at the forefront, each adopting distinct strategies to enhance their market positioning. Cisco Systems (US) emphasizes innovation through its robust portfolio of software-defined networking solutions, while Nokia (FI) focuses on strategic partnerships to bolster its 5G capabilities. Ericsson (SE) is actively pursuing mergers and acquisitions to expand its service offerings, thereby shaping a competitive environment that is increasingly collaborative yet fiercely competitive.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with a mix of established players and emerging startups. This fragmentation allows for diverse offerings, yet the collective influence of major companies like Huawei Technologies (CN) and Juniper Networks (US) is significant, as they drive innovation and set industry standards.

In November Cisco Systems (US) announced a strategic partnership with a leading cloud service provider to enhance its network automation capabilities. This move is likely to strengthen Cisco's position in the cloud networking segment, enabling it to offer more integrated solutions that cater to the evolving needs of enterprises. The partnership underscores the importance of collaboration in driving technological advancements within the market.

In October Nokia (FI) launched a new suite of AI-driven network management tools aimed at optimizing operational efficiency for telecom operators. This initiative reflects Nokia's commitment to leveraging artificial intelligence to enhance service delivery and reduce operational costs. The introduction of these tools may provide Nokia with a competitive edge, particularly as operators seek to streamline their operations in an increasingly complex network environment.

In September Ericsson (SE) completed the acquisition of a prominent software company specializing in network analytics. This acquisition is poised to enhance Ericsson's capabilities in data-driven decision-making, allowing it to offer more sophisticated solutions to its clients. The strategic importance of this move lies in Ericsson's ability to integrate advanced analytics into its existing offerings, thereby improving customer satisfaction and operational performance.

As of December the competitive trends within the Next Generation Network Oss Bs Market are increasingly defined by digitalization, sustainability, and AI integration. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to stay ahead in a rapidly evolving landscape. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to deliver cutting-edge solutions that meet the demands of a digital-first world.