Expansion of End-Use Industries

The Non Halogenated Flame Retardants Market is benefiting from the expansion of end-use industries such as electronics, automotive, and construction. As these sectors grow, the demand for flame retardants that comply with safety regulations and environmental standards is increasing. The electronics industry, in particular, is experiencing a shift towards non-halogenated flame retardants due to the rising consumer demand for safer electronic products. Additionally, the construction sector is increasingly adopting non-halogenated options to enhance fire safety in buildings. This expansion is expected to drive market growth, with projections indicating a steady increase in the consumption of non-halogenated flame retardants across various applications.

Stringent Regulatory Frameworks

The Non Halogenated Flame Retardants Market is significantly influenced by stringent regulatory frameworks aimed at reducing hazardous substances in consumer products. Governments and regulatory bodies are increasingly implementing regulations that restrict the use of halogenated flame retardants due to their potential health and environmental risks. For instance, the European Union's REACH regulation has led to a heightened focus on safer alternatives, thereby boosting the demand for non-halogenated options. This regulatory pressure is expected to drive market growth, as manufacturers seek compliance while meeting consumer expectations for safety. The market is likely to witness a shift towards non-halogenated flame retardants, with an anticipated increase in market share as companies adapt to these evolving regulations.

Growing Awareness of Fire Safety Standards

The Non Halogenated Flame Retardants Market is witnessing a surge in awareness regarding fire safety standards across multiple sectors. As industries face increasing scrutiny over safety practices, the demand for effective flame retardants is on the rise. This heightened awareness is particularly evident in sectors such as construction and automotive, where compliance with fire safety regulations is paramount. The market is likely to expand as companies prioritize the integration of non-halogenated flame retardants into their products to meet these standards. Furthermore, the increasing incidence of fire-related incidents has prompted stakeholders to seek safer alternatives, thereby driving the growth of the non-halogenated flame retardants market.

Increasing Demand for Eco-Friendly Products

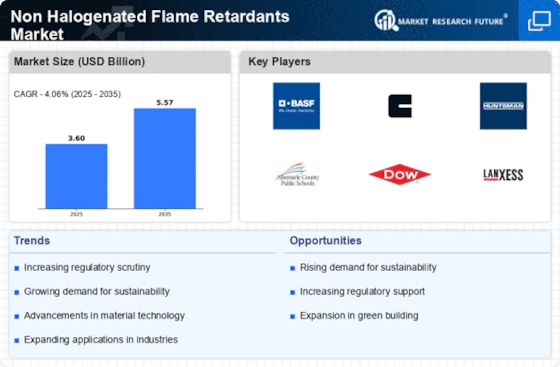

The Non Halogenated Flame Retardants Market is experiencing a notable shift towards eco-friendly products. As consumers become more environmentally conscious, manufacturers are compelled to adopt sustainable practices. This trend is reflected in the rising demand for non-halogenated flame retardants, which are perceived as safer alternatives to traditional halogenated options. According to recent data, the market for non-halogenated flame retardants is projected to grow at a compound annual growth rate of approximately 6% over the next few years. This growth is driven by the increasing awareness of environmental issues and the need for safer materials in various applications, including textiles, electronics, and construction. Consequently, companies are investing in research and development to innovate and expand their product offerings in the Non Halogenated Flame Retardants Market.

Technological Innovations in Flame Retardants

Technological advancements play a crucial role in shaping the Non Halogenated Flame Retardants Market. Innovations in material science and chemistry have led to the development of new formulations that enhance the performance of non-halogenated flame retardants. These advancements not only improve fire resistance but also address concerns related to toxicity and environmental impact. For example, the introduction of bio-based flame retardants is gaining traction, appealing to manufacturers looking for sustainable solutions. The market is expected to benefit from ongoing research and development efforts, with projections indicating a potential increase in the adoption of advanced non-halogenated flame retardants across various sectors, including automotive, construction, and electronics.