Market Analysis

In-depth Analysis of Non-Invasive Monitoring Device Market Industry Landscape

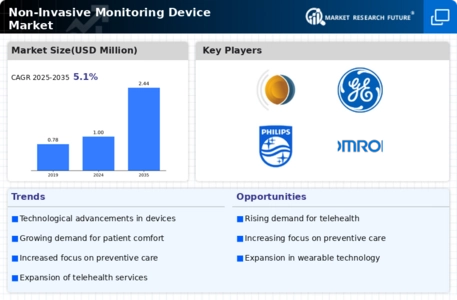

The non-invasive monitoring device market represents a vital segment within the healthcare industry, offering innovative solutions for continuous patient monitoring without the need for invasive procedures. These devices play a crucial role in monitoring vital signs, detecting abnormalities, and enhancing patient care across various medical settings. The market dynamics tend to get driven by an ever increasing demand for systematic patient monitoring. The use of non-invasive monitoring devices is now possible, as healthcare services can access real-time data of the patients' physiological parameters which helps in tracking trends and immediate response in case of occurrence of abrupt changes in their condition. Market trends towards noninvasive evaluating instrument featuring wearables devices are being adopted of late. Smartwatch and trackers that are wearable serve the purpose of empowering users who can then monitor their health on a continuous basis, monitor and prompt proactive healthcare, and also possible detecting of health issues before they con become serious. A transformative trend in the market is shown to be remote patient monitoring solutions that are adopted by various medical personnel. Invasive devices that come with connectivity features provide healthcare professionals with the possibility of remotely monitoring the patients, raising the effectiveness of chronic condition management, minimizing readmissions to the hospital, and improving the general welfare and condition of patients. The advent and growth of home healthcare services lead to market dynamics furtherimproving patients’ health and wellness by providing them with an opportunity to be active participants in their own care. Non-invasive monitoring devices, which can be utilized at home, have made it possible for the individuals to support themselves between hospital visits and thereby reducing the number of hospital visits and promoting independence. Regulatory compliance and data security are the factors of great importance, indirectly conditioning the dynamics of the market. Surveillance of compliance with stringent regulatory requirements as well as data security measures holistically inspires trust, which is critical in the context of broad adoption of digital healthcare technology.

International expansion and global health initiatives impact market dynamics. Non-invasive monitoring devices contribute to global healthcare goals by improving access to healthcare services, especially in resource-limited settings, and supporting health programs focused on preventive care and early intervention. Considerations related to the environmental impact of non-invasive monitoring devices are emerging as a factor in market dynamics. Efforts to develop environmentally sustainable devices and promote responsible manufacturing practices align with the broader trend towards eco-friendly healthcare solutions.

Leave a Comment