Rising E-commerce Demand

The surge in e-commerce activities is significantly impacting the Non-passenger Vehicle Market. As online shopping continues to grow, the demand for delivery vehicles is on the rise. Companies are increasingly investing in their logistics capabilities to meet consumer expectations for fast and reliable delivery services. This trend is reflected in the increasing sales of light commercial vehicles, which are projected to account for a substantial share of the market. The need for efficient last-mile delivery solutions is driving innovations in vehicle design and functionality, thereby shaping the future landscape of the Non-passenger Vehicle Market.

Technological Innovations

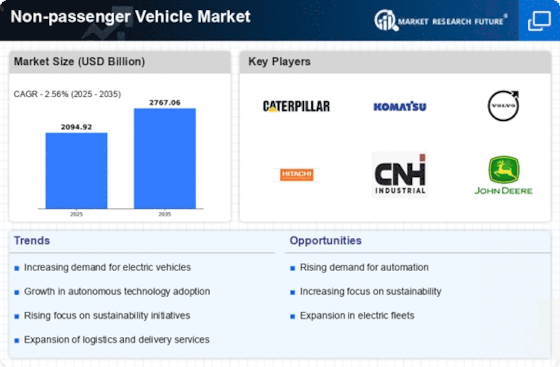

Technological advancements play a pivotal role in shaping the Non-passenger Vehicle Market. Innovations such as autonomous driving, advanced telematics, and connectivity features are transforming how non-passenger vehicles operate. The integration of artificial intelligence and machine learning is enhancing safety and efficiency, making vehicles more appealing to businesses. For example, the market for autonomous trucks is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This technological evolution not only improves operational efficiency but also reduces costs, thereby attracting more investments into the Non-passenger Vehicle Market.

Infrastructure Development

Infrastructure development is a critical driver for the Non-passenger Vehicle Market. The expansion of road networks, logistics hubs, and charging stations for electric vehicles is essential for supporting the growth of non-passenger vehicles. Governments are investing heavily in infrastructure projects to facilitate smoother transportation and logistics operations. For instance, the construction of dedicated freight corridors is expected to enhance the efficiency of goods movement, thereby increasing demand for commercial vehicles. This investment in infrastructure not only supports existing market players but also encourages new entrants into the Non-passenger Vehicle Market.

Sustainability Regulations

The Non-passenger Vehicle Market is increasingly influenced by stringent sustainability regulations imposed by governments worldwide. These regulations aim to reduce carbon emissions and promote environmentally friendly practices. As a result, manufacturers are compelled to innovate and develop vehicles that comply with these standards. For instance, the introduction of electric and hybrid models has surged, with electric vehicle sales projected to reach 30% of total vehicle sales by 2030. This shift not only aligns with regulatory requirements but also caters to a growing consumer base that prioritizes sustainability. Consequently, companies that adapt to these regulations are likely to gain a competitive edge in the Non-passenger Vehicle Market.

Economic Growth and Urbanization

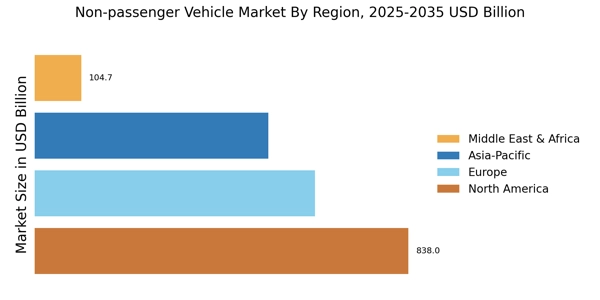

Economic growth and urbanization are key factors driving the Non-passenger Vehicle Market. As economies expand, there is a corresponding increase in demand for transportation solutions to support commercial activities. Urbanization leads to higher population densities, necessitating efficient logistics and transportation systems. This trend is evident in emerging markets, where the demand for non-passenger vehicles is expected to rise sharply. The growth of industries such as construction, logistics, and agriculture further fuels this demand. Consequently, businesses are likely to invest more in non-passenger vehicles to enhance their operational capabilities within the Non-passenger Vehicle Market.