Growing Geriatric Population

The growing geriatric population is a significant factor contributing to the expansion of the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market. As individuals age, the incidence of hypertension tends to increase, necessitating effective management strategies. By 2025, it is projected that the number of people aged 60 and older will reach 1.2 billion, creating a substantial demand for antihypertensive therapies. Non-peptide drugs are particularly appealing for this demographic due to their favorable side effect profiles and ease of administration. Consequently, healthcare providers are increasingly turning to these medications to address the unique needs of older patients, thereby driving market growth. The intersection of an aging population and the rising prevalence of hypertension presents a compelling opportunity for stakeholders in the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market.

Advancements in Drug Development

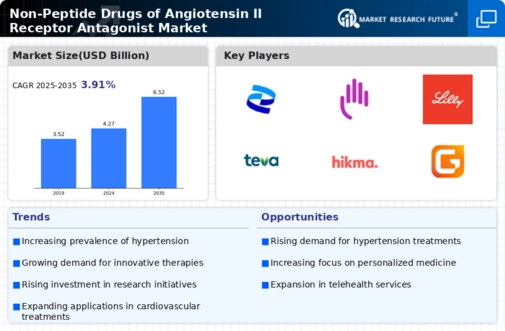

Advancements in drug development technologies are significantly influencing the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market. The integration of cutting-edge research methodologies, such as high-throughput screening and structure-based drug design, has led to the discovery of novel non-peptide antagonists. These innovations not only enhance the therapeutic efficacy of existing drugs but also facilitate the development of new formulations with improved pharmacokinetic profiles. As a result, the market is witnessing a wave of new product launches, which are expected to capture substantial market share. Moreover, the increasing investment in research and development by pharmaceutical companies indicates a strong commitment to advancing treatment options for hypertension, thereby driving growth in the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market.

Increasing Prevalence of Hypertension

The rising prevalence of hypertension is a primary driver for the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market. As hypertension affects a significant portion of the adult population, the demand for effective treatment options continues to grow. According to recent estimates, nearly 1.13 billion people worldwide suffer from hypertension, leading to a surge in the need for antihypertensive medications. Non-peptide drugs, known for their efficacy and safety profiles, are increasingly being prescribed as first-line therapies. This trend is likely to persist, as healthcare providers seek to manage hypertension effectively, thereby propelling the market forward. Furthermore, the increasing awareness of hypertension's complications, such as cardiovascular diseases, further emphasizes the necessity for innovative treatment solutions in the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market.

Increased Focus on Preventive Healthcare

An increased focus on preventive healthcare is shaping the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market. As healthcare systems worldwide shift towards preventive measures, there is a growing emphasis on early intervention for hypertension management. This proactive approach encourages the use of non-peptide drugs as part of comprehensive treatment plans aimed at reducing the risk of cardiovascular events. The market is likely to benefit from initiatives promoting regular health screenings and awareness campaigns that highlight the importance of managing blood pressure. Furthermore, the integration of non-peptide antagonists into preventive healthcare strategies may lead to improved patient outcomes and reduced healthcare costs, thereby enhancing the attractiveness of the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is a crucial driver of the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market. Regulatory agencies are increasingly recognizing the need for expedited approval processes for novel antihypertensive medications. This trend is evident in the implementation of programs aimed at facilitating the development and approval of breakthrough therapies. As a result, pharmaceutical companies are more inclined to invest in research and development of non-peptide drugs, knowing that regulatory pathways are becoming more favorable. This supportive environment not only accelerates the introduction of new products to the market but also enhances competition, ultimately benefiting patients. The ongoing collaboration between regulatory bodies and industry stakeholders is likely to foster innovation within the Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market.