Regulatory Compliance

Regulatory compliance is a critical driver for the Non-Woven Glass Fiber Prepreg Market. As governments implement stricter regulations regarding material safety and environmental impact, manufacturers are compelled to adapt their processes and products accordingly. Compliance with these regulations not only ensures market access but also enhances brand reputation among consumers. The increasing focus on safety standards in industries such as construction and automotive further propels the demand for compliant materials. This trend indicates that companies investing in regulatory compliance are likely to gain a competitive edge, thereby fostering growth within the Non-Woven Glass Fiber Prepreg Market. The potential for increased market share is substantial for those who prioritize adherence to these evolving standards.

Sustainability Initiatives

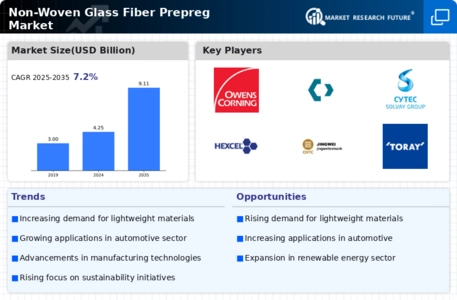

The Non-Woven Glass Fiber Prepreg Market is increasingly influenced by sustainability initiatives. As industries strive to reduce their carbon footprint, the demand for eco-friendly materials rises. Non-woven glass fiber prepregs, known for their recyclability and lower environmental impact, align with these initiatives. This shift is evident as manufacturers adopt greener production processes, which not only meet regulatory requirements but also appeal to environmentally conscious consumers. The market is projected to grow as companies prioritize sustainable practices, potentially leading to a compound annual growth rate of around 5% over the next few years. This trend indicates a significant opportunity for the Non-Woven Glass Fiber Prepreg Market to expand its reach and influence across various sectors.

Technological Advancements

Technological advancements play a pivotal role in shaping the Non-Woven Glass Fiber Prepreg Market. Innovations in manufacturing processes, such as automated production lines and enhanced curing techniques, have improved the efficiency and quality of prepregs. These advancements enable manufacturers to produce high-performance materials that meet stringent industry standards. Furthermore, the integration of smart technologies, such as IoT and AI, facilitates real-time monitoring and quality control, thereby reducing waste and enhancing productivity. As a result, the market is witnessing a surge in demand for advanced prepreg solutions, particularly in sectors like aerospace and automotive, where performance and reliability are paramount. This trend suggests a robust growth trajectory for the Non-Woven Glass Fiber Prepreg Market.

Rising Investment in Infrastructure

Rising investment in infrastructure development is significantly impacting the Non-Woven Glass Fiber Prepreg Market. As countries allocate substantial budgets for infrastructure projects, the demand for durable and lightweight materials escalates. Non-woven glass fiber prepregs, with their superior mechanical properties, are increasingly utilized in construction applications, including bridges, buildings, and other structures. Recent reports suggest that infrastructure spending is projected to increase by 7% annually, driven by urbanization and the need for modernization. This trend presents a lucrative opportunity for the Non-Woven Glass Fiber Prepreg Market to expand its presence in the construction sector, catering to the growing demand for innovative and sustainable building materials.

Growing Demand in Aerospace and Automotive

The Non-Woven Glass Fiber Prepreg Market is experiencing a surge in demand, particularly from the aerospace and automotive sectors. The lightweight and high-strength properties of non-woven glass fiber prepregs make them ideal for applications in aircraft and vehicles, where weight reduction is crucial for fuel efficiency. Recent data indicates that the aerospace sector alone is expected to grow at a rate of 6% annually, driven by increasing air travel and the need for more fuel-efficient aircraft. Similarly, the automotive industry is shifting towards lightweight materials to enhance vehicle performance and reduce emissions. This growing demand presents a significant opportunity for the Non-Woven Glass Fiber Prepreg Market to expand its product offerings and cater to these evolving needs.