Growth in Automotive Industry

The Non-Woven Tape Market is also benefiting from the expansion of the automotive sector. Non-woven tapes are increasingly utilized in automotive manufacturing for applications such as insulation, sound dampening, and bonding. The automotive industry is projected to grow at a rate of 4% annually, which could lead to a heightened demand for non-woven tapes. These tapes offer advantages such as lightweight properties and resistance to extreme temperatures, making them suitable for various automotive components. As manufacturers seek to improve vehicle performance and reduce weight, the reliance on non-woven tapes is expected to increase. This trend may contribute to a more robust market for non-woven tapes, as automotive companies continue to innovate and enhance their product offerings.

Expansion in Packaging Solutions

The Non-Woven Tape Market is witnessing a significant transformation due to the evolving packaging solutions. Non-woven tapes are increasingly being adopted in packaging applications due to their strength, durability, and versatility. The packaging industry is anticipated to grow at a rate of 3.5% annually, which may drive the demand for non-woven tapes. These tapes are particularly useful in securing packages, providing tamper evidence, and ensuring product integrity during transportation. As e-commerce continues to flourish, the need for reliable packaging solutions is likely to escalate, thereby enhancing the market for non-woven tapes. Additionally, the shift towards sustainable packaging materials may further propel the adoption of non-woven tapes, as manufacturers seek eco-friendly alternatives that do not compromise on performance.

Increased Focus on Sustainability

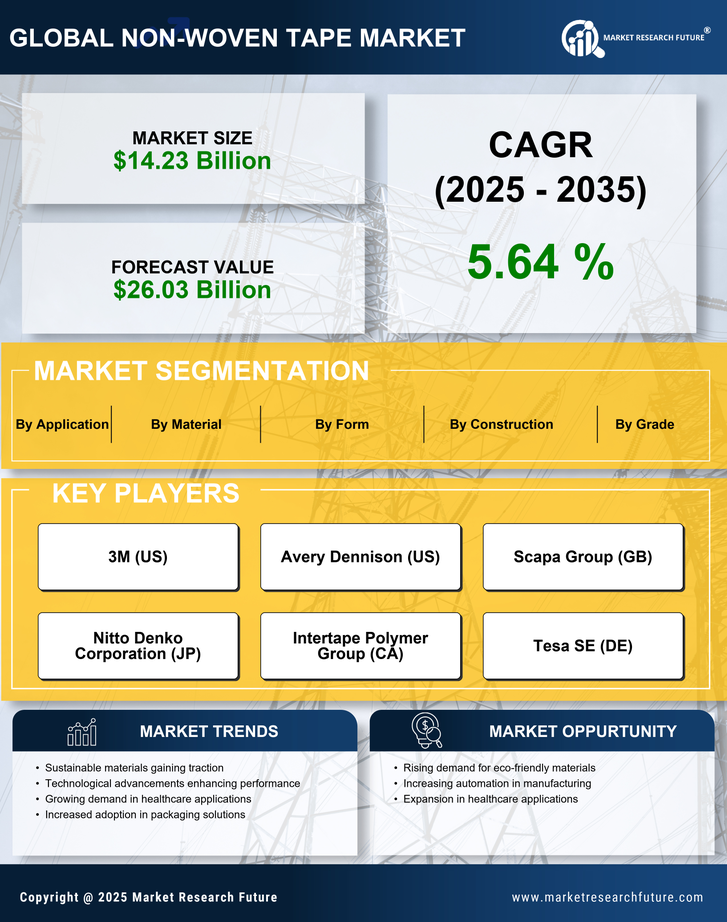

The Non-Woven Tape Market is increasingly influenced by the growing emphasis on sustainability. As consumers and businesses alike become more environmentally conscious, there is a rising demand for eco-friendly products, including non-woven tapes made from biodegradable materials. This shift is prompting manufacturers to explore sustainable alternatives that align with consumer preferences. The market for sustainable non-woven tapes is projected to grow at a rate of 6% annually, reflecting a significant trend towards environmentally responsible practices. Companies that prioritize sustainability in their product offerings may gain a competitive edge, as they cater to a market that values eco-friendliness. This focus on sustainability is likely to reshape the non-woven tape market, encouraging innovation and the development of greener products.

Rising Demand in Healthcare Sector

The Non-Woven Tape Market is experiencing a notable surge in demand, particularly within the healthcare sector. This growth is primarily driven by the increasing utilization of non-woven tapes in medical applications such as wound care, surgical procedures, and patient monitoring. The market for medical tapes is projected to reach approximately USD 2 billion by 2026, indicating a compound annual growth rate of around 5%. Non-woven tapes are favored for their breathability, flexibility, and hypoallergenic properties, making them ideal for sensitive skin. As healthcare providers continue to prioritize patient comfort and safety, the adoption of non-woven tapes is likely to expand, thereby bolstering the overall market. Furthermore, the ongoing advancements in medical technology may further enhance the functionality and application of non-woven tapes in clinical settings.

Technological Innovations in Manufacturing

The Non-Woven Tape Market is poised for growth due to ongoing technological innovations in manufacturing processes. Advances in production techniques, such as the development of high-speed manufacturing lines and improved adhesive formulations, are enhancing the quality and performance of non-woven tapes. These innovations are expected to reduce production costs and increase efficiency, making non-woven tapes more accessible to various industries. As manufacturers adopt these new technologies, the market is likely to see an influx of innovative products that cater to specific applications. Furthermore, the integration of automation and smart manufacturing practices may streamline operations, potentially leading to a more competitive landscape within the non-woven tape market.