E-commerce Growth

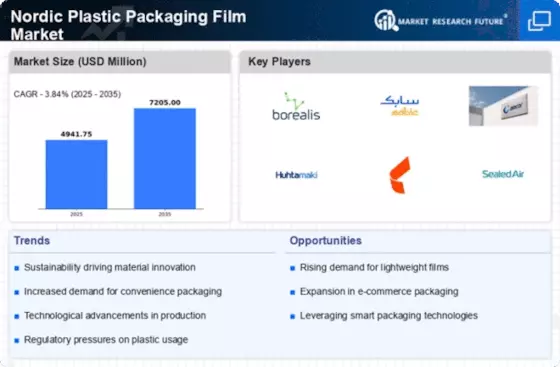

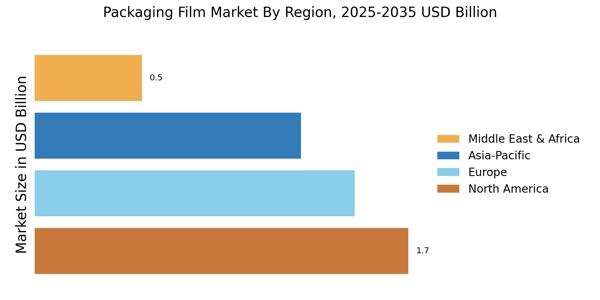

The rapid expansion of e-commerce is a pivotal driver for the Nordic Plastic Packaging Film Market. With online shopping becoming increasingly prevalent, the demand for efficient and protective packaging solutions has surged. In 2025, e-commerce sales in the Nordic region reached an estimated 25 billion euros, necessitating robust packaging to ensure product safety during transit. This trend has prompted manufacturers to innovate packaging designs that cater specifically to the needs of e-commerce, such as lightweight and durable films that reduce shipping costs. Furthermore, the rise of direct-to-consumer models has led to an increase in customized packaging solutions, further propelling the growth of the Nordic Plastic Packaging Film Market. As e-commerce continues to thrive, the demand for specialized packaging solutions is expected to remain strong, driving market expansion.

Consumer Preferences

Consumer preferences are evolving, significantly impacting the Nordic Plastic Packaging Film Market. As consumers become more discerning, there is a noticeable shift towards packaging that emphasizes convenience, functionality, and sustainability. In 2025, surveys indicated that over 60% of consumers in the Nordic region preferred products with minimal and recyclable packaging. This trend has prompted manufacturers to rethink their packaging strategies, focusing on lightweight materials that reduce waste and enhance user experience. Additionally, the rise of health-conscious consumers has led to an increased demand for packaging that preserves product freshness and safety. As these preferences continue to shape the market, companies within the Nordic Plastic Packaging Film Market are likely to adapt their offerings to align with consumer expectations, fostering innovation and growth.

Regulatory Compliance

Regulatory compliance is a significant driver impacting the Nordic Plastic Packaging Film Market. Governments in the Nordic region have implemented stringent regulations aimed at reducing plastic waste and promoting recycling. For instance, the European Union's directives on single-use plastics have prompted manufacturers to adapt their product offerings to meet these new standards. In 2025, it was estimated that compliance with these regulations influenced approximately 40% of packaging design decisions within the industry. Companies are increasingly focusing on developing packaging solutions that not only comply with regulations but also appeal to environmentally conscious consumers. This shift towards compliance-driven innovation is likely to foster a more sustainable packaging landscape in the Nordic Plastic Packaging Film Market, encouraging businesses to invest in research and development for compliant materials.

Sustainability Initiatives

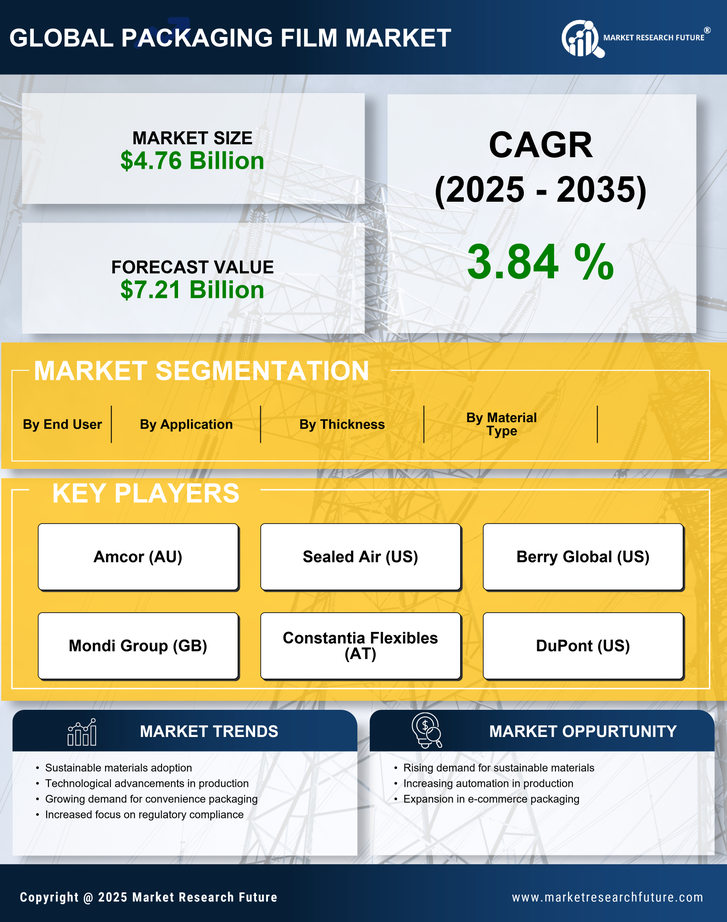

The Nordic Plastic Packaging Film Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, there is a growing demand for eco-friendly packaging solutions. This trend is reflected in the rising adoption of biodegradable and recyclable materials within the industry. In 2025, it was estimated that approximately 30% of plastic packaging in the Nordic region was made from sustainable sources. Companies are investing in research and development to create innovative packaging solutions that minimize environmental impact. This shift not only meets consumer expectations but also aligns with regulatory pressures aimed at reducing plastic waste. As a result, the Nordic Plastic Packaging Film Market is likely to see a significant transformation towards more sustainable practices, which could enhance brand loyalty and market share for companies that prioritize eco-friendly options.

Technological Advancements

Technological advancements play a crucial role in shaping the Nordic Plastic Packaging Film Market. Innovations in film production processes, such as the development of multi-layer films and enhanced barrier properties, have significantly improved the performance of packaging materials. In 2025, it was reported that the introduction of smart packaging technologies, including QR codes and temperature indicators, gained traction among consumers and businesses alike. These advancements not only enhance product safety and shelf life but also provide valuable information to consumers, thereby increasing engagement. Additionally, automation in manufacturing processes has led to increased efficiency and reduced production costs, allowing companies to offer competitive pricing. As technology continues to evolve, the Nordic Plastic Packaging Film Market is likely to experience further growth driven by enhanced product offerings and operational efficiencies.