E-commerce Growth

The Nordic Pouch Packaging Market is witnessing a notable impact from the growth of e-commerce. As online shopping continues to expand, the demand for packaging that can withstand the rigors of shipping and handling is increasing. Pouch packaging, known for its durability and lightweight nature, is becoming a preferred choice for e-commerce businesses. In 2025, it is estimated that e-commerce sales in the Nordic region will rise by 30%, creating a substantial opportunity for pouch packaging manufacturers. This trend suggests that companies in the Nordic Pouch Packaging Market may need to adapt their packaging solutions to meet the specific requirements of online retail, including enhanced protection and branding opportunities.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Nordic Pouch Packaging Market. Innovations in materials science and production techniques are enabling the development of high-performance pouches that enhance product shelf life and safety. For instance, the introduction of barrier films and smart packaging technologies is expected to revolutionize the market. In 2025, the adoption of such technologies is anticipated to increase by 25%, as manufacturers seek to differentiate their products and improve consumer satisfaction. This technological evolution not only enhances the functionality of pouch packaging but also aligns with the growing demand for quality and freshness in food products. As a result, companies in the Nordic Pouch Packaging Market are likely to invest heavily in research and development to stay competitive.

Health and Wellness Trends

The Nordic Pouch Packaging Market is also being driven by the rising health and wellness trends among consumers. There is a growing preference for healthier food options, which has led to an increase in the demand for packaging that preserves the nutritional value of products. Pouch packaging, with its ability to provide airtight seals and protect contents from external factors, is well-suited for health-focused products. In 2025, the market for health-oriented snacks and beverages is projected to grow by 18%, further boosting the demand for pouch packaging solutions. This trend indicates that manufacturers in the Nordic Pouch Packaging Market must adapt their offerings to cater to health-conscious consumers, potentially leading to new product lines and packaging innovations.

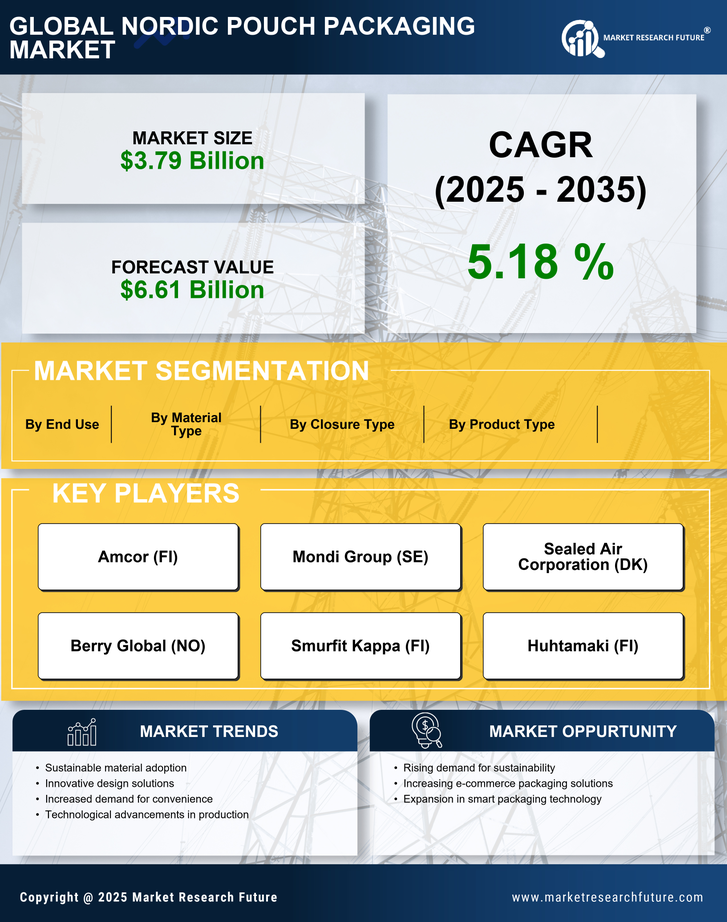

Sustainability Initiatives

The Nordic Pouch Packaging Market is increasingly influenced by sustainability initiatives. Consumers are becoming more environmentally conscious, leading to a demand for eco-friendly packaging solutions. This shift is evident as companies adopt biodegradable and recyclable materials in their pouch packaging. In 2025, it is estimated that the market for sustainable packaging will grow significantly, with a projected increase of 20% in the Nordic region alone. This trend not only aligns with consumer preferences but also meets regulatory requirements aimed at reducing plastic waste. As a result, manufacturers in the Nordic Pouch Packaging Market are investing in sustainable practices, which could enhance their market position and appeal to a broader customer base.

Rising Demand for Convenience

The Nordic Pouch Packaging Market is experiencing a surge in demand for convenience-oriented packaging solutions. As lifestyles become increasingly fast-paced, consumers are seeking products that offer ease of use and portability. Pouch packaging, known for its lightweight and resealable features, caters to this need effectively. In 2025, the convenience food sector is projected to grow by 15%, further driving the demand for pouch packaging. This trend is particularly pronounced in sectors such as snacks, beverages, and ready-to-eat meals, where quick access and minimal preparation time are paramount. Consequently, manufacturers are likely to innovate and diversify their offerings to meet the evolving preferences of consumers in the Nordic Pouch Packaging Market.