Rising Frequency of Power Outages

The increasing frequency of power outages in North America is a critical driver for the backup power market. According to the U.S. Energy Information Administration, the average American experiences several hours of power interruptions annually, which has prompted both residential and commercial sectors to seek reliable backup solutions. This trend is particularly pronounced in regions prone to severe weather events, where outages can last for extended periods. As a result, the demand for backup power systems, including generators and battery storage, is expected to rise significantly. The backup power market is likely to see a surge in sales as consumers prioritize energy security and reliability, leading to a projected growth rate of approximately 8% annually over the next five years.

Growing Awareness of Energy Independence

The increasing awareness of energy independence among consumers and businesses is significantly influencing the backup power market. Many individuals and organizations are recognizing the importance of self-sufficiency in energy production, particularly in light of fluctuating energy prices and geopolitical uncertainties. This shift is leading to a higher adoption of backup power systems, such as solar generators and battery storage solutions. In fact, a recent survey indicated that nearly 60% of homeowners in North America are considering backup power options to enhance their energy autonomy. This trend is likely to propel the market forward, with an anticipated growth rate of 7% annually as more consumers invest in sustainable and reliable energy solutions.

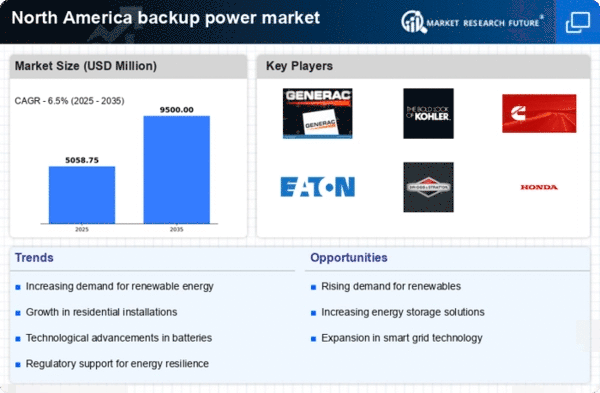

Regulatory Changes and Environmental Concerns

Regulatory changes and growing environmental concerns are influencing the backup power market in North America. Stricter emissions regulations and a push for cleaner energy sources are prompting businesses and consumers to consider eco-friendly backup power options. The increasing emphasis on sustainability is leading to a rise in the adoption of renewable energy-based backup systems, such as solar-powered generators. This shift is not only aligned with regulatory requirements but also appeals to environmentally conscious consumers. The market is expected to experience a growth rate of around 6% as more stakeholders seek to comply with regulations while also addressing their energy needs sustainably.

Technological Innovations in Backup Power Solutions

Technological advancements in backup power solutions are reshaping the market landscape in North America. Innovations such as smart inverters, advanced battery technologies, and integrated energy management systems are enhancing the efficiency and reliability of backup power systems. The backup power market is benefiting from these developments, as they allow for better integration with renewable energy sources and improved performance during outages. For instance, lithium-ion batteries have become increasingly popular due to their high energy density and longer life cycles. As a result, the market is projected to grow by approximately 9% over the next five years, driven by the demand for more efficient and technologically advanced backup power solutions.

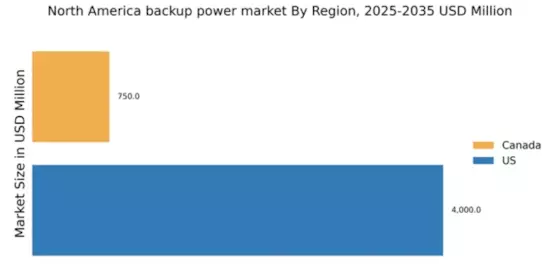

Increased Urbanization and Infrastructure Development

Urbanization in North America is driving the demand for backup power solutions. As cities expand and infrastructure develops, the reliance on consistent power supply becomes paramount. The backup power market is witnessing a shift as urban centers invest in resilient energy systems to support growing populations and commercial activities. With urban areas accounting for over 80% of the U.S. population, the need for uninterrupted power supply is critical. Furthermore, the construction of new commercial buildings and residential complexes often includes provisions for backup power systems, which is expected to contribute to a market growth of around 10% in the coming years. This trend indicates a robust opportunity for manufacturers and service providers in the backup power market.