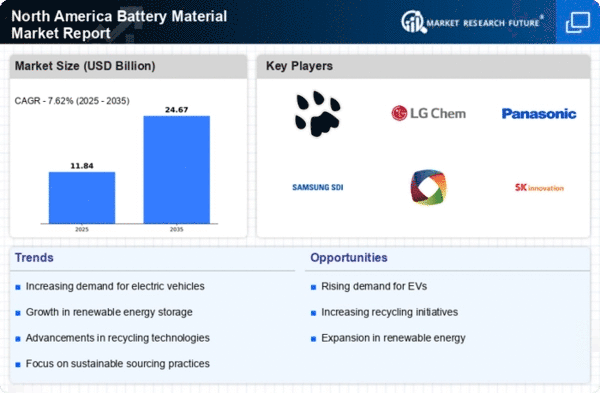

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) in North America is a primary driver for the battery material market. As consumers and businesses alike shift towards sustainable transportation, the demand for high-performance batteries is surging. In 2025, the EV market is projected to grow by approximately 30%, necessitating a corresponding increase in battery materials such as lithium, cobalt, and nickel. This trend indicates a robust market for battery materials, as manufacturers strive to meet the evolving needs of the automotive industry. The battery material market is thus positioned to benefit significantly from this transition, as automakers require advanced materials to enhance battery efficiency and longevity.

Investment in Renewable Energy Storage

The push for renewable energy sources in North America is driving the need for efficient energy storage solutions, which in turn fuels the battery material market. As solar and wind energy installations proliferate, the demand for batteries that can store this energy is expected to rise. By 2025, the energy storage market is anticipated to reach $10 billion, with a substantial portion allocated to battery materials. This growth suggests that the battery material market will play a crucial role in supporting the transition to a more sustainable energy landscape, as manufacturers seek to develop materials that can optimize energy storage capabilities.

Growing Consumer Awareness of Sustainability

Consumer awareness regarding sustainability is increasingly impacting the battery material market in North America. As individuals become more conscious of their environmental footprint, the demand for eco-friendly battery solutions is rising. This shift is prompting manufacturers to explore sustainable sourcing and production methods for battery materials. In 2025, it is projected that 40% of consumers will prioritize sustainability when purchasing electronic devices and vehicles, thereby driving demand for batteries made from responsibly sourced materials. This trend suggests that the battery material market must adapt to meet the expectations of environmentally conscious consumers, potentially leading to innovations in material sourcing and production.

Regulatory Support for Clean Energy Initiatives

Government regulations aimed at promoting clean energy and reducing carbon emissions are significantly influencing the battery material market. In North America, policies encouraging the use of renewable energy and electric vehicles are creating a favorable environment for battery manufacturers. For example, tax incentives for EV purchases and funding for battery research are expected to bolster market growth. By 2025, it is estimated that regulatory frameworks will contribute to a 20% increase in battery material demand, as companies align their strategies with governmental objectives. This regulatory support underscores the importance of the battery material market in achieving national sustainability goals.

Technological Innovations in Battery Production

Advancements in battery production technologies are reshaping the battery material market in North America. Innovations such as solid-state batteries and improved recycling processes are enhancing the efficiency and sustainability of battery materials. For instance, solid-state batteries, which utilize solid electrolytes, are projected to increase energy density by up to 50% compared to traditional lithium-ion batteries. This technological evolution indicates a potential shift in material requirements, as manufacturers adapt to new production methods. Consequently, the battery material market is likely to experience growth driven by the need for materials that align with these cutting-edge technologies.