Advancements in RFID Technology

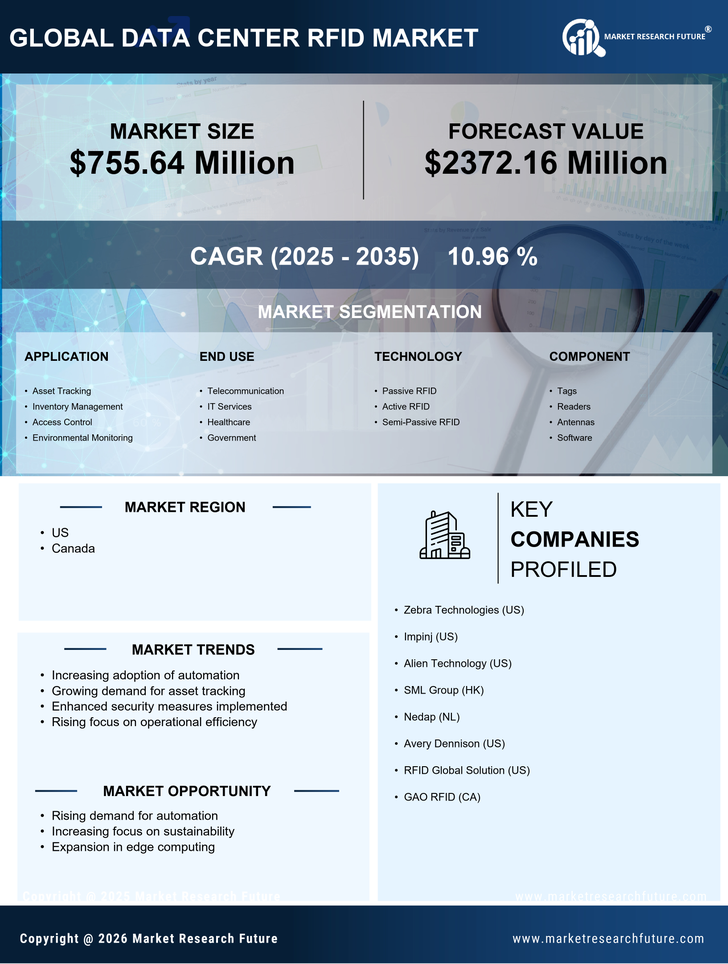

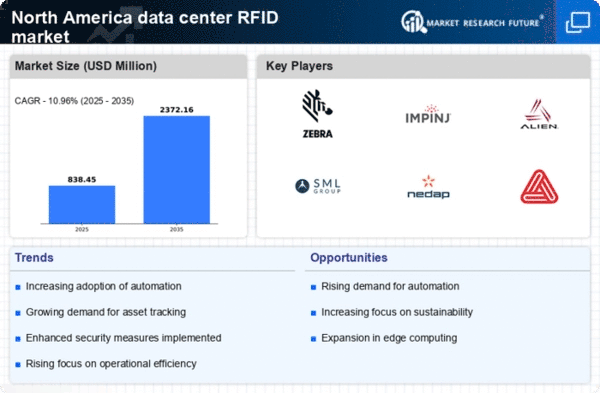

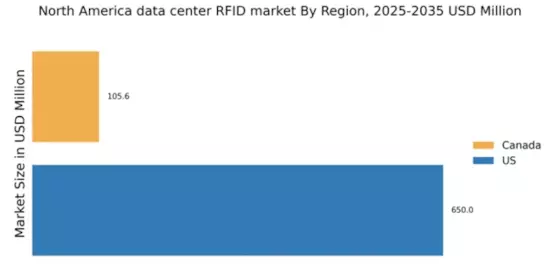

Technological advancements in RFID systems are significantly influencing the data center-rfid market. Innovations such as improved read ranges, enhanced data storage capabilities, and the integration of artificial intelligence are making RFID solutions more effective and appealing to businesses. In North America, the adoption of advanced RFID technologies is expected to grow at a CAGR of 15% over the next five years. These advancements not only enhance the performance of RFID systems but also reduce costs associated with implementation and maintenance. As companies in various sectors, including logistics and manufacturing, recognize the benefits of these advancements, the data center-rfid market is poised for substantial growth, driven by the need for more sophisticated tracking and management solutions.

Regulatory Compliance and Security Needs

The increasing emphasis on regulatory compliance and security is a key driver for the data center-rfid market. Organizations are under pressure to adhere to stringent regulations regarding data protection and asset management. RFID technology provides a means to enhance security protocols by enabling accurate tracking of assets and ensuring compliance with industry standards. In North America, the market is witnessing a shift towards RFID solutions that offer robust security features, with an estimated growth rate of 12% annually. This focus on compliance and security is likely to drive investments in RFID systems, as businesses seek to mitigate risks and protect sensitive information, thereby bolstering the data center-rfid market.

Increased Focus on Operational Efficiency

The pursuit of operational efficiency is a significant driver for the data center-rfid market. Companies are increasingly looking for ways to streamline their operations and reduce costs. RFID technology facilitates this by automating processes such as inventory tracking and asset management, leading to faster decision-making and reduced labor costs. In North America, organizations that implement RFID solutions report an average operational cost reduction of 20%. This focus on efficiency is likely to encourage more businesses to adopt RFID systems, as they seek to enhance productivity and maintain a competitive edge in their respective markets. Consequently, the data center-rfid market is expected to benefit from this trend as more companies recognize the value of operational improvements.

Rising Adoption of Smart Warehousing Solutions

The rise of smart warehousing solutions is driving growth in the data center-rfid market. As e-commerce continues to expand, businesses are investing in technologies that enhance warehouse operations. RFID technology plays a crucial role in smart warehousing by enabling real-time tracking of inventory and improving supply chain visibility. In North America, the smart warehousing market is projected to grow by 25% over the next few years, with RFID being a key component of this transformation. This trend indicates a shift towards more automated and data-driven warehouse management practices, which is likely to further stimulate the data center-rfid market as companies seek to optimize their logistics and inventory management.

Growing Demand for Efficient Inventory Management

The data center-rfid market is experiencing a surge in demand for efficient inventory management solutions. As organizations increasingly rely on real-time data to optimize their operations, RFID technology offers a robust solution for tracking assets and inventory. In North America, the market for RFID solutions is projected to reach approximately $10 billion by 2026, driven by the need for improved accuracy and reduced operational costs. Companies are recognizing that implementing RFID can lead to a reduction in inventory discrepancies by up to 30%, thereby enhancing overall efficiency. This growing demand for precise inventory management is likely to propel the data center-rfid market forward, as businesses seek to leverage technology to streamline their processes and improve profitability.