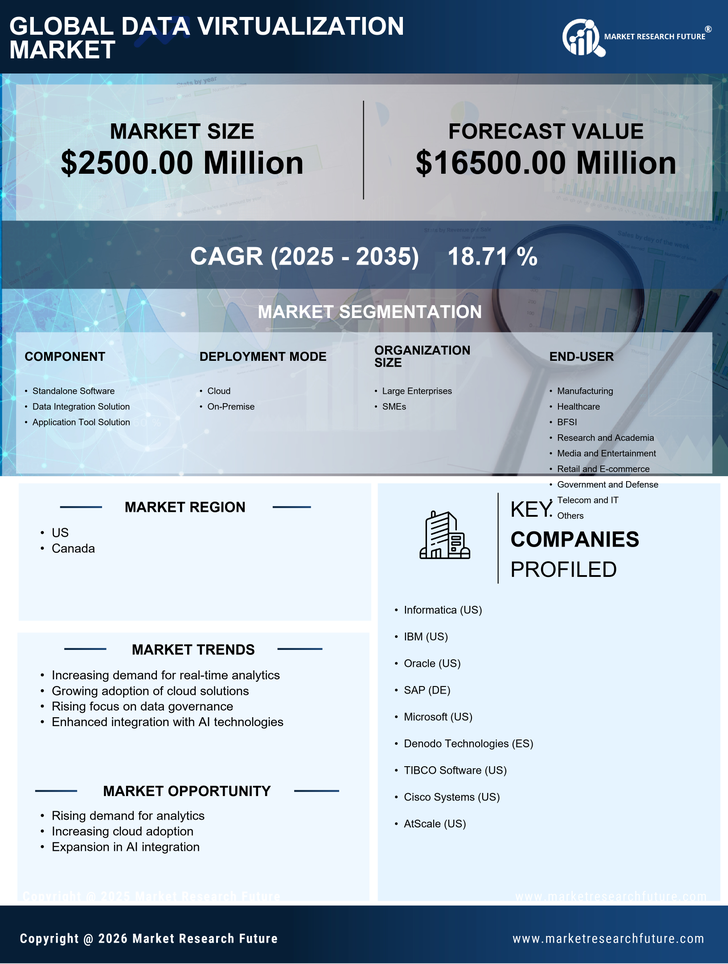

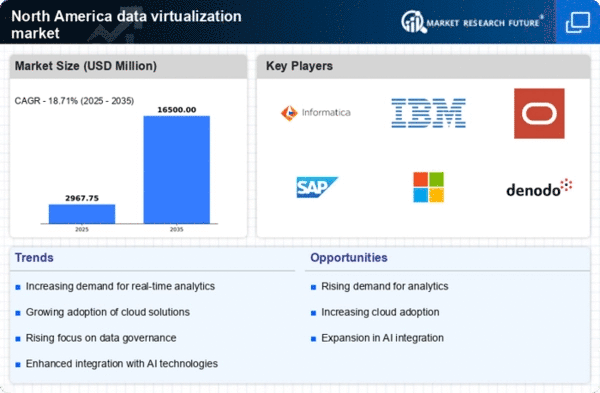

Rising Focus on Data Analytics

In the current landscape, the data virtualization market is significantly influenced by the rising focus on data analytics. Organizations are increasingly leveraging analytics to derive actionable insights from their data. This trend is underscored by the fact that companies utilizing advanced analytics are 5 times more likely to make faster decisions than their competitors. As a result, the demand for data virtualization solutions that support analytics capabilities is on the rise. The ability to access and analyze data in real-time is becoming a critical factor for businesses aiming to maintain a competitive edge. Consequently, investments in data virtualization technologies are expected to grow, as organizations prioritize analytics-driven decision-making.

Advancements in Technology Infrastructure

The data virtualization market is witnessing a transformation due to advancements in technology infrastructure. The proliferation of high-speed internet, cloud computing, and edge computing technologies is reshaping how organizations manage and access data. These advancements enable faster data processing and improved connectivity, which are essential for effective data virtualization. As businesses increasingly adopt cloud-based solutions, the demand for virtualization technologies that can seamlessly integrate with existing infrastructure is likely to rise. This trend suggests that organizations are prioritizing investments in modern technology stacks to enhance their data management capabilities, thereby driving growth in the data virtualization market.

Increased Regulatory Compliance Requirements

The data virtualization market faces heightened pressure from increased regulatory compliance requirements. Organizations in North America are compelled to adhere to stringent data protection regulations, such as the CCPA and GDPR. These regulations necessitate robust data governance frameworks, which in turn drive the demand for data virtualization solutions that ensure compliance. Companies are investing in technologies that facilitate data lineage, auditing, and reporting to meet these regulatory demands. As a result, the market for data virtualization is likely to expand, with organizations seeking solutions that not only streamline data access but also enhance compliance capabilities. This trend indicates a growing recognition of the importance of data governance in the virtualization landscape.

Growing Demand for Data Integration Solutions

The data virtualization market in North America experiences a notable surge in demand for data integration solutions. Organizations increasingly seek to unify disparate data sources to enhance decision-making processes. This trend is driven by the need for real-time insights and the ability to access data from various platforms seamlessly. According to recent estimates, the data integration segment is projected to grow at a CAGR of approximately 15% over the next five years. This growth indicates a robust appetite for solutions that facilitate data accessibility and integration, thereby propelling the data virtualization market forward. As businesses recognize the value of integrated data, investments in virtualization technologies are likely to increase, further solidifying the market's expansion.

Emphasis on Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are becoming paramount in the data virtualization market. Organizations are under constant pressure to reduce operational costs while maximizing the value derived from their data assets. Data virtualization solutions offer a compelling proposition by enabling businesses to access and utilize data without the need for extensive physical data storage. This approach not only reduces costs associated with data management but also enhances agility in data access. As companies strive to optimize their resources, the adoption of data virtualization technologies is likely to increase. This trend indicates a shift towards more efficient data management practices, further propelling the growth of the data virtualization market.