Cost Reduction Initiatives

Cost efficiency remains a primary driver in the data center-virtualization market. Organizations are increasingly focused on reducing operational costs while maintaining high service levels. Virtualization enables companies to consolidate their physical servers, leading to lower hardware expenses and reduced energy consumption. It is estimated that businesses can save up to 30% on IT costs through effective virtualization strategies. This financial incentive is particularly appealing in a landscape where budget constraints are prevalent. Furthermore, the reduction in physical space requirements translates to lower real estate costs, making virtualization an attractive option for many enterprises. As organizations continue to prioritize cost reduction, the data center-virtualization market is likely to see sustained growth.

Emergence of Edge Computing

The rise of edge computing is significantly influencing the data center-virtualization market. As organizations increasingly deploy IoT devices and require real-time data processing, the need for localized computing resources becomes critical. Virtualization plays a vital role in enabling edge computing by allowing organizations to deploy virtualized resources closer to the data source. This trend is expected to drive the market as businesses seek to enhance performance and reduce latency. Analysts project that the edge computing market will grow substantially, with virtualization being a key enabler. The integration of edge computing with virtualization strategies will create new opportunities and challenges within the data center-virtualization market.

Growing Demand for Scalability

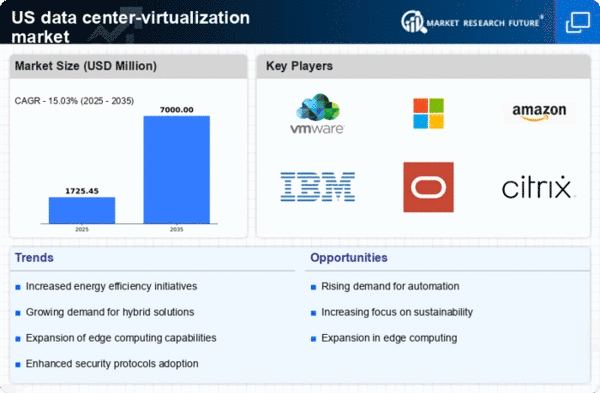

The data center-virtualization market is experiencing a notable increase in demand for scalability solutions. Organizations are increasingly seeking to expand their IT infrastructure without incurring significant capital expenditures. Virtualization technologies allow businesses to scale their resources dynamically, accommodating fluctuating workloads. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for businesses to remain agile and responsive to market changes. As companies continue to adopt virtualization, they can optimize resource allocation and improve operational efficiency, which is crucial in today's competitive landscape. The ability to scale resources on-demand is becoming a key differentiator for organizations, thereby propelling the data center-virtualization market forward.

Regulatory Compliance and Data Governance

Regulatory compliance is a crucial driver in the data center-virtualization market. Organizations are increasingly required to adhere to stringent data protection regulations, such as GDPR and HIPAA. Virtualization technologies can assist in meeting these compliance requirements by providing enhanced data governance capabilities. By virtualizing their data centers, organizations can implement more effective security measures and access controls, ensuring that sensitive information is adequately protected. The growing emphasis on compliance is prompting businesses to invest in virtualization solutions that facilitate adherence to regulatory standards. As the landscape of data governance continues to evolve, the data center-virtualization market is likely to benefit from increased demand for compliant virtualization solutions.

Increased Focus on Disaster Recovery Solutions

The importance of robust disaster recovery solutions is becoming increasingly apparent in the data center-virtualization market. Organizations are recognizing the need to protect their data and ensure business continuity in the face of potential disruptions. Virtualization technologies facilitate efficient backup and recovery processes, allowing businesses to minimize downtime and data loss. Recent surveys indicate that nearly 60% of organizations consider disaster recovery a top priority in their IT strategy. This heightened focus on resilience is driving investments in virtualization solutions that offer comprehensive recovery options. As companies seek to safeguard their operations, the demand for advanced disaster recovery capabilities within the data center-virtualization market is expected to rise.