Regulatory Support for Clean Energy

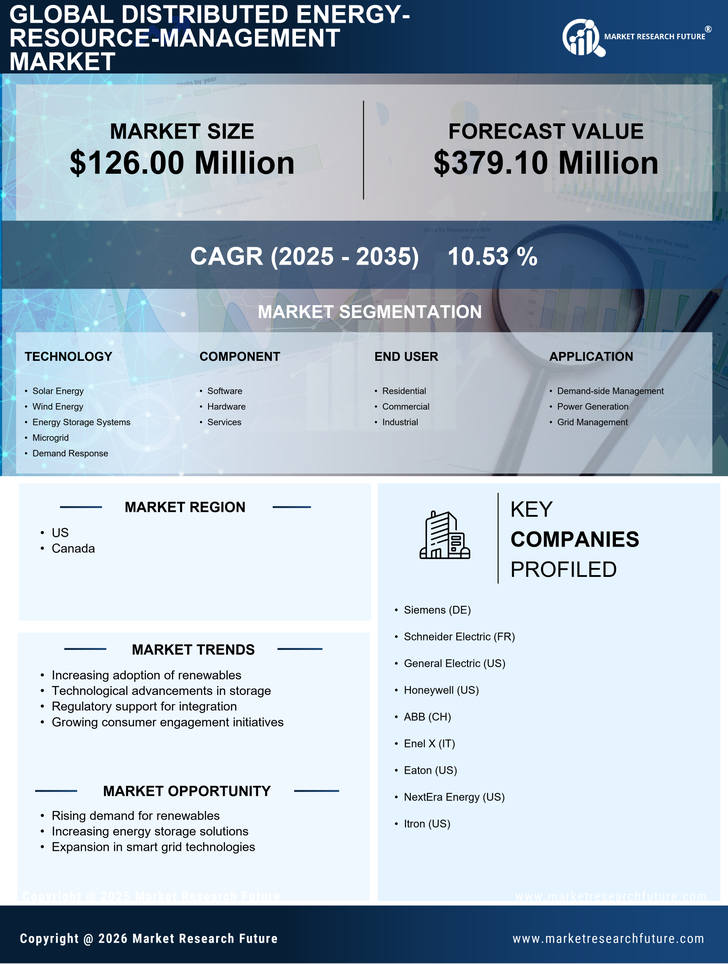

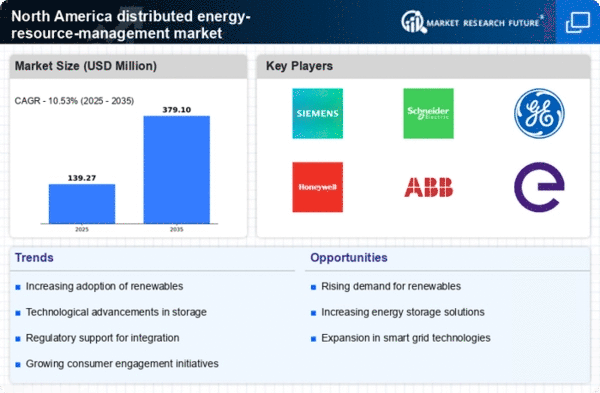

The distributed energy-resource-management market in North America benefits from robust regulatory frameworks that promote clean energy initiatives. Governments at both federal and state levels have implemented policies that incentivize the adoption of renewable energy technologies. For instance, tax credits and rebates for solar and wind energy installations have been pivotal in driving market growth. In 2025, it is estimated that approximately 30% of energy generation in North America will come from renewable sources, largely due to these supportive regulations. This regulatory environment not only encourages investment in distributed energy resources but also fosters innovation in energy management solutions, thereby enhancing the overall efficiency of the energy grid.

Rising Consumer Demand for Energy Independence

Consumer preferences are shifting towards energy independence, significantly impacting the distributed energy-resource-management market in North America. As individuals and businesses seek to reduce reliance on traditional utility providers, the demand for decentralized energy solutions is increasing. This trend is evidenced by a 25% rise in residential solar installations in 2025 compared to previous years. Consumers are increasingly investing in energy storage systems and smart technologies that allow them to manage their energy consumption more effectively. This growing desire for self-sufficiency not only drives market growth but also encourages the development of innovative energy management solutions tailored to individual needs.

Technological Innovations in Energy Management

Technological advancements are playing a crucial role in shaping the distributed energy-resource-management market in North America. Innovations such as advanced metering infrastructure, real-time data analytics, and artificial intelligence are enhancing the efficiency of energy management systems. In 2025, it is projected that the adoption of smart technologies will increase by 40%, enabling better integration of distributed energy resources into the grid. These technologies facilitate improved monitoring and control of energy consumption, allowing users to optimize their energy usage and reduce costs. As a result, the market is witnessing a surge in demand for sophisticated energy management solutions that leverage these technological advancements.

Growing Awareness of Environmental Sustainability

The increasing awareness of environmental sustainability is driving the distributed energy-resource-management market in North America. As consumers and businesses become more conscious of their carbon footprints, there is a heightened demand for clean energy solutions. In 2025, surveys indicate that over 70% of consumers prioritize sustainability in their energy choices. This shift in consumer behavior is prompting companies to invest in renewable energy technologies and energy-efficient practices. The emphasis on sustainability not only influences purchasing decisions but also shapes corporate strategies, leading to a more competitive market for distributed energy resources. Consequently, this growing awareness is likely to propel further innovations in energy management solutions.

Increased Investment in Infrastructure Development

Investment in energy infrastructure is a key driver of the distributed energy-resource-management market in North America. As the demand for reliable and resilient energy systems grows, significant funding is being allocated to upgrade existing infrastructure and develop new energy projects. In 2025, it is estimated that investments in energy infrastructure will reach $100 billion, focusing on enhancing grid capabilities and integrating renewable energy sources. This influx of capital not only supports the deployment of distributed energy resources but also encourages collaboration between public and private sectors to create a more sustainable energy landscape. Such developments are essential for accommodating the increasing complexity of energy management.