Growth of the Mediterranean Diet

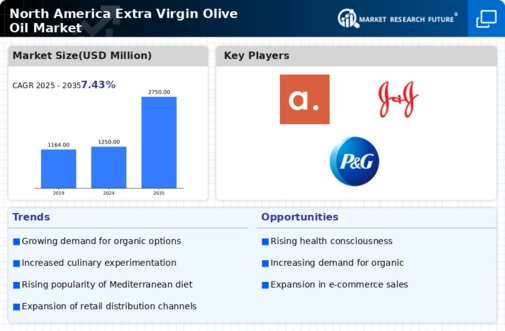

The Mediterranean diet, recognized for its health benefits, is gaining traction in North America, thereby driving the extra virgin-olive-oil market. This diet emphasizes the use of olive oil as a primary fat source, promoting its consumption among health enthusiasts. Research indicates that adherence to this diet can lead to improved cardiovascular health and weight management. As more North Americans adopt this lifestyle, the demand for extra virgin olive oil is likely to increase. Market data suggests that sales of olive oil have surged by 20% in regions where the Mediterranean diet is popular, highlighting the correlation between dietary trends and olive oil consumption.

Culinary Trends and Gourmet Cooking

The rise of culinary trends and gourmet cooking is significantly impacting the extra virgin-olive-oil market. As consumers become more adventurous in their cooking, they are increasingly seeking high-quality ingredients, including premium extra virgin olive oil. This trend is evident in the growing popularity of cooking shows and social media platforms that emphasize gourmet recipes. Market analysis indicates that the demand for specialty olive oils has surged by 18% in the past year, reflecting this culinary shift. As more individuals experiment with flavors and cooking techniques, the market for extra virgin olive oil is expected to expand, driven by the desire for authentic and high-quality culinary experiences.

Sustainability and Ethical Sourcing

Sustainability concerns are increasingly influencing consumer choices in the extra virgin-olive-oil market. As environmental awareness grows, consumers are more inclined to purchase products that are sustainably sourced and produced. This trend is particularly evident in North America, where a significant portion of consumers is willing to pay a premium for ethically sourced olive oil. Reports indicate that around 30% of consumers prioritize sustainability when selecting food products, including olive oil. This shift towards ethical consumption is likely to shape the market landscape, encouraging producers to adopt sustainable practices and cater to the evolving preferences of environmentally conscious consumers.

Health Consciousness Among Consumers

The increasing awareness of health benefits associated with extra virgin olive oil is a primary driver in the extra virgin-olive-oil market. Consumers are becoming more health-conscious, seeking products that offer nutritional advantages. Extra virgin olive oil is rich in monounsaturated fats and antioxidants, which are linked to reduced risks of chronic diseases. According to recent data, the consumption of olive oil in North America has risen by approximately 15% over the past five years, reflecting this trend. As more individuals prioritize healthy eating, the demand for high-quality extra virgin olive oil is expected to continue its upward trajectory, influencing market dynamics significantly.

E-commerce Expansion and Online Retailing

The rise of e-commerce is transforming the extra virgin-olive-oil market, providing consumers with greater access to a variety of products. Online retailing platforms have made it easier for consumers to purchase high-quality extra virgin olive oil from the comfort of their homes. This shift is particularly relevant in North America, where online grocery shopping has seen substantial growth. Data shows that online sales of olive oil have increased by 25% in the last year alone, indicating a shift in purchasing behavior. As e-commerce continues to expand, it is likely to play a crucial role in shaping the distribution channels and accessibility of extra virgin olive oil.